Choose Corporate Receivables and Payables Services?

2

Electronic Fund Management

3

Simplify and Standardize Receivables and Payables Processes

4

Provide Various Payment Channels for an Optimized Receivables and Payables Experience

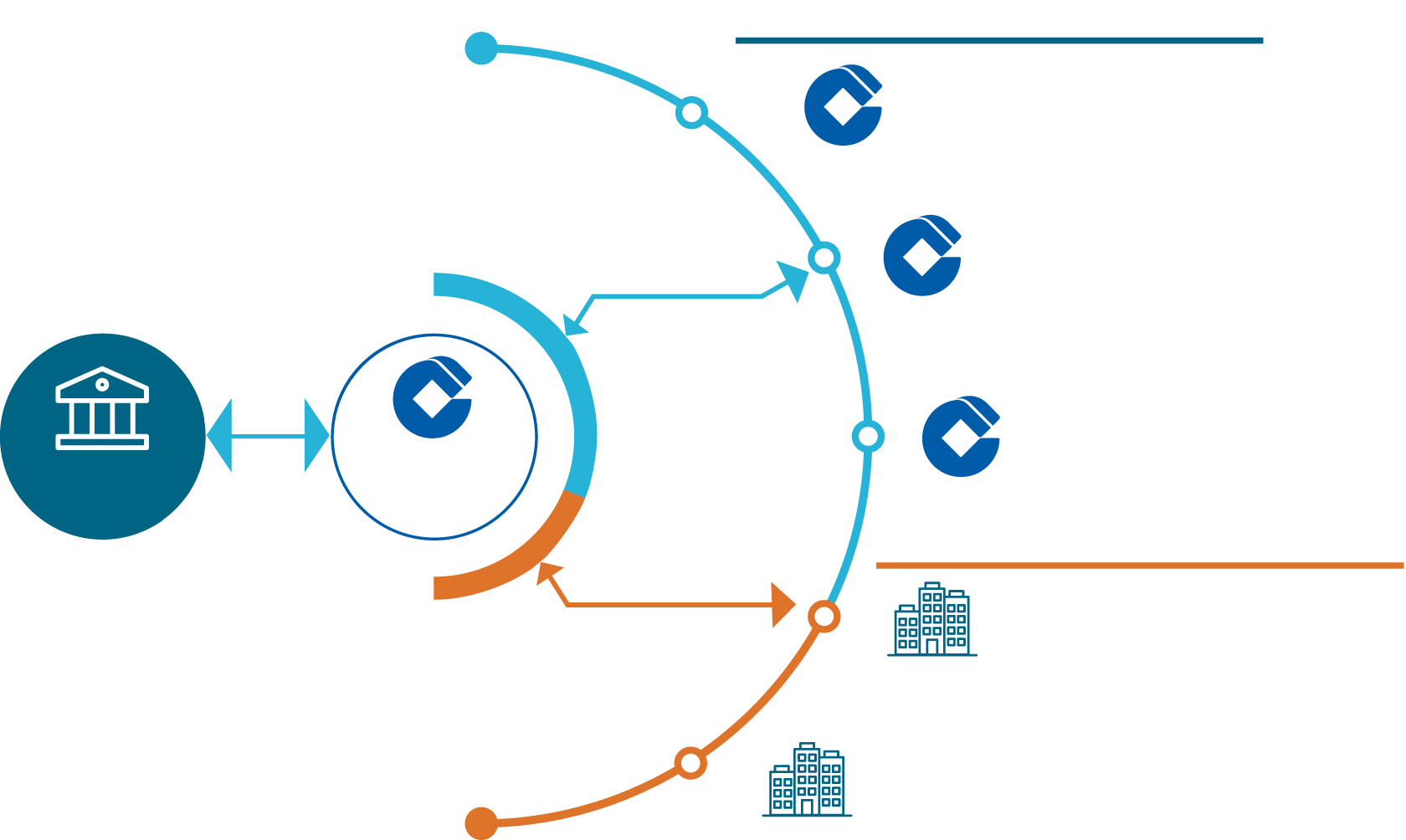

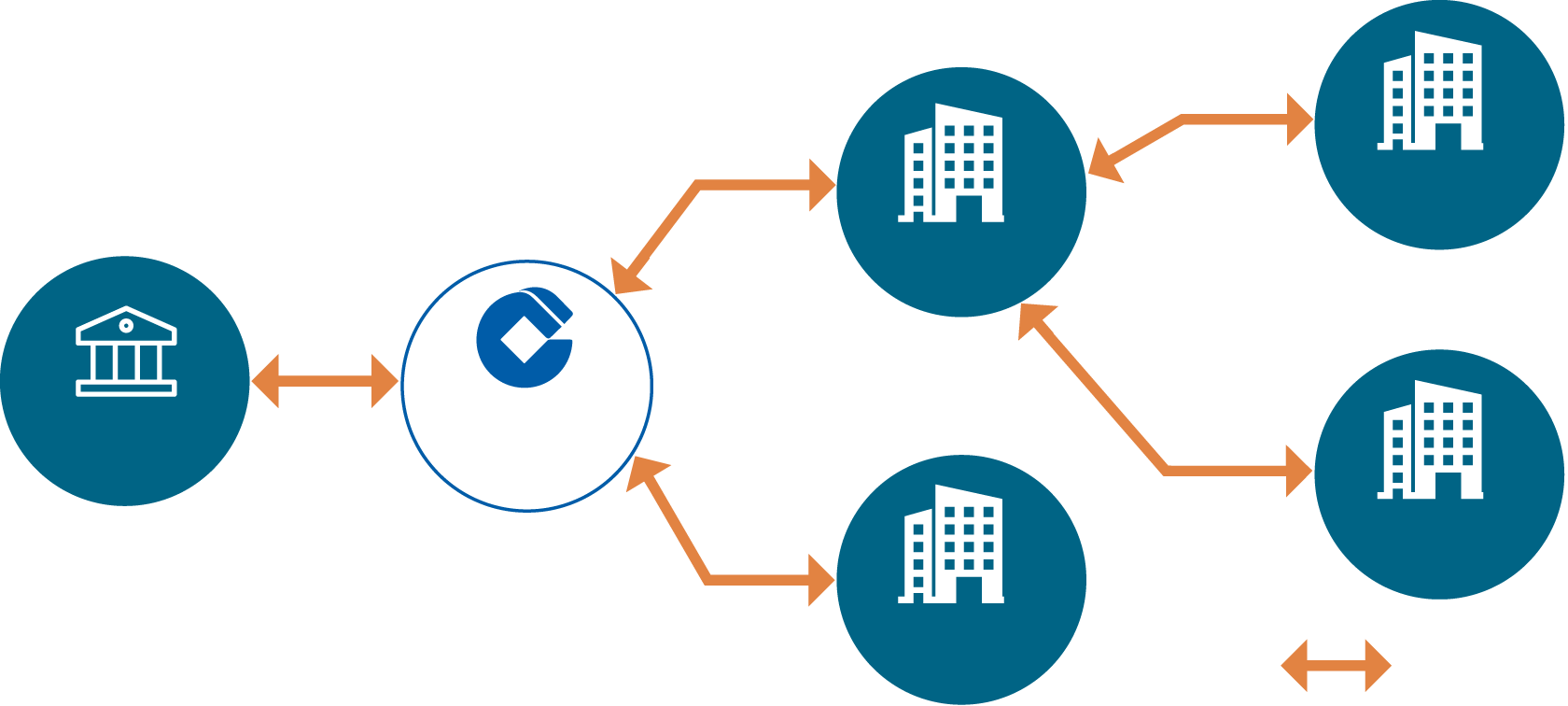

Corporate Receivables/Payables Management Services is a one-stop electronic receivables and payables service solution provided by CCB (Asia). It allows companies to offer multiple payment methods to personal customers via mobile applications, Faster Payment Service (FPS), automated teller machines (ATMs), etc., facilitating fund transfers to corporate accounts anytime and anywhere. Additionally, companies can make external payments efficiently through electronic means.

Simplify Receivables Process

Improve Cash Flow

Online Payment

In-person Payment

Direct Debit

Online Payment Gateway (Credit Card/Electronic Wallet/FPS)

FPS Redirect Payment

QR Code

Payment

eDDA

Direct Debit

Company

Customer

Employees/

Suppliers

Real-time Batch Payments

Centralized Account Management

Website/Mobile App Payment

Corporate Payroll

Fund Transfer

Online Bill Payment

Electronic Fund Management

Standardized Payment Process

Electronic Receivables Services

Online Receivables Scenario

Offline Receivables Scenario

Direct Debit Services

Website or Mobile App Payments

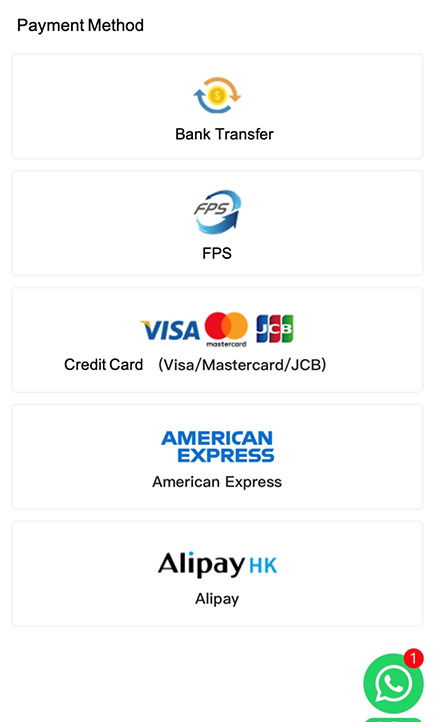

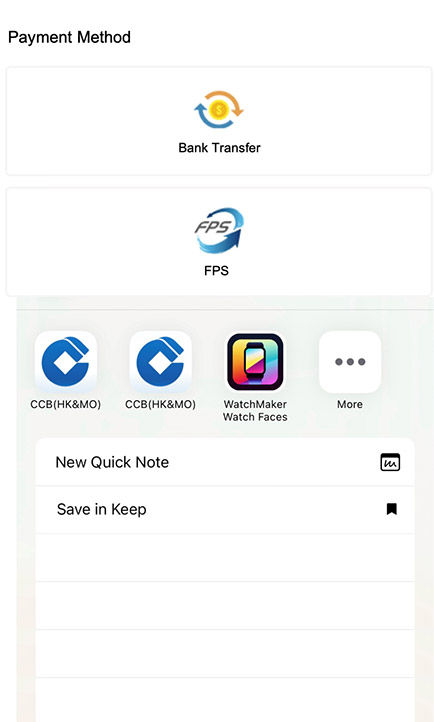

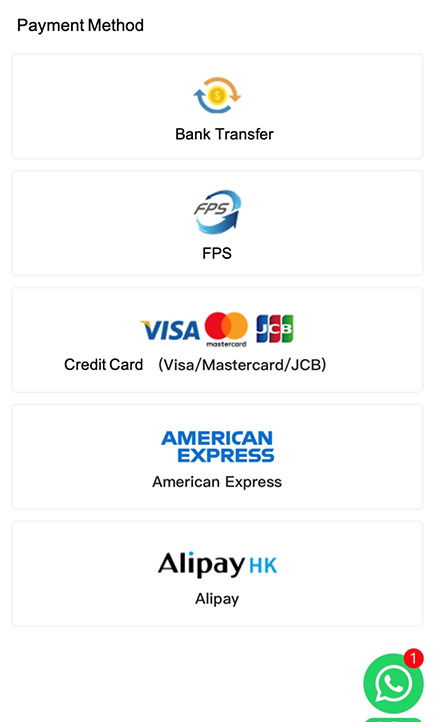

Companies can collaborate with CCB (Asia) to open an online payment gateway service, providing customers with payment methods like FPS, electronic wallets, and credit cards on websites and mobile apps.

Supported Payment Methods

Customer Payment Experience Optimization

Offers multiple direct payment methods to personal customers.

Electronic Receivables Process

Provides real-time transaction queries and integrated reconciliation reports to simplify the reconciliation process.

Faster Payment System1

Instant Settlement, Immediate Funds

Electronic Wallet

Scan to Pay, Enjoy Convenience

Credit Card

Flexible Payments, Earn Rewards

1Supports e-wallets and bank mobile apps with FPS payment functionality. The use of e-wallets depends on the service scope of the relevant stored value payment tools.

FPS Redirect Payments on Website or Mobile App

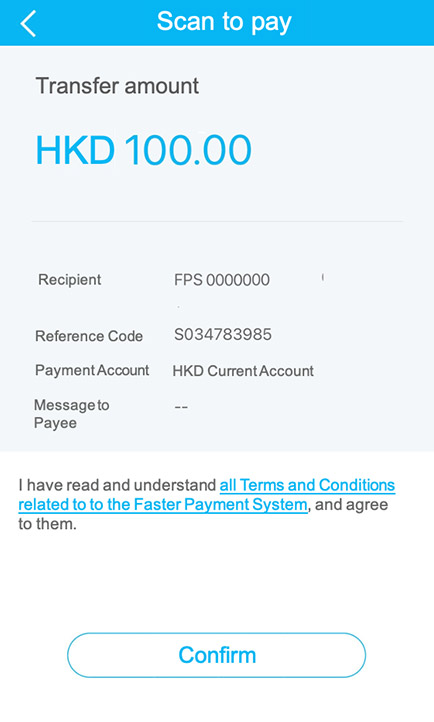

Companies can enable FPS redirect services, allowing transactions to be completed through supporting mobile banking apps. The transaction result information is sent to the company's client-side via API for a seamless payment experience.

Optimize Customer Payment Experience

Provide one-stop instant payment service without manually switching applications

Unified Cash Flow Management

Batch processing, report management, and notification push in the backend, directly managing different types of online and offline receivables

Steps 1

Steps 2

Steps 3

Steps 1

FPS Redirect Payment on

Company Website or Mobile App

Display Bank Apps Supporting

Redirect Technology

Complete FPS Transaction

via Bank App

FPS Redirect Payment on

Company Website or Mobile App

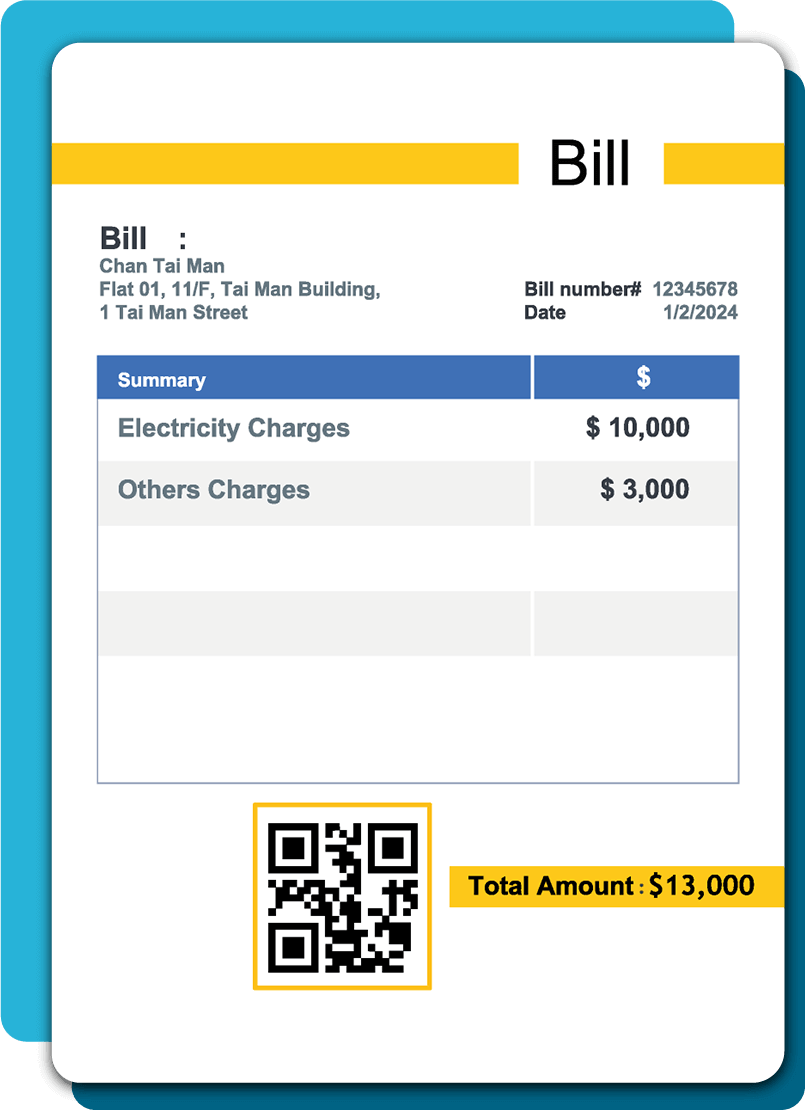

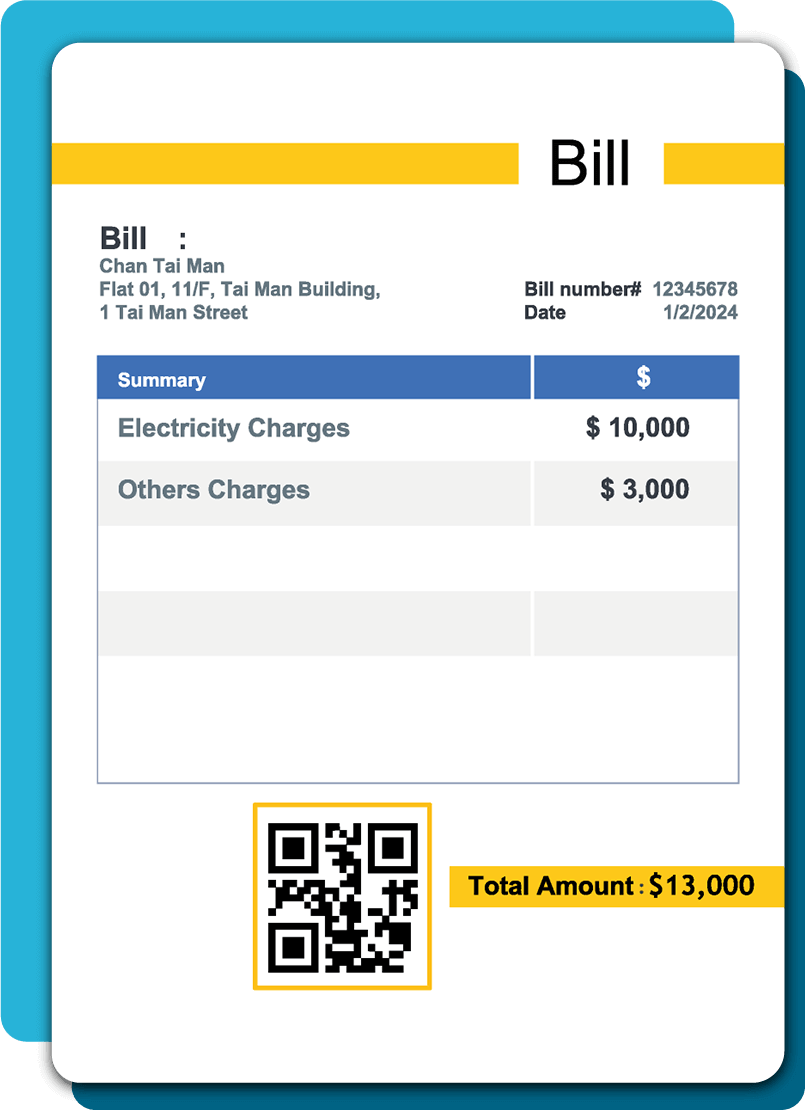

QR Code on Bill Payments

Companies can print FPS QR codes on bills for customers to scan and pay via mobile apps in HKD or RMB.

Convenient

Customers can directly scan the QR code on the bill using mobile banking, completing the FPS payment without entering any payment information.

Direct

Complete Scan & Pay in three steps.

Simple

Suitable for merchants handling periodic and batch payments. Merchants can issue physical bills or payment notices to customers, and the system will immediately notify the merchant and update the bill payment status once the payment is completed.

QR Code Billing

*Payment can be completed using FPS scanning, whether with CCB (Asia) or other banks/payment service providers.

In-store QR Code Payments

Customers can pay in-store by scanning a QR code generated by the company's system integrated with CCB (Asia)'s merchant management platform. Customers can make payments to merchants in Hong Kong dollars or Chinese yuan through either self-scanning or merchant scanning.

One-stop Customer Payment Experience

Supports mobile apps, websites, and API integration, facilitating company and customer usage.

Digitalization and Automation of Payment Processes

Provides businesses with management functions such as transaction record inquiry, refund management, and payment notifications, making the payment process more convenient.

QR Code Payment

Customers scan the QR code and input payment details to complete the transaction.

QR Code Payment (Dynamic)

After the company system is integrated with the CCB (Asia) Merchant Management Platform, a dynamic QR code is generated. Customers do not need to input payment details; they can directly scan the QR code to make payments.

*CCB (Asia) provides your company with a scanning box. Customers can directly make payments by scanning the payment code.

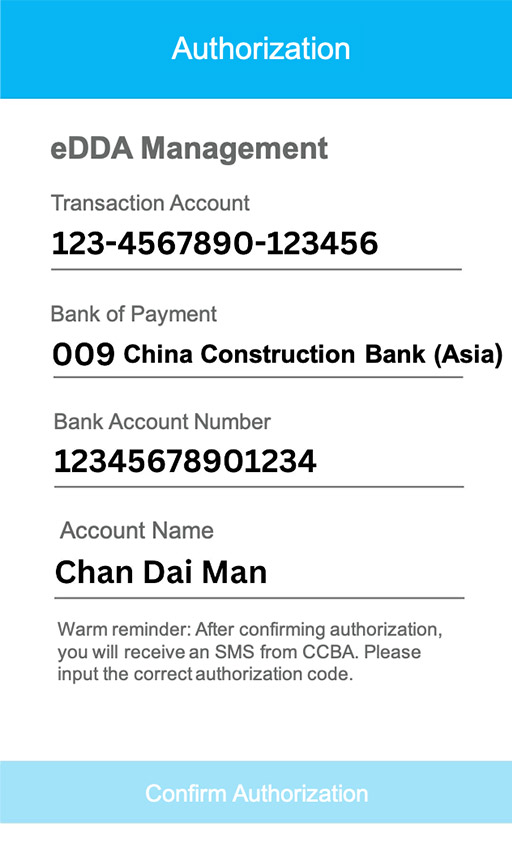

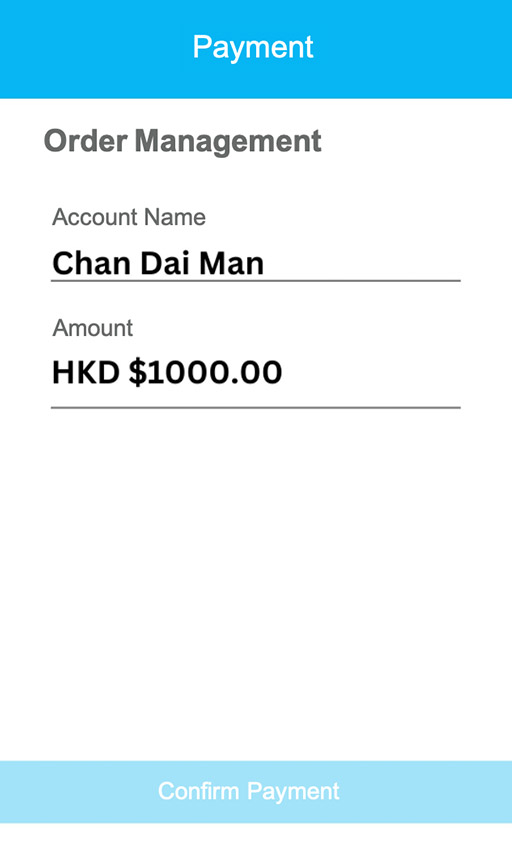

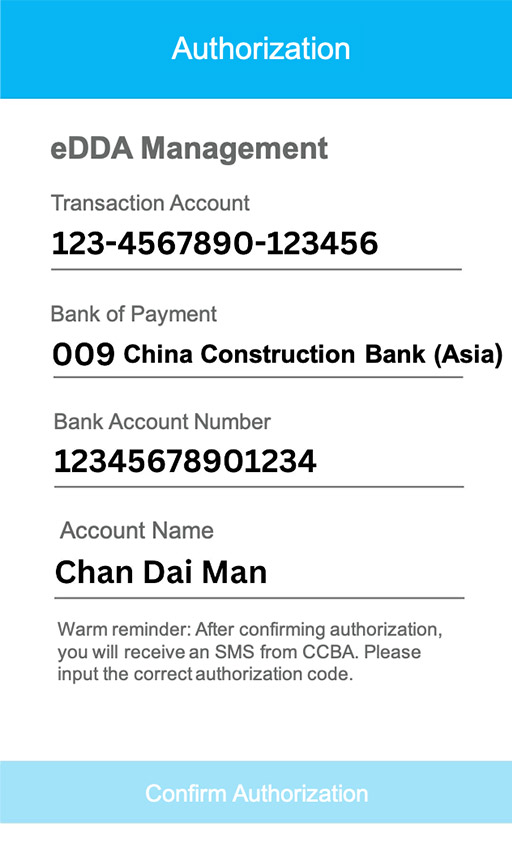

eDDA Account Binding Payments

In addition to one-time payment options, businesses can obtain customers' electronic direct debit authorization (eDDA). This allows CCB (Asia) to instantly collect fees in HKD or RMB from customers' accounts at CCB (Asia) or other local banks through electronic channels. The debit amount can be specified per instruction.

Digitalization and Automated Management

Setting up eDDA debit authorization and real-time transaction status inquiry electronically streamlines financial management for companies.

Support for 24/7 Real-Time Transactions

Fastest processing time of 1 minute* accelerates cash flow.

* Requires corresponding cooperation based on the application used by the customer.

Reduction in Administrative Expenses

Reasonable service fees reduce the risk of manual handling and increase work efficiency.

Payment Features on Customer Mobile Apps

eDDA Authorization

Instant Payments

Payment Record Inquiry

eDDA Authorization

Batch Deduction via Bank Account Binding

CCB (Asia) offers a convenient batch deduction service, allowing companies to collect regular payments via electronic channels from customer accounts at CCB (Asia) or other local banks.

Automated Payment Process

Issuing instructions for disbursing Hong Kong dollars or Chinese yuan via corporate online banking or "Bank-Enterprise Direct Link."

Electronic Fund Control

Business transactions can be processed anytime, with funds deposited into the corporate bank account on T+1, providing electronic statements and real-time transaction inquiry.

Reduction in Administrative Expenses

Reasonable service fees reduce the risk of manual handling and increase work efficiency.

Real-Time Direct Debit Example

CCBHKTEST1

CCBHKTEST2

CCBHKTEST3

009/58871000

009/58871000

009/58871000

Electronic bill

Electronic bill

Electronic bill

Electronic Payment Services

Payment Scenario 1

Payment Scenario 2

Payment Scenario 3

Payment Scenario 4

Real-time Batch Disbursement

CCB (Asia) offers convenient batch disbursement services, allowing enterprises to complete payroll and vendor payments through electronic channels, significantly enhancing operational efficiency.

Automated Payment Process

Establishing Hong Kong dollar or Chinese yuan disbursement instructions using account numbers, mobile phone numbers, email addresses, or Quick Payment System identification codes.

Enhanced Fund Control Capability

Supports 24/7 payment transactions, with funds deposited immediately* into any local bank account, efficiently managing company operational funds.

Reduction in Administrative Expenses

Reasonable service fees reduce inconvenience associated with using checks/cash, enhancing work efficiency.

Real-Time Direct Debit Example

0000000026

1234567899

5555666655

Salary-Feb

Salary-Feb

Salary-Feb

*Immediate deposits require the receiving bank to also support instant processing.

Online Bill Payment

Enterprises can pay low-risk merchant bills such as government departments, educational/charitable/public utility organizations, and various industries including finance, retail, information technology, and transportation through Electronic Payment Services Company (EPSCO), Hong Kong Interbank Clearing Limited (HKICL), or Faster Payment System (FPS), as well as bills from registered credit card, credit finance, and securities companies considered high-risk merchants.

Anywhere, Anytime

Through online corporate banking, enables local bill payment services and bill management anytime, anywhere.

Instant Payment

Instantly pay various bills via the Faster Payment System, convenient and fast.

Default Transactions

Pre-set payment transaction instructions can be set up, up to 60 days prior to the due date, avoiding overdue payments.

EPS / Electronic Bill Payment

- Supports bill payment through EPS or Electronic Bill Payment channels.

- Supports over 350 merchants and institutions, including government organizations, public services, telecommunications companies, insurance companies, and educational institutions.

- EPS supports Hong Kong dollars, while Electronic Bill Payment supports Hong Kong dollars/Chinese yuan/US dollars.

FPS Payment

- Supports payment via mobile phone numbers/email addresses or Quick Payment System identification codes (FPS ID).

- Supports Hong Kong dollars/Chinese yuan.

- Transaction process is consistent with FPS remittance process.

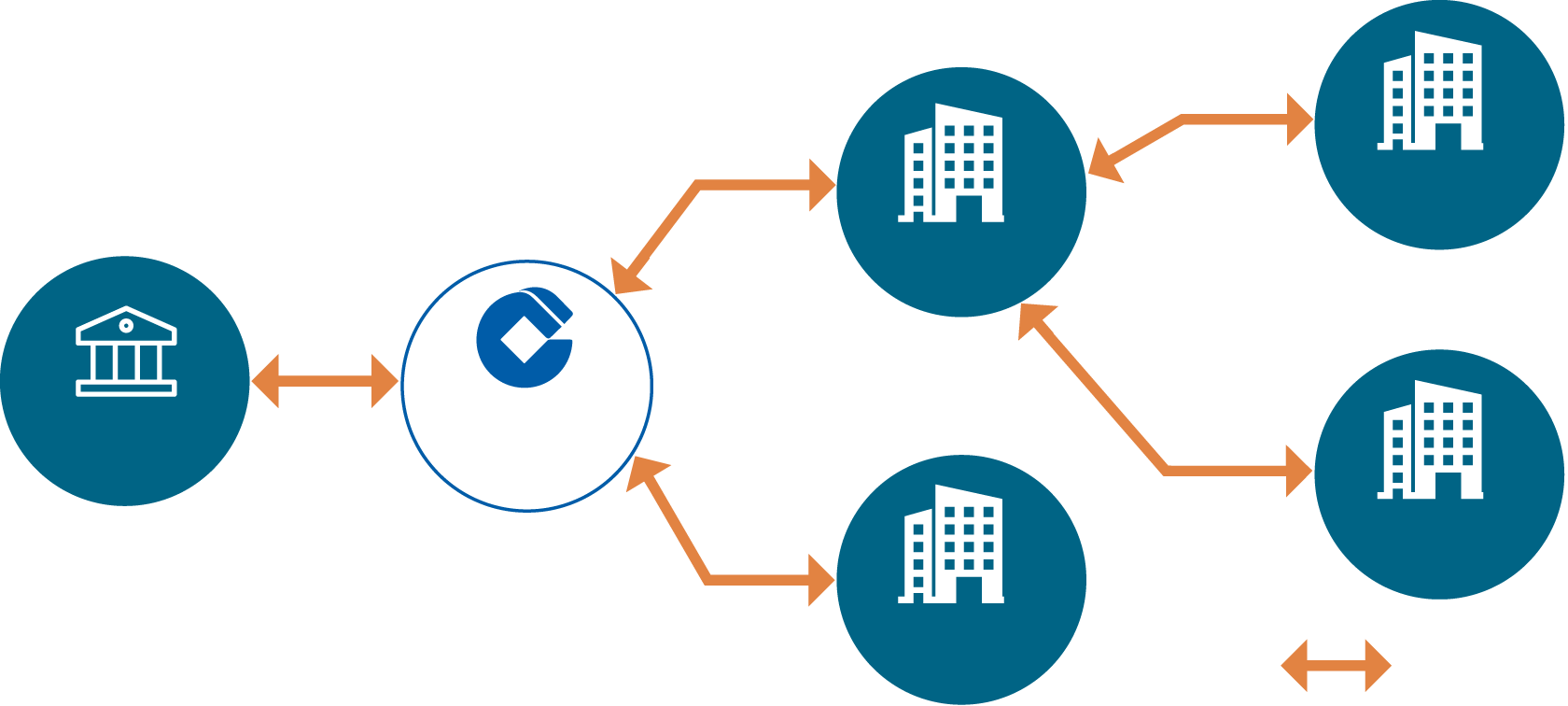

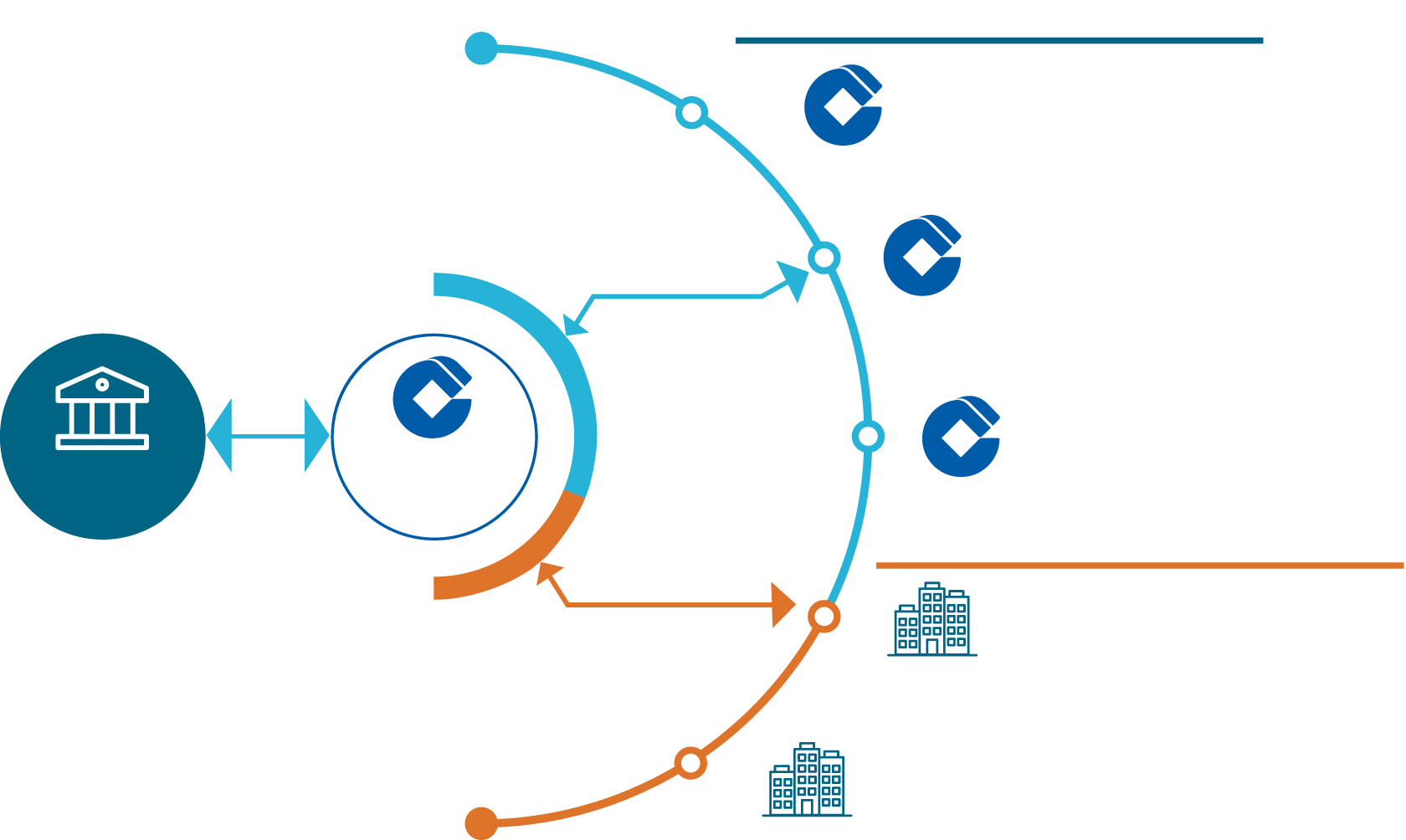

Centralized Account Management

Enterprises can access subsidiary or branch accounts in a "one-stop" manner through various channels such as corporate online banking and Bank-Enterprise Direct Link, making subsidiary or branch accounts "visible and controllable".

Through CCB (Asia) accounts, immediate inquiry and centralized payment authorization can be achieved, thus centrally managing accounts and flexibly utilizing funds.

Enterprise

One-stop access

Corporate online banking Bank-Enterprise Direct

Link

Other Bank Account Inquiry

(Sending MT940/MT942 messages)

Interest-bearing deposits

Account inquiry

Centralized payment

(via the Clearing House Automated Transfer System CHATS / Telegraphic Transfer TT)

Using China Construction Bank (Asia) accounts in Mainland, Hong Kong, and Macau

Hong Kong Branch 1

Mainland Branch 2

Macau Branch 3

Using Other Bank Accounts

Hong Kong Branch 1

Hong Kong Branch 2

Using MT940/MT942 messages, summarizes balance information and transaction details of other bank accounts (domestic and overseas).

Satisfy multinational enterprises' realization of global account "visibility and controllability"

Helps multinational enterprises flexibly manage funds in China, Hong Kong, and Macau.

Provides account information management, comprehensively grasping fund distribution.

Enhances cash flow visibility, improves fund management efficiency.

Monitoring business processes, achieving payment automation and standardization.

Reduces financial and management costs.

Local Fund Pooling

Enterprises and local subsidiaries or subsidiaries can enjoy flexible fund pooling services, including instant or scheduled fund pooling.

Enterprises can customize personalized fund pooling services according to their needs to improve fund utilization efficiency and create higher returns.

Enterprise

One-stop access

Corporate online banking Bank-Enterprise Direct Link

Subsidiary 1

Subsidiary 2

Subsidiary 3

Subsidiary 4

Fund flow

Various Fund Management Models

Supports

single-time pooling or

disbursement execution mode, supporting immediate execution and scheduled execution.

Weekly pooling can be processed on a

daily, monthly, end-of-month, etc., cycle.

Pooling amounts include

zero balance, target balance, or pooling mode tailored to customer needs.

Supports

internal pricing, subsidiaries can choose interest allocation according to business needs.

Dynamic Cash Management

Physically centralizes enterprise funds, dynamically shares group resources through linked payments, and supports

payment by collection to improve group fund utilization efficiency and achieve automatic allocation of group funds.

Flexible Parameter Settings

Supports

multiple modes of fund pooling, personalized

multi-level parameter settings, such as pooling path, electronic information notification parameters, etc., to flexibly adapt to business development.

Simple and Fast Management

Through providing

real-time electronic message notification and

report inquiry functions, check transaction status in real time. Supports

display in multiple languages to meet the daily business needs of different corporate customers and enhance customer experience.

Education Industry

Through supporting multiple electronic payment channels, educational institutions can customize exclusive billing codes for each student for cross-bank payments, unified cash flow management, and follow-up on payment status. As tested, the entire payment process can be completed in as fast as 10 seconds*, providing parents with a faster and more convenient payment method, saving time and procedures for both parties. Meanwhile, CCB (Asia) also provides other proxy payment services, allowing corporate institutions to easily handle administrative tasks such as issuing scholarships and payroll.

Simplify payment processes

Improve cash flow

Online Payment

In-person Payment

Automatic Transfer

Online payment gateway (credit card/e-wallet/FPS)

FPS jump payment

QR code

payment

eDDA

direct debit

School/

Educational Institution

Students

Employee/

Student

Instant disbursement

Batch remittance

Enterprise payroll/disbursement to local students

Issuing scholarships to overseas students

Electronic fund management

Standardized payment processes

*The above information is for reference only

Simplify Receivables Process

Simplify Receivables Process Improve Cash Flow

Improve Cash Flow

Electronic Fund Management

Electronic Fund Management Standardized Payment Process

Standardized Payment Process

Simplify payment processes

Simplify payment processes Improve cash flow

Improve cash flow

Electronic fund management

Electronic fund management Standardized payment processes

Standardized payment processes