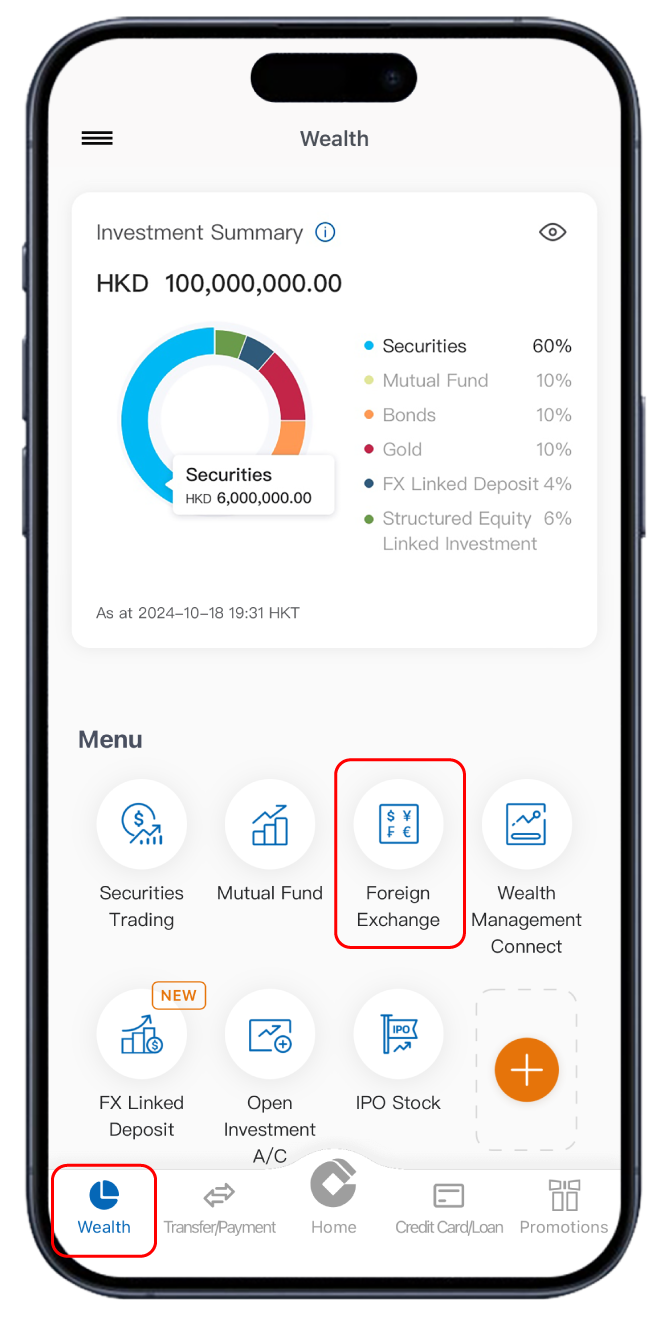

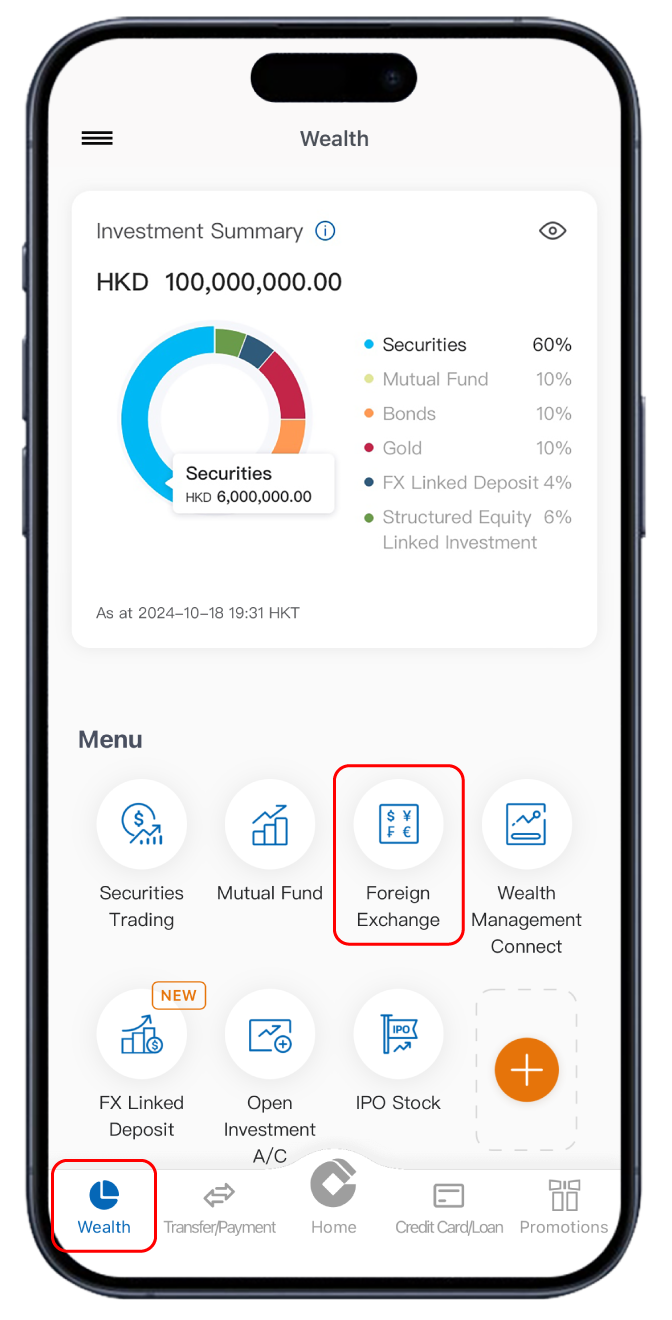

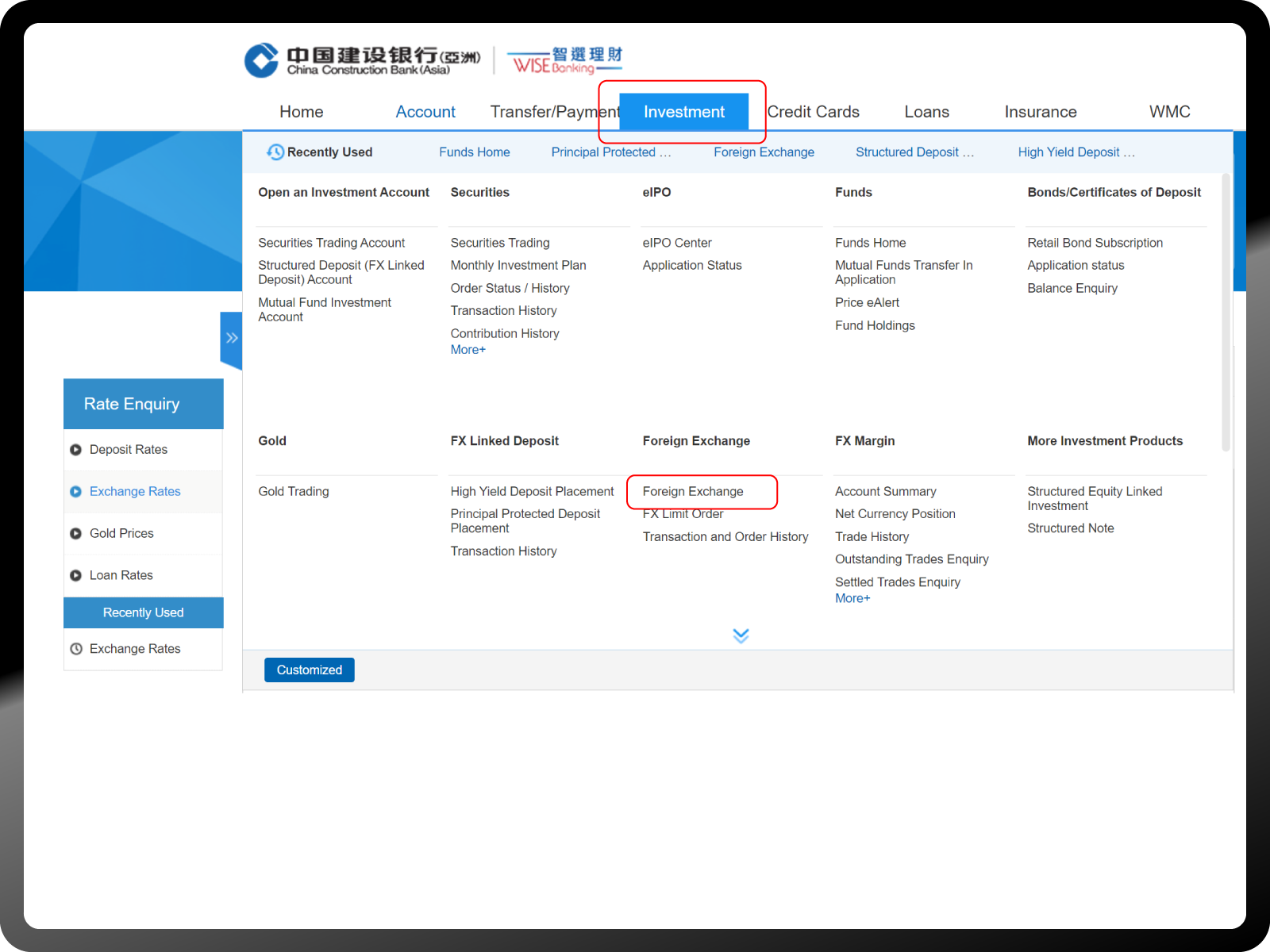

Foreign Exchange

One-stop FX Service

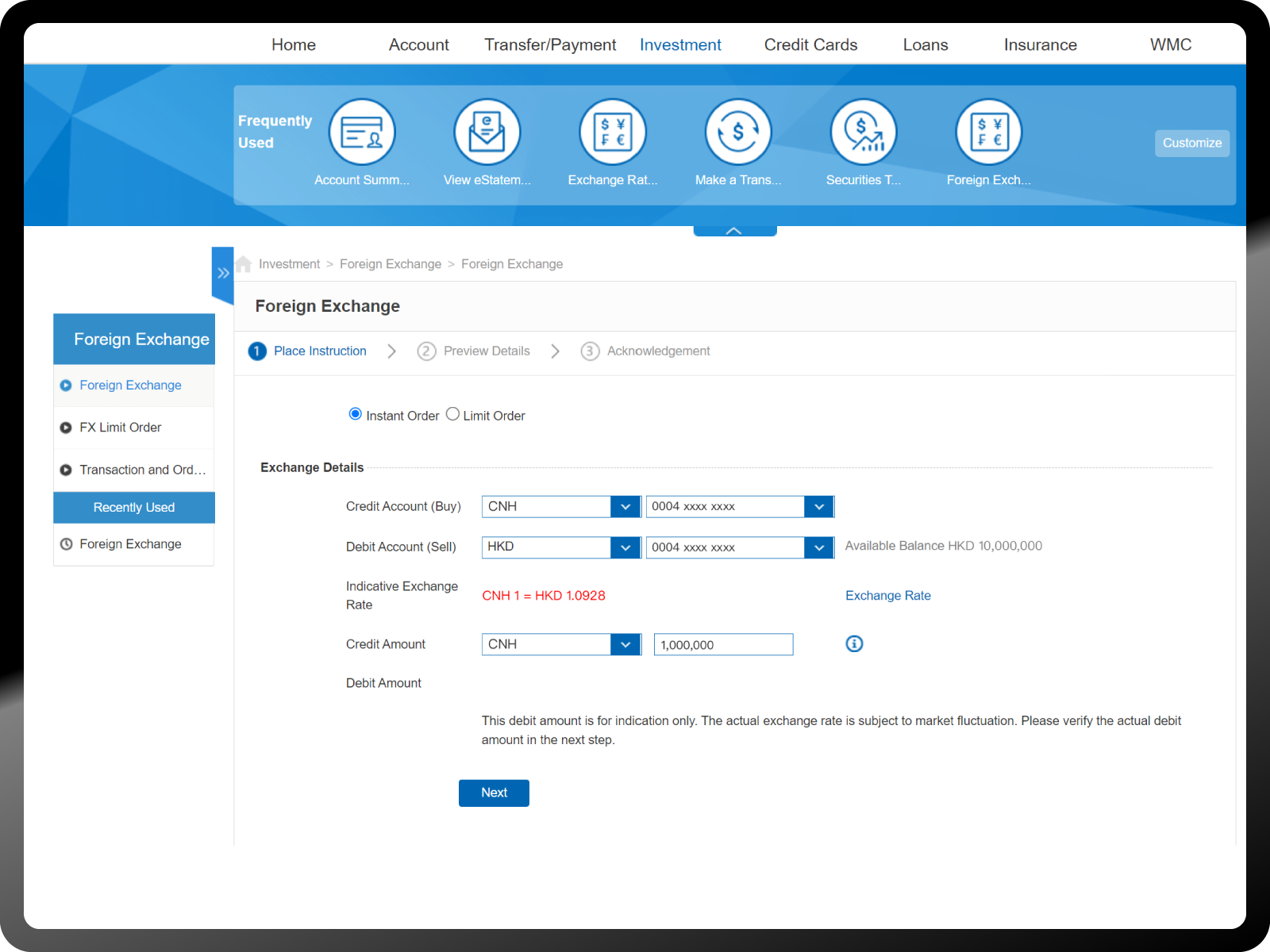

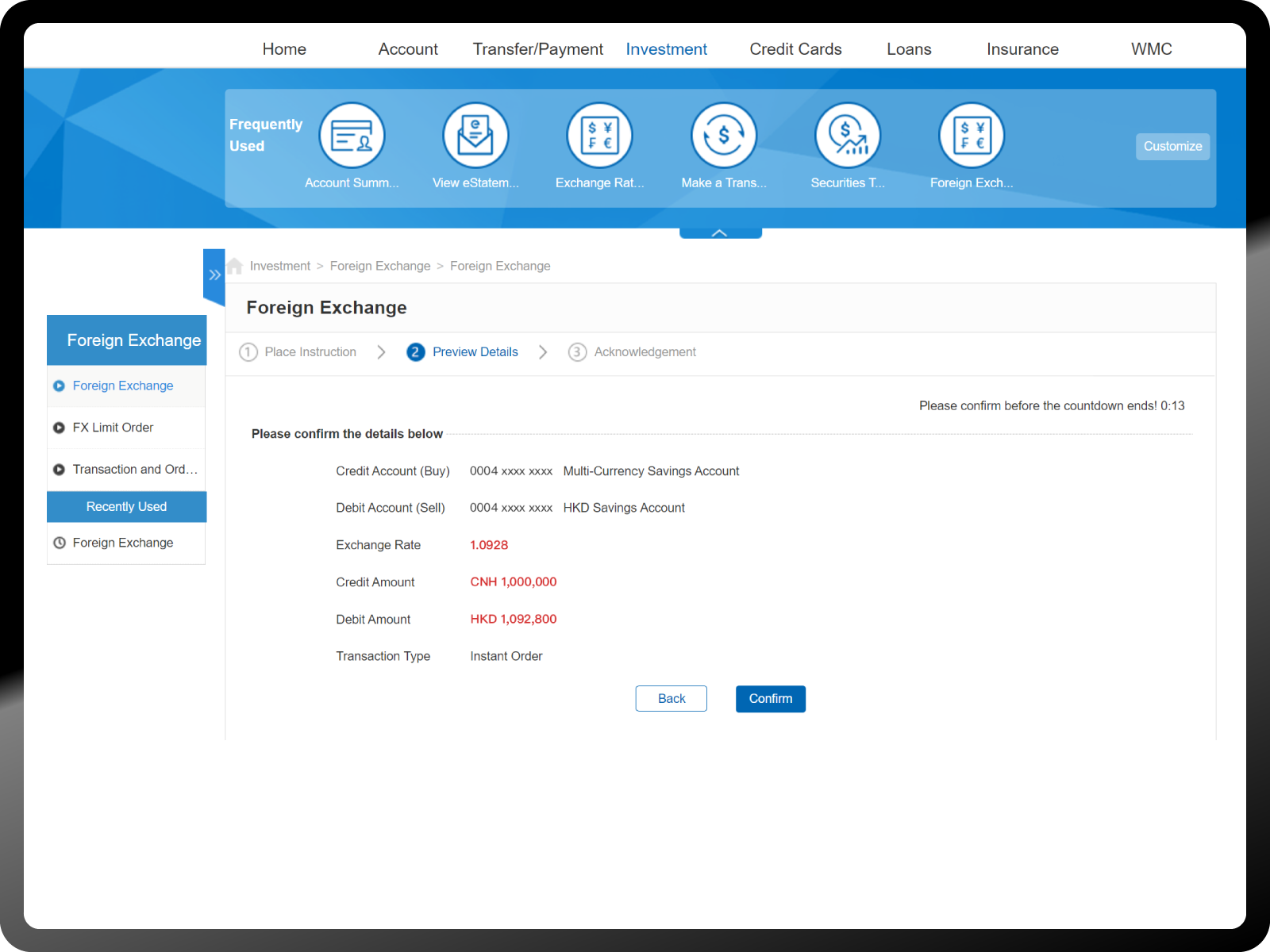

Seize FX Opportunities Easily

Seize FX Opportunities Easily

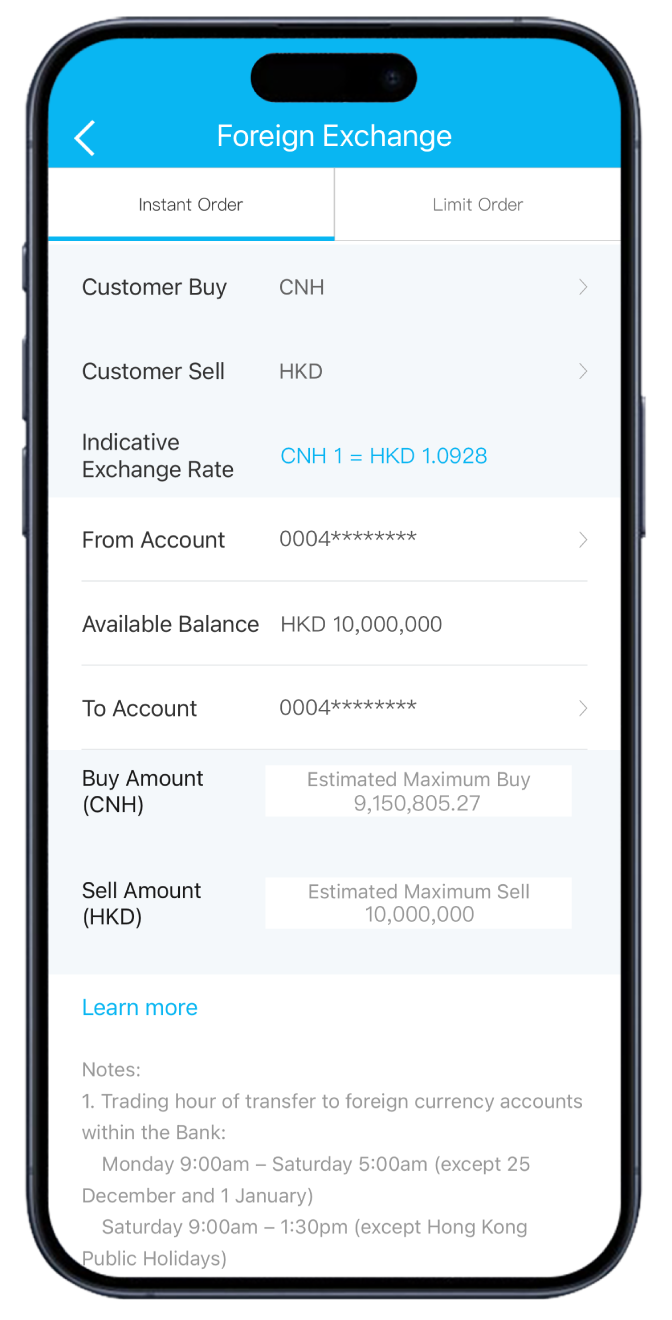

Currency Choices

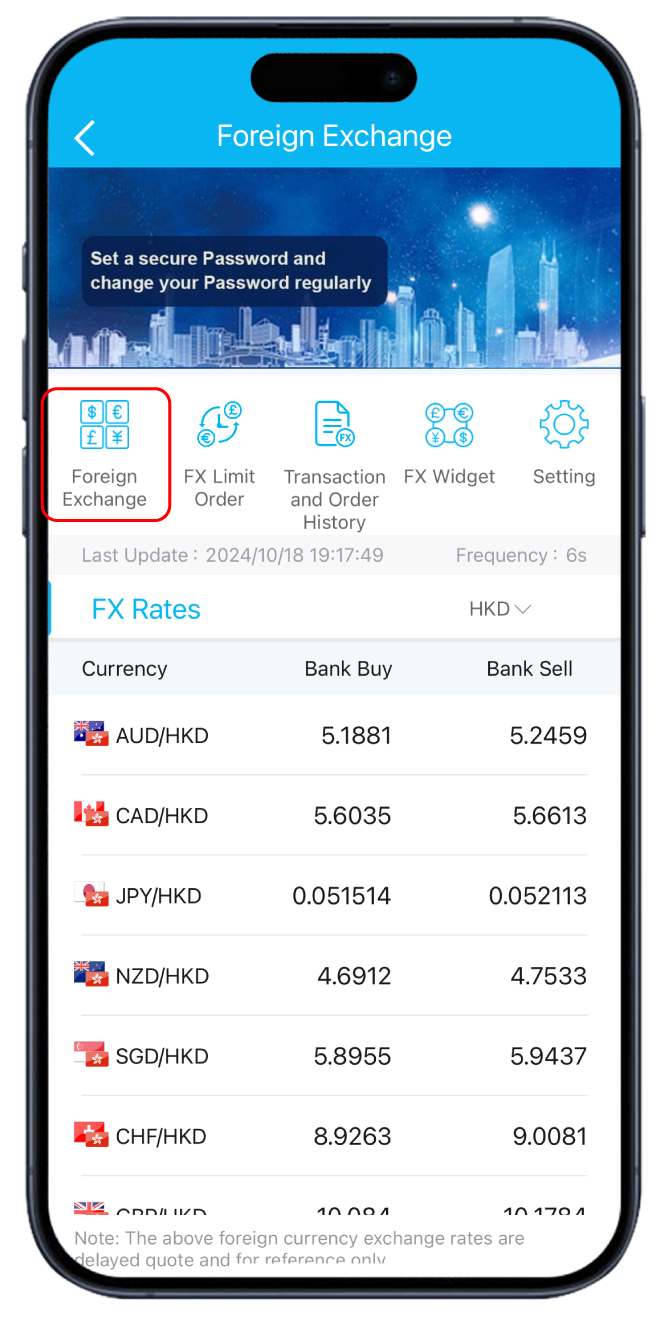

Price Alert Services

FX Price Alert: Receive SMS and/or email notifications immediately when your preset target exchange rate is reached.

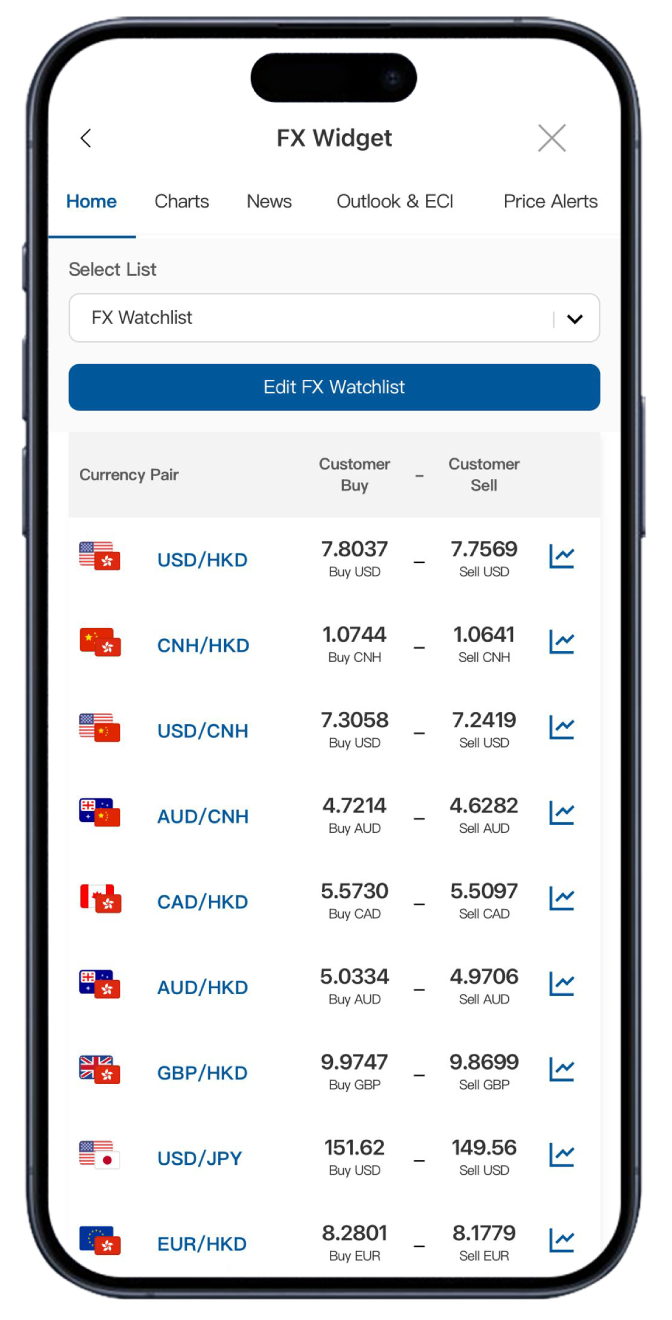

with Newly Launched FX Widget3

Customized FX Watchlist

View the real-time exchange rates of your selected currency pairs at a glance

Interactive FX Charts

Analyze FX trends at your fingertips via the interactive charts with technical indicators

FX News and Economic Indicators

Track the latest FX news and seize opportunities in the FX market

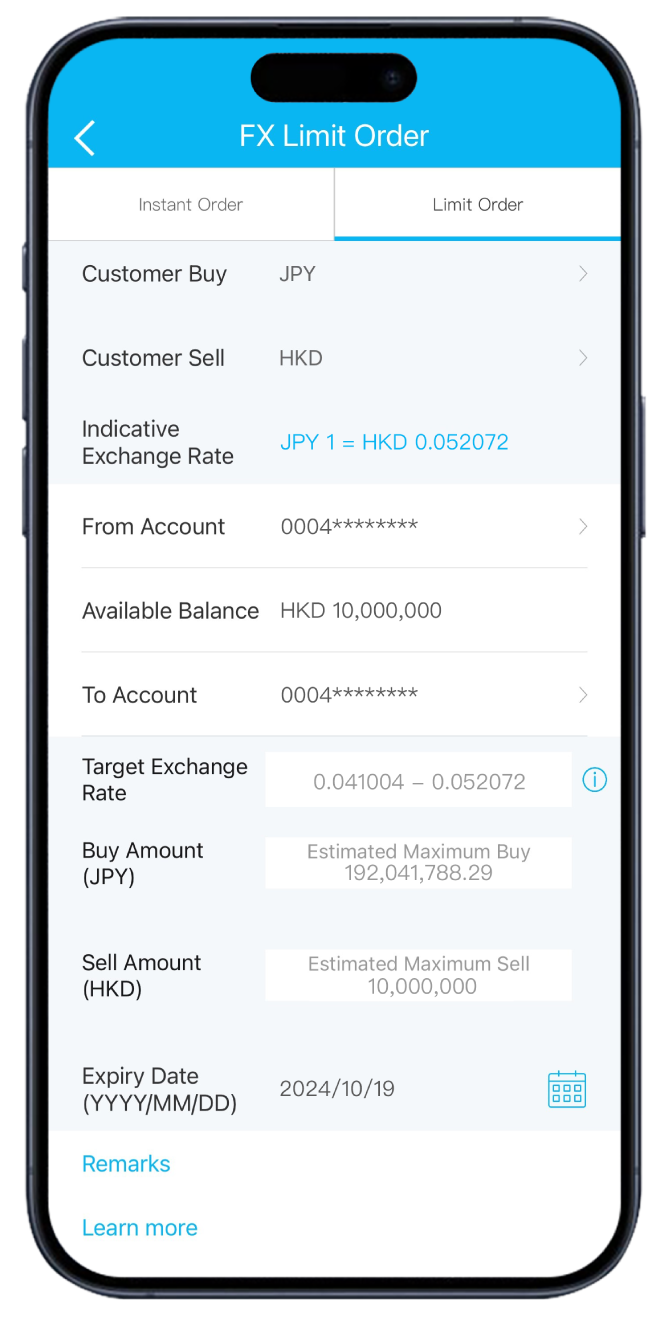

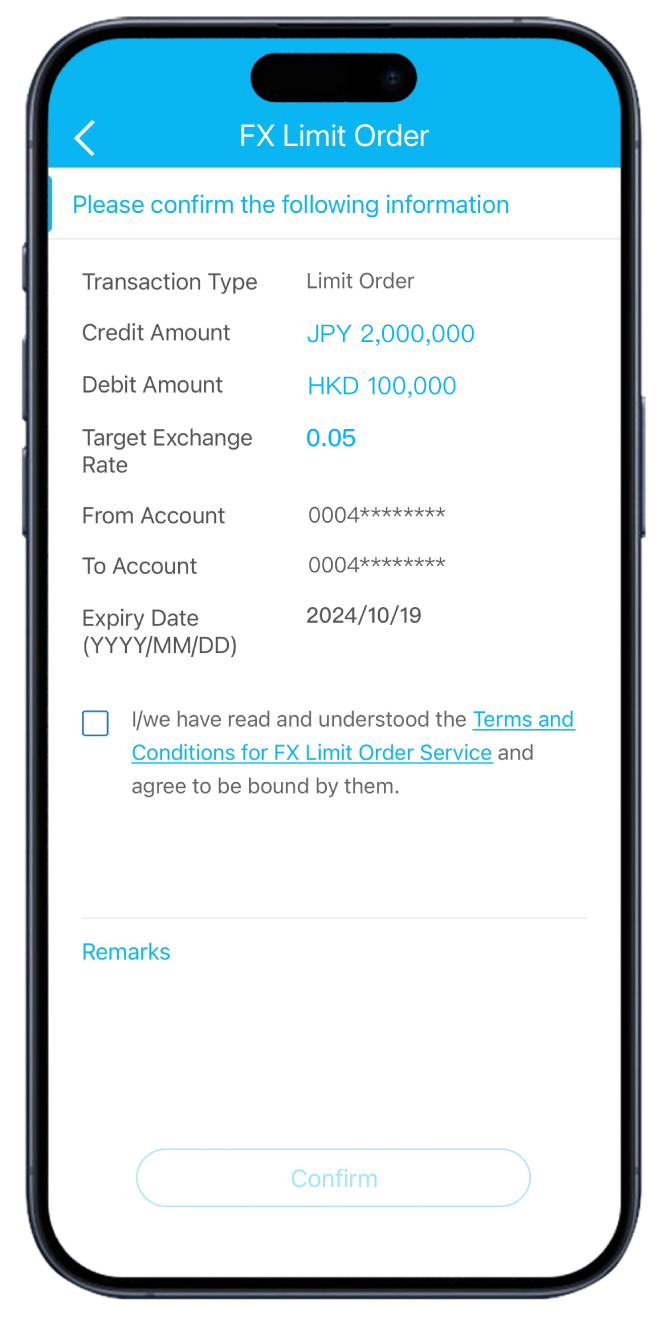

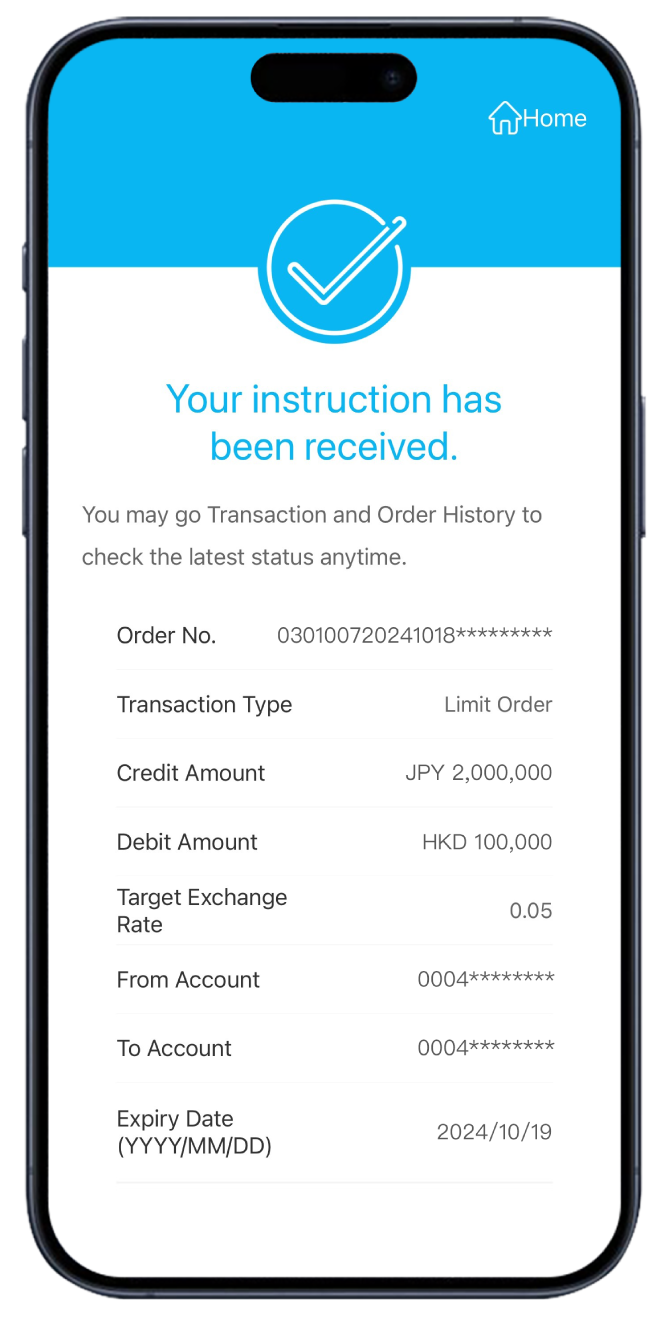

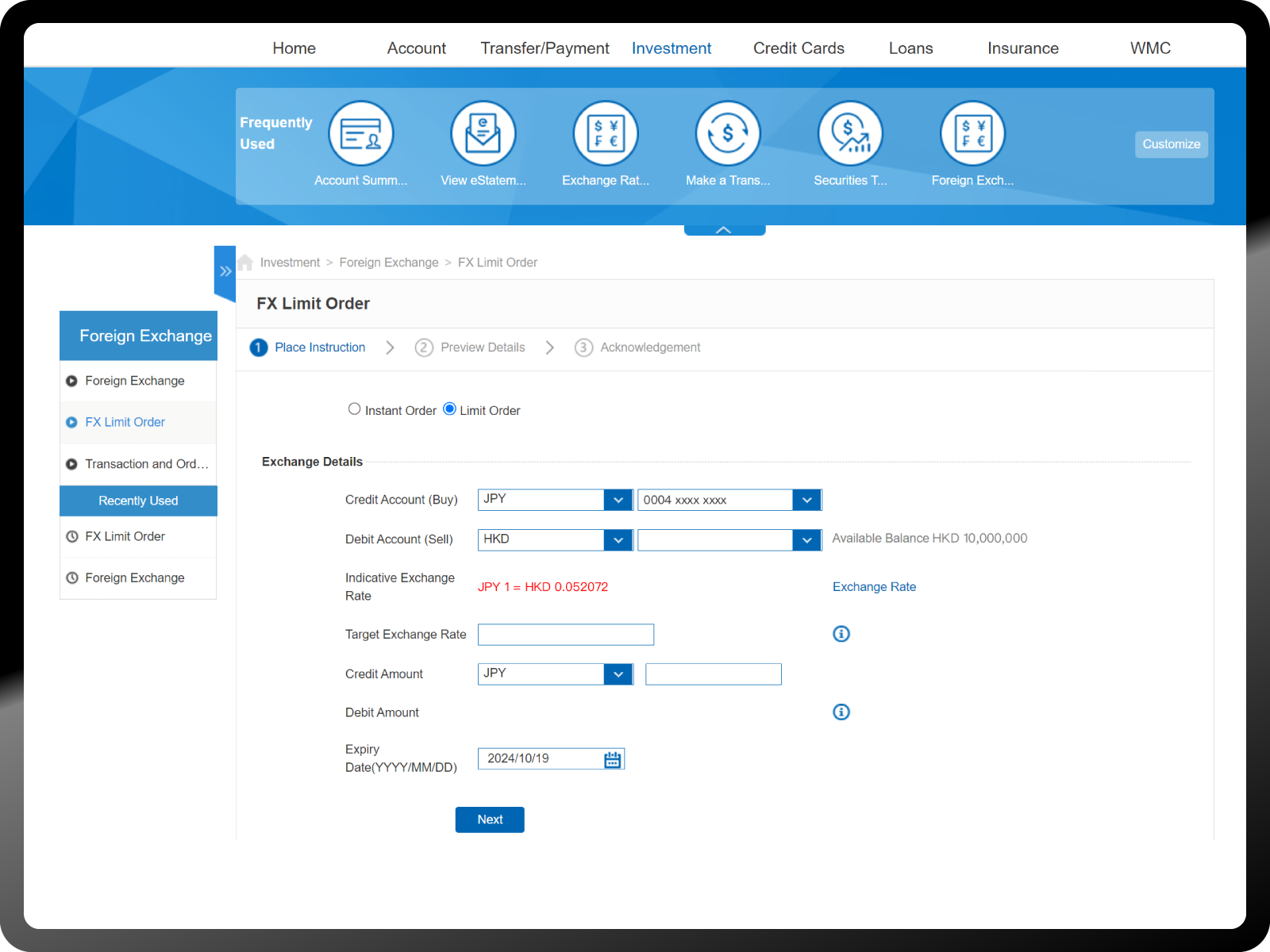

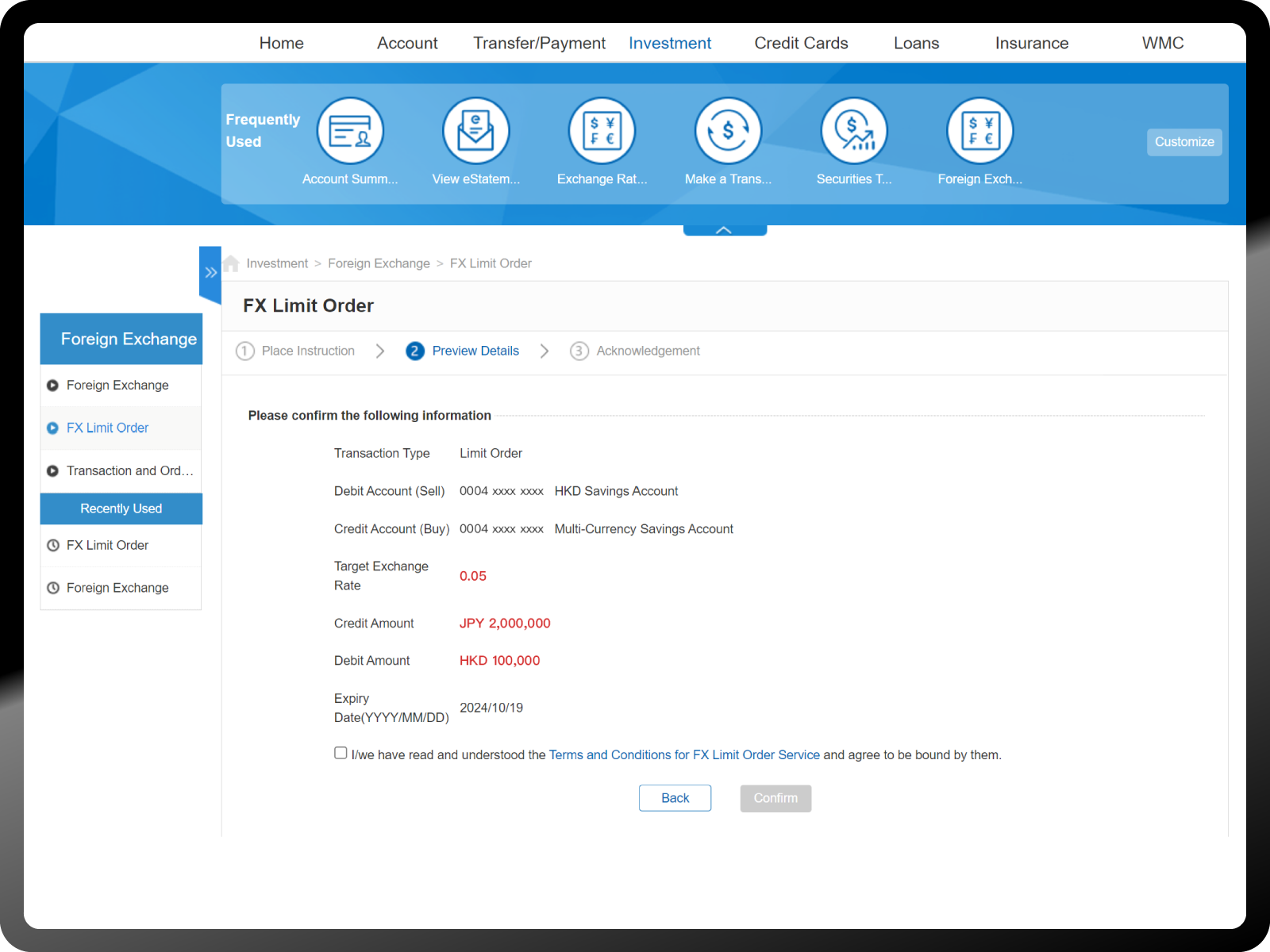

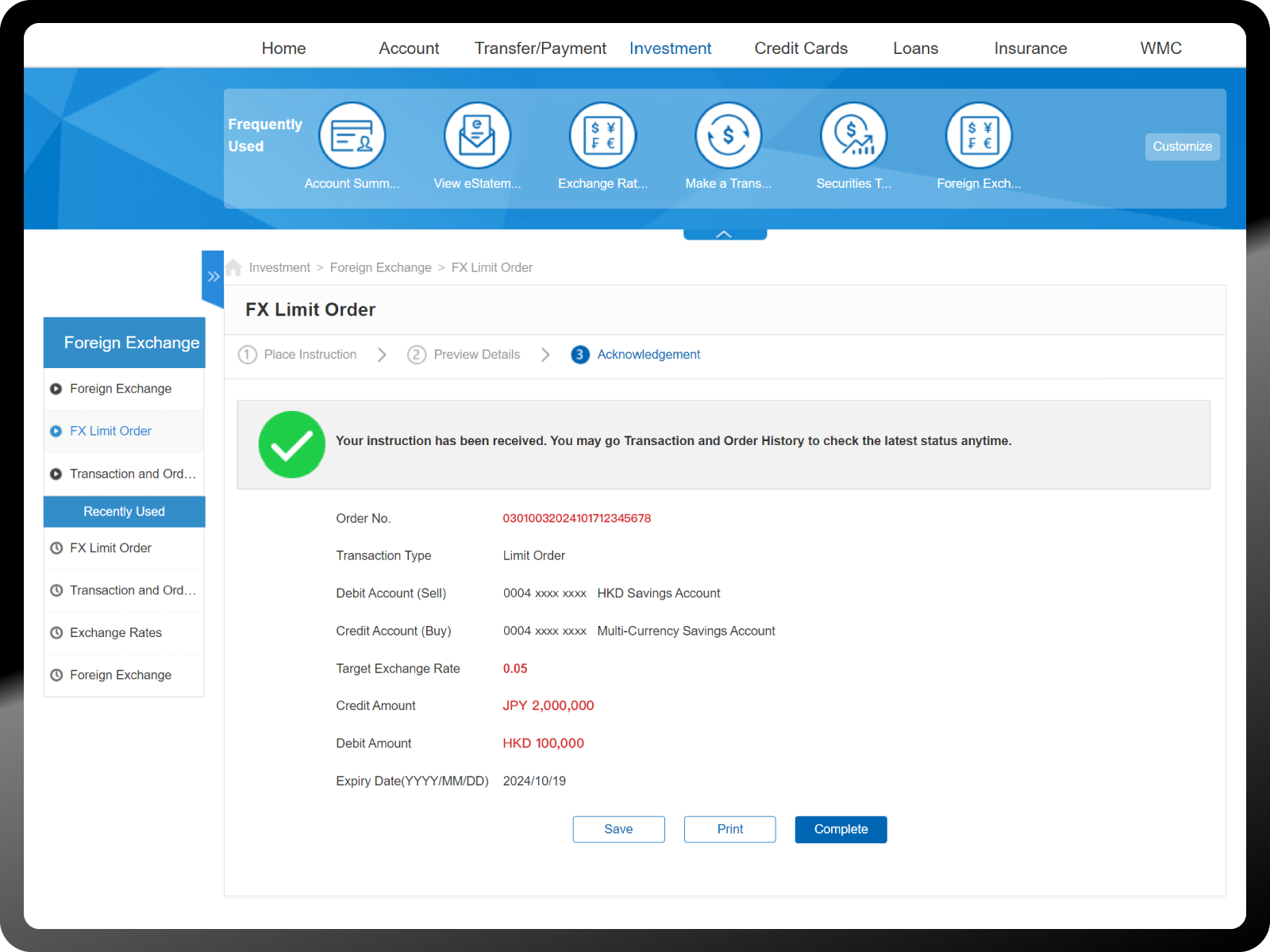

FX Price Alerts and Limit Orders

Receive instant notification or exchange automatically when your preset target exchange rate is reached to capture every FX opportunities

CCB (Asia) has prepared a series of “FX Classroom” for you, starting from the fundamental to advance levels gradually, so you can understand FX concepts easily!

(Chinese version only)

- The maximum amount of each FX transaction via Online Banking, Mobile Banking or Phone Banking is HKD 6,000,000 or its equivalent.

- The trading hours of FX transactions through Online Banking and Mobile Banking are from 9:00 a.m. on Monday to 05:00 a.m. on Saturday (except December 25 and January 1) and from 9:00 a.m. to 1:30 p.m. on Saturday (except Hong Kong public holidays). The trading hours on December 25 and January 1 will be closed at 5:00 a.m., and resumed at 9:00 a.m. on December 26 and January 2 respectively (except Sundays and Public Holidays on Saturdays).

- Customer needs to update the CCB (HK & MO) Mobile App to version 2.2.9 or above to use the “FX Widget” function.

Risk Disclosure

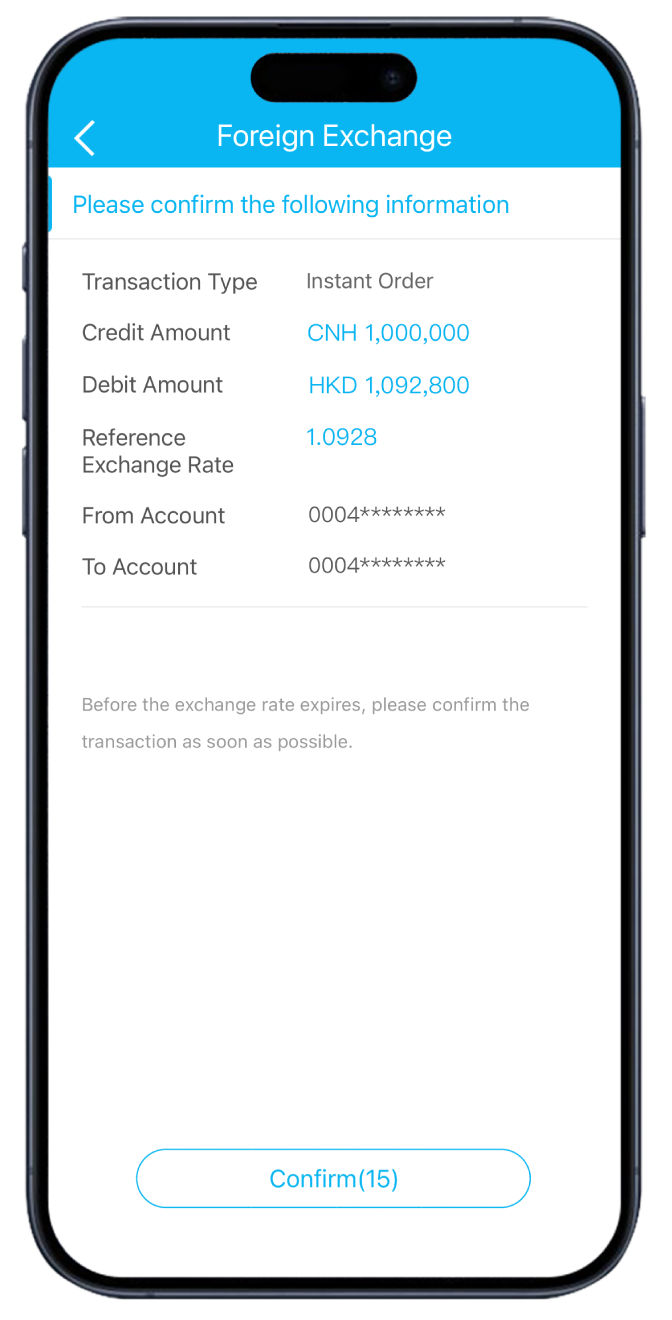

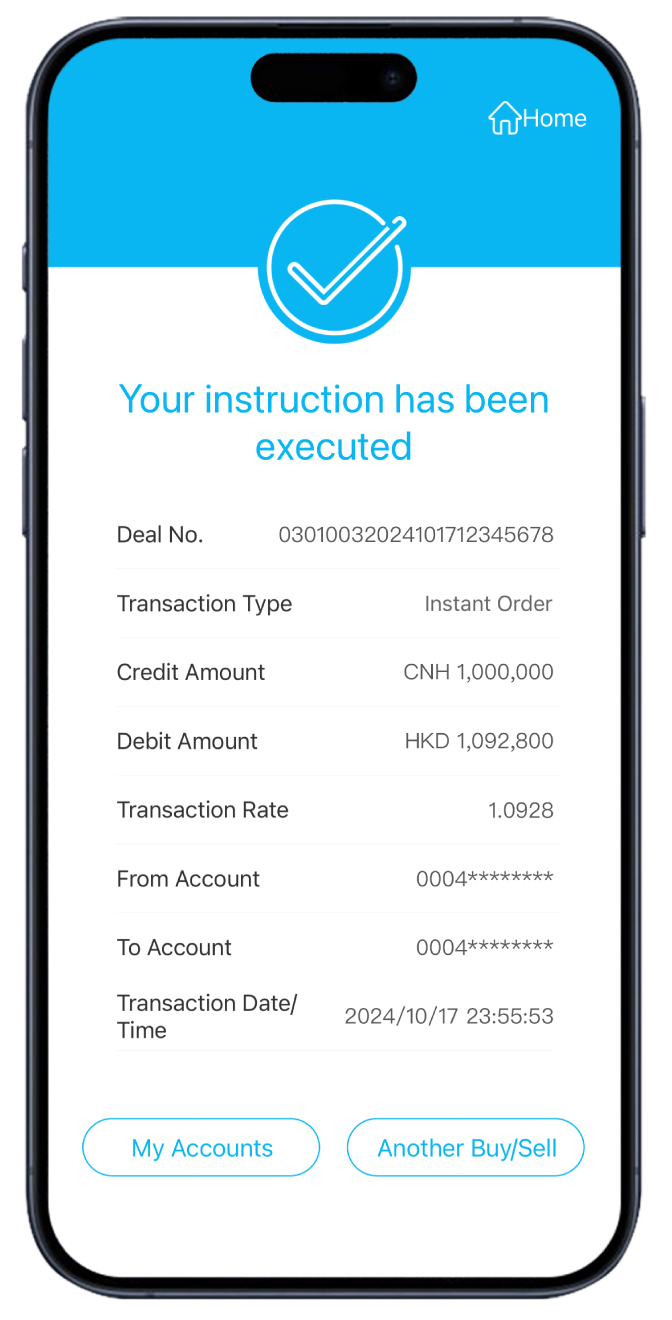

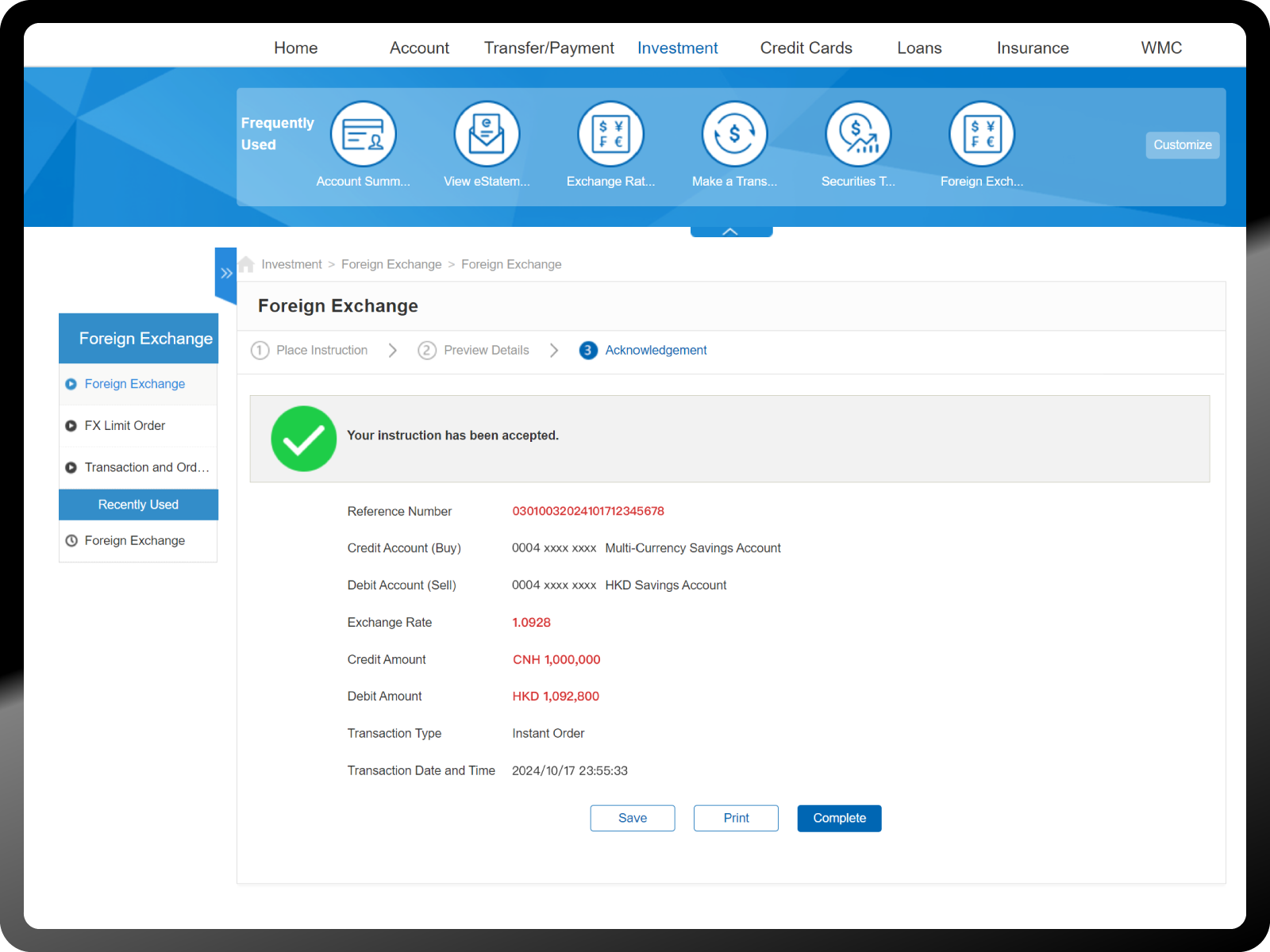

Currency Exchange

Currency exchange involves bid-ask spread.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.