Online New Fund Time Deposit Offers

Enjoy preferential interest rates

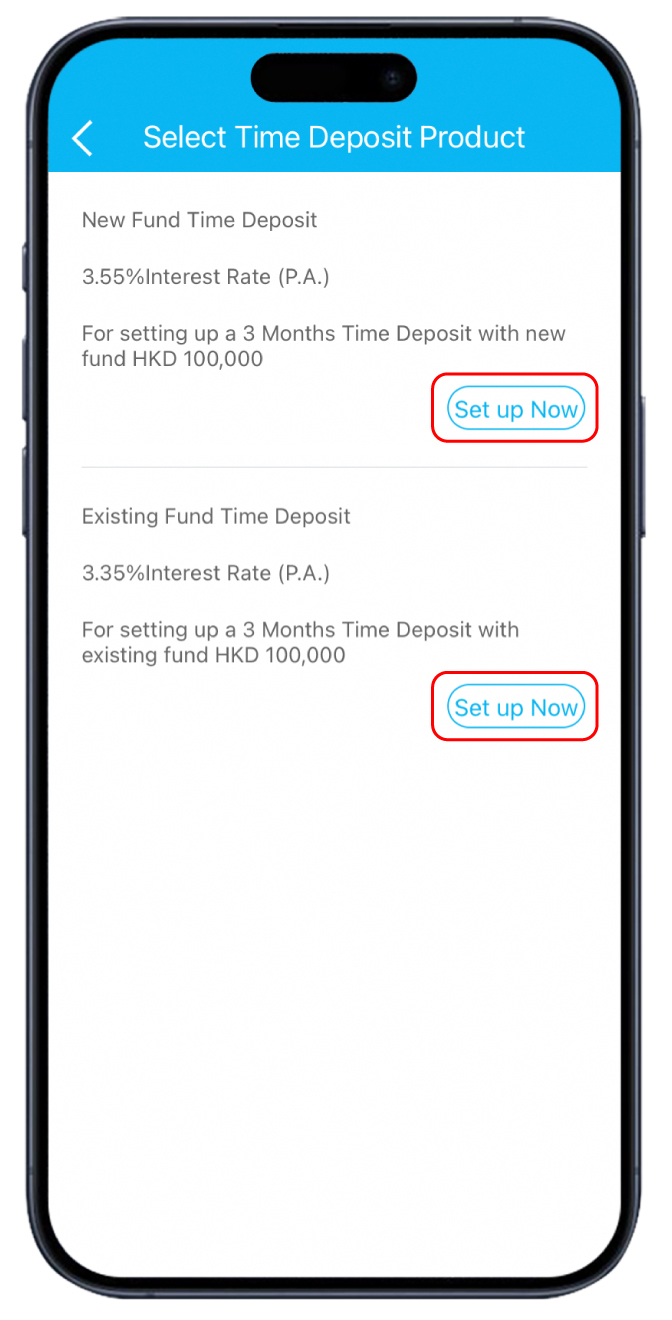

| Currency | Deposit Amount | Deposit Tenor |

Online Extra Interest Rate (p.a.) | Reference Time Deposit Interest Rate (p.a.) (include Online Extra Interest Rate (p.a.))* |

| USD | USD100,000 or above |

0.10% | 4.00% | |

| HKD | HKD1,000,000 or above |

3.20% | ||

| RMB | RMB500,000 or above |

1.50% | ||

| GBP | Equivalent to HKD30,000 or above |

0.20% | 3.75% | |

| AUD | 3.35% | |||

| NZD | 3.25% | |||

| CAD | 2.25% |

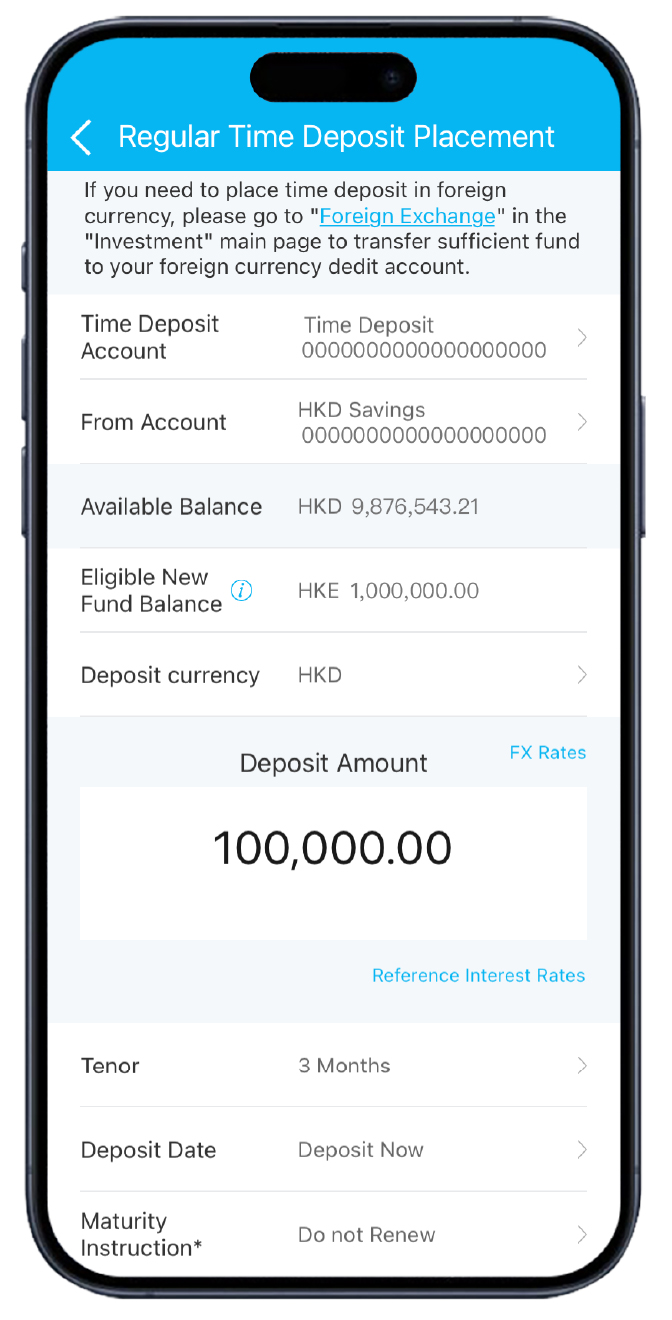

“Eligible New Fund Balance” refers to the incremental balance when comparing the day end Total Deposit Balance of last calendar day (T-1 day) with the day end Total Deposit Balance as of 3 calendar days ago (T-3 day), after deduction of the sum of principal amount (if applicable) which has been entitled to new fund offer of Time Deposit within the latest 3 calendar days (T day, T-1 day and T-2 day), where T day is today:

- Total Deposit Balance refers to the available balance of all deposit accounts, including Savings Accounts and/or Checking Accounts and Time Deposits of Hong Kong Dollar and foreign currencies (whether accounts in sole name or as primary holder of joint name accounts).

- The Bank reserves the right of final decision should there be any dispute in the definition of New Funds.

Notes: Eligible New Fund Balance affected by individual factors, mainly include 1) the check deposit cut off time on the check deposit day and 2) public holiday, long weekend and the day fall into typhoon. Please refer to the detail and examples on the time deposit product page on our website or contact our bank staff for more details.

With following customer transaction records as an example, the “Eligible New Fund Balance” for customer today (22 January) is calculated as follows:

| (A) Total Deposit Balance of last calendar day (T-1 day) | HK$300,000 |

| Deduct (B) Total Deposit Balance as of 3 calendar days ago (T-3 day) | - HK$100,000 |

| Deduct (C=C1+C2+C3) Sum of principal amount which has been entitled to new fund offer of Time Deposit within the latest 3 calendar days (T day, T-1 day and T-2 day) | - HK$40,000 |

| “Eligible New Fund Balance” (A – B – C) | HK$160,000 |

Customer’s transaction record

| Date | Day End Total Deposit Balance | Transactions performed by customer | Sum of Principal Amount which has been entitled to new fund offer of Time Deposit |

|---|---|---|---|

| 19 January (T-3) | HK$100,000 (B) | -- | HK$0 |

| 20 January (T-2) | HK$300,000 | Transfer in New Fund of HK$200,000 | HK$0 (C1) |

| 21 January (T-1) | HK$300,000 (A) | Set up New Fund Time Deposit with HK$40,000 | HK$40,000 (C2) |

| 22 January (T) | -- | -- | HK$0 (C3) |

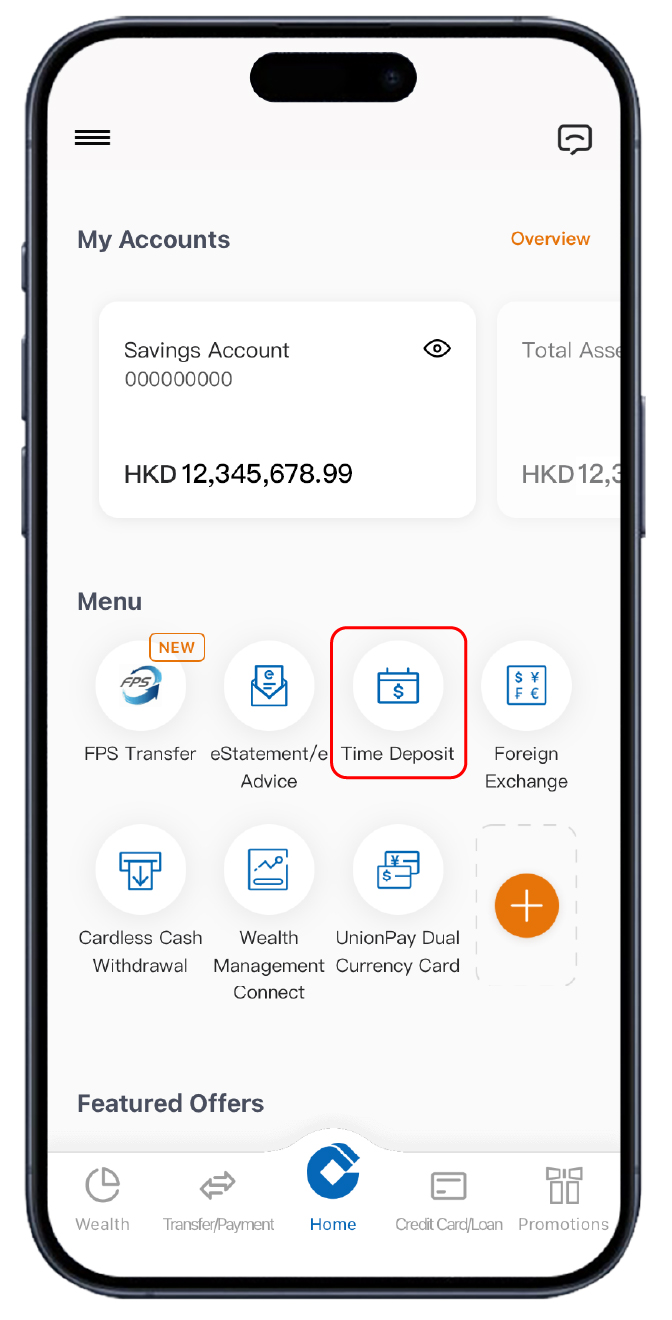

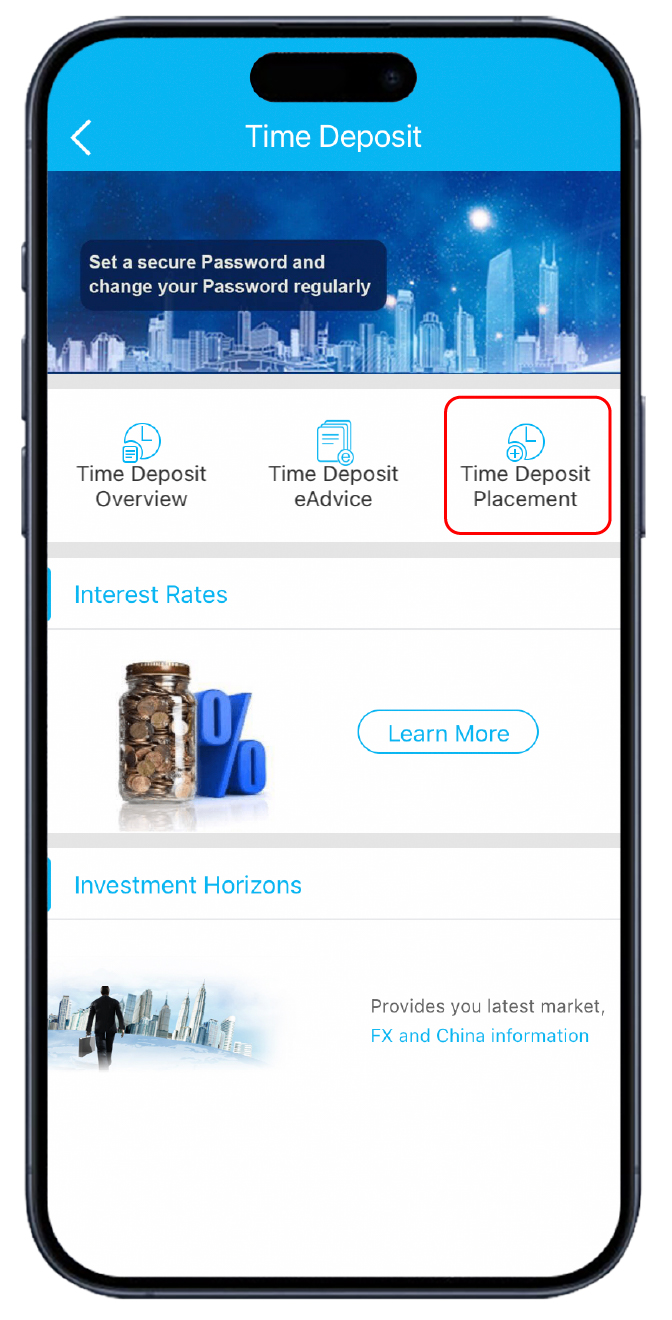

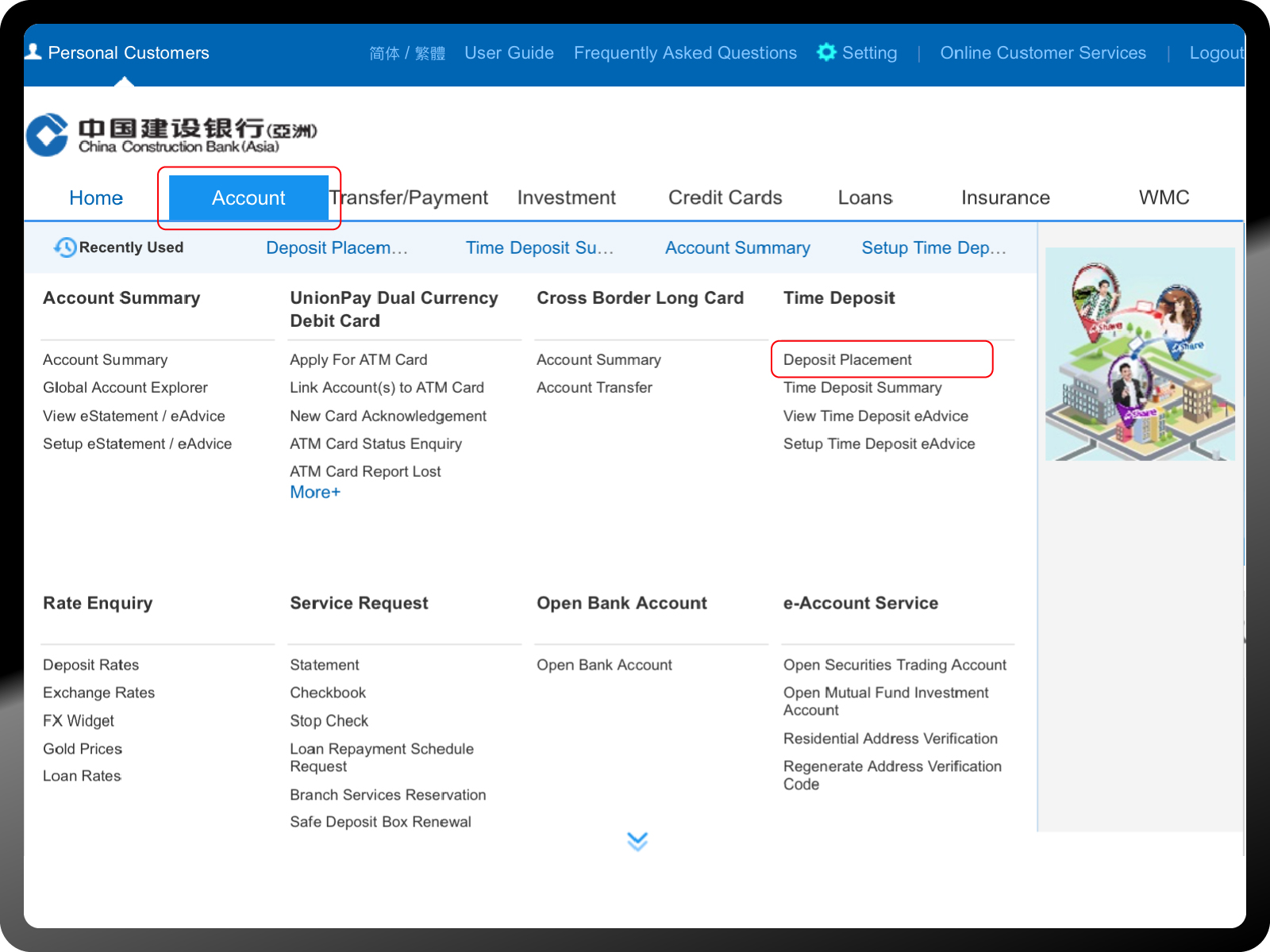

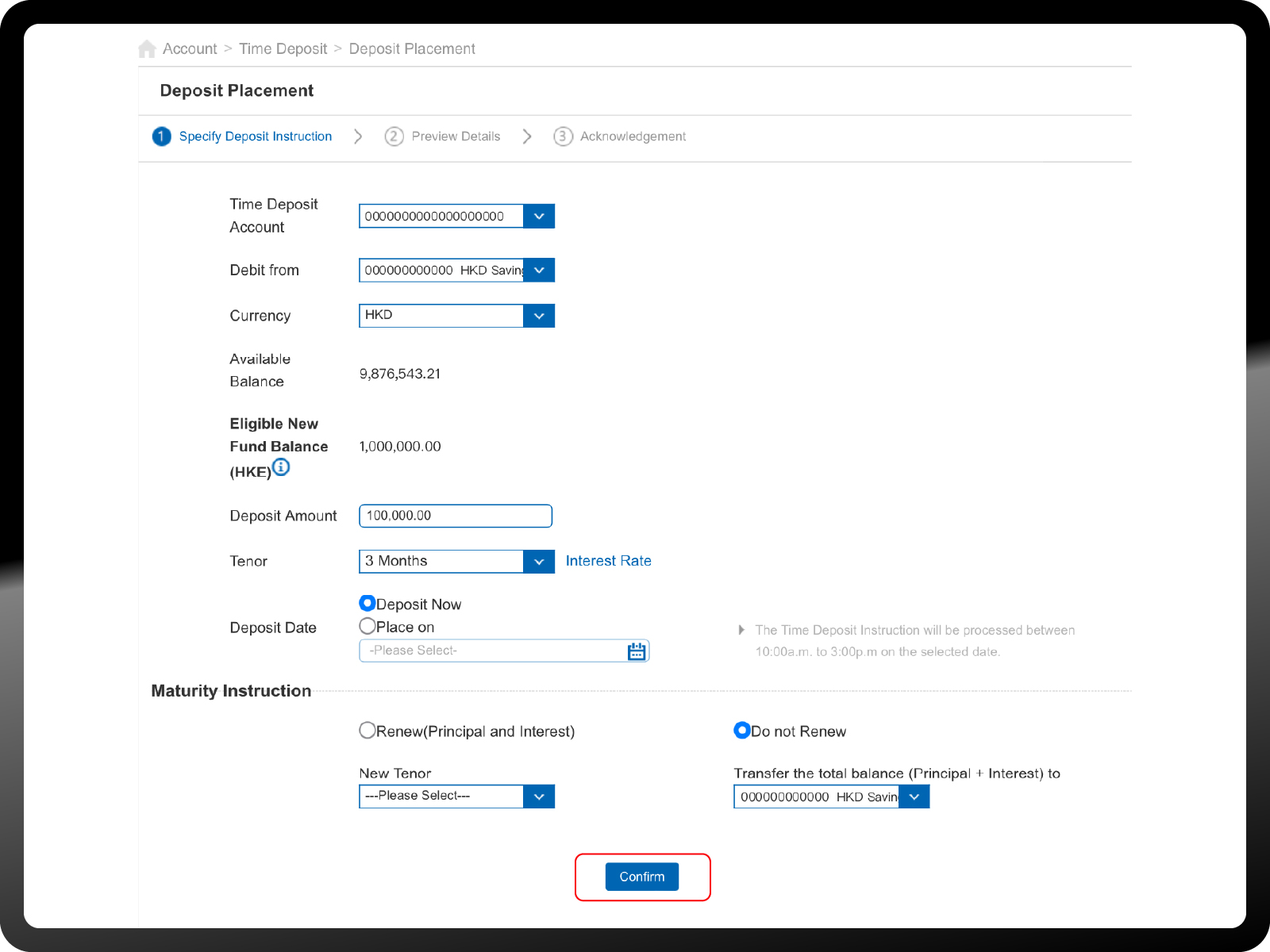

via e-Channels of Just Clicks Away

- Time Deposit set up service hours:- Mobile Banking and Online Banking: 9am to 6pm, Mondays to Fridays

Customer must currently hold a Time Deposit Account with the Bank in order to place time deposits via Online Banking or Mobile Banking. For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank’s branches for account opening.

via Online Banking Now

Mobile Banking Now

- NOT applicable to Time Deposit renewals, including Renewal (Principal and Interest), Renewal (Renew Principal Only), Renewal (Change Principal Amount) and Renewal (Change Tenor).

- Customer must hold a Time Deposit Account with the Bank in order to place time deposits via the Bank’s e-Channels (including Mobile Banking, Online Banking or Smart Teller Machines at designated branches). For customers who do not hold a Time Deposit Account, please contact a Relationship Manager or visit the Bank's branches for account opening.

The above offers and services are bound by related terms and conditions, please refer to the following terms and conditions.

Enquiry Hotline : 2903 8303

- The promotion period of this Promotion is from January 22, 2025 to March 31, 2025 (both dates inclusive) (the “Promotion Period”).

- China Construction Bank (Asia) Corporation Limited (the “Bank”) reserves the right to vary, suspend and terminate the Promotion and to vary or modify any of these Terms and Conditions from time to time without prior notice. In case of disputes, the decision of the Bank shall be final and binding.

- The Promotion is only applicable to Personal Banking customers of the Bank (“Eligible Customer(s)”), but not applicable to the corporate customers, Commercial Banking customers and Capital Investment Entrant Scheme customers of the Bank.

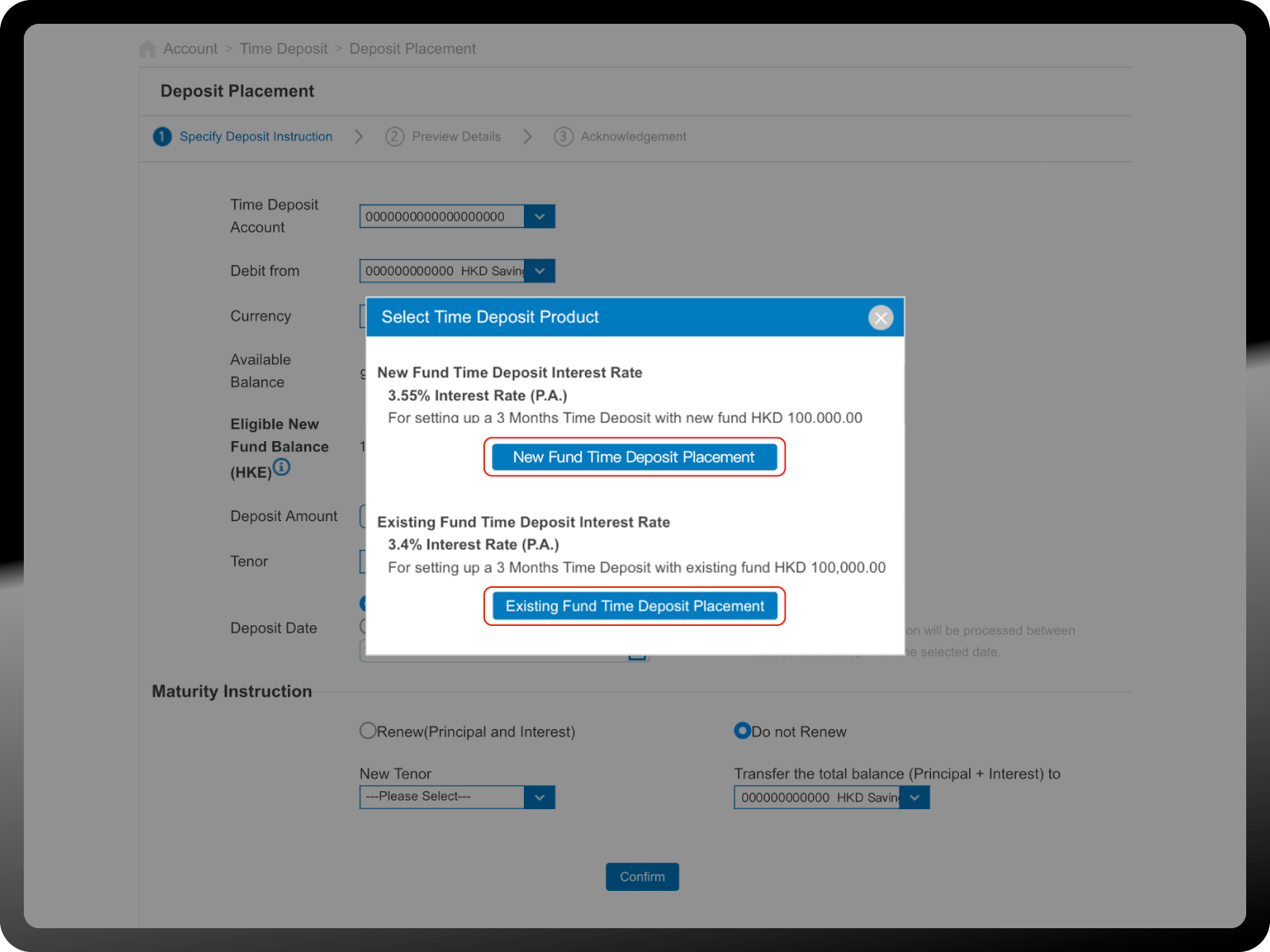

- During the Promotion Period, Eligible Customer who successfully set up eligible new fund time deposit via the Bank’s e-Channels (including Mobile Banking, Online Banking or Smart Teller Machines at designated branches) can enjoy preferential interest rate, the relevant interest rates will be subject to the rates quoted by the Bank in e-Channels from time to time.

- The Promotion is not applicable to Time Deposit renewals, including Renewal (Principal and Interest), Renewal (Renew Principal Only), Renewal (Change Principal Amount) and Renewal (Change Tenor).

- “Eligible New Fund Balance” refers to the incremental balance when comparing the day end Total Deposit Balance of last calendar day (T-1 day) with the day end Total Deposit Balance as of 3 calendar days ago (T-3 day), after deduction of the sum of principal amount (if applicable) which has been entitled to new fund offer of Time Deposit within the latest 3 calendar days (T day, T-1 day and T-2 day), where T day is today:

- Total Deposit Balance refers to the available balance of all deposit accounts, including Savings Accounts and/or Checking Accounts and Time Deposits of Hong Kong Dollar and foreign currencies (whether accounts in sole name or as primary holder of joint name accounts).

- The Bank reserves the right of final decision should there be any dispute in the definition of New Funds.

Notes: Eligible New Fund Balance affected by individual factors, mainly include 1) the check deposit cut off time on the check deposit day and 2) public holiday, long weekend and the day fall into typhoon. Please refer to the detail and examples on the time deposit product page on our website or contact our bank staff for more details.

- Any withdrawal or partial withdrawal of a time deposit prior to maturity of the time deposit without sufficient prior notice shall only be permitted at the discretion of the Bank. The Bank may levy a charge and/or forfeit the interest accrued on the time deposit in whole or in part in such instances.

- If the maturity date of the time deposit period falls on a day which is not a Business Day (as defined below), the maturity date of the time deposit and / or the automatic roll-over instruction of the time deposit will be deferred to the following Business Day without prior notice. The Bank will not be responsible to any person for the deferral of the time deposit maturity date and/or the automatic roll-over instruction. “Business Day" means a day on which the Bank is open for business in Hong Kong, but excluding Saturdays, Sundays, public holidays and the day which the Bank is unable to open for business due to extreme weather or sudden event.

- If there is any inconsistency between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including national and international financial and economic conditions and political and natural events. The effect of normal market force may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and price linked to such rates, may rise or fall rapidly. The fluctuations in the exchange rate of a foreign currency may result in losses in the event that you convert HKD to any foreign currency or vice versa.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.