Mutual Fund Investment

Diversify your investments effectively to enhance your earning power

- Investment involves risk, prices of investment product may go up as well as down, and may become valueless.

- Mutual funds are investment product and some may involve derivatives. The investment decision is yours but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

offering 3 major upgrades to further enhance your investment experience!

3 Major Upgrades

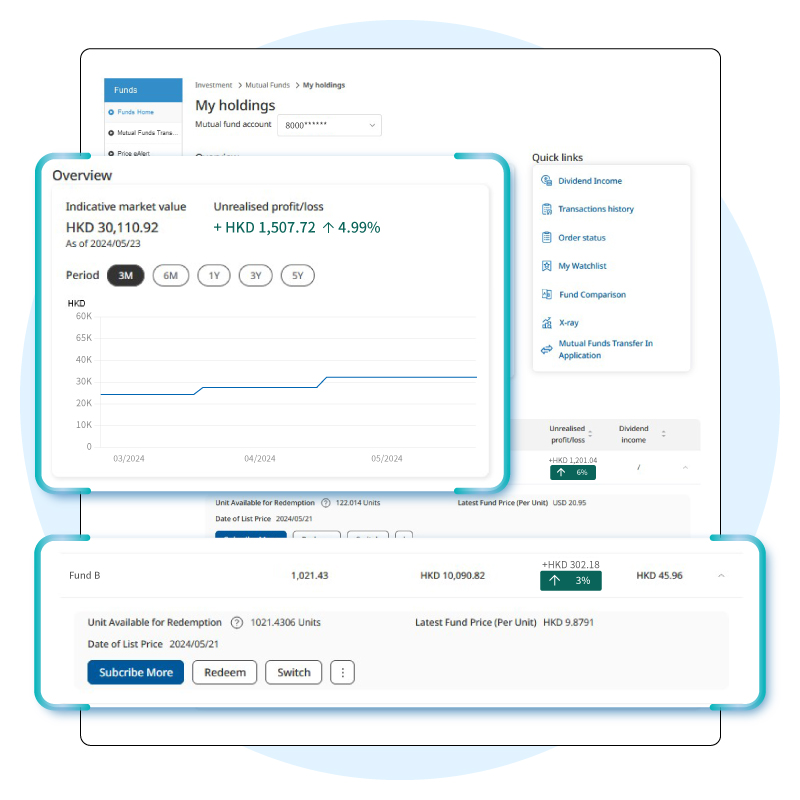

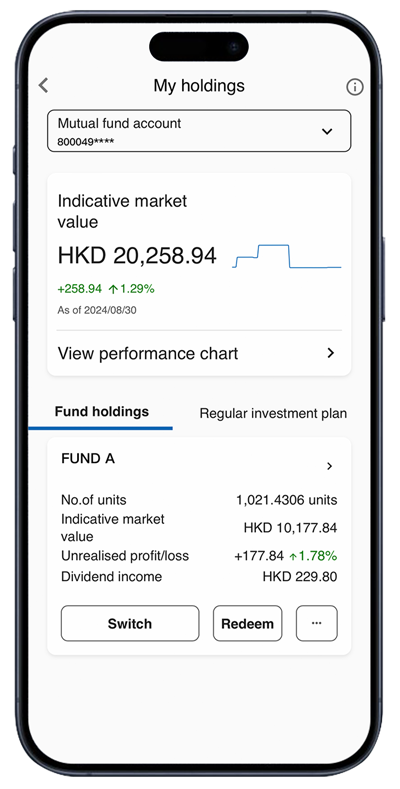

Profit/loss data of each mutual fund, along with account balances paired with trend charts are newly added on the new Mutual Fund Account Overview.

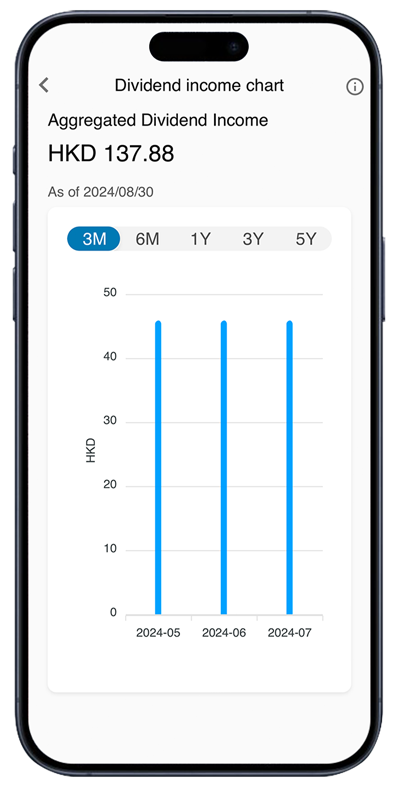

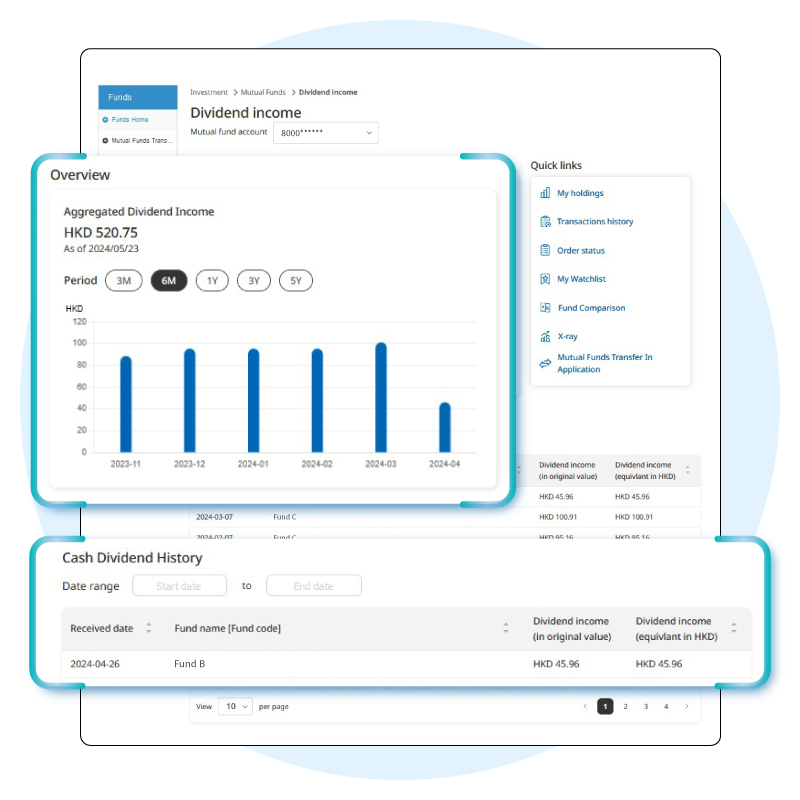

New "Dividend Income" feature allows investors to access past records of cash dividends for each fund held and the aggregated dividend income.

Provided for analysis, market overview and asset allocation to help you understand market trends and seize market opportunities.

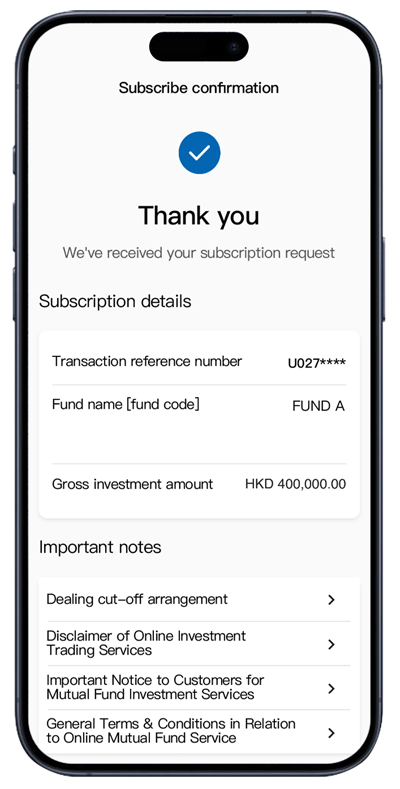

Subscription Guide (PDF)

Application Guide (PDF)

Most of the funds provide monthly dividend distribution share class, to provide stable income.

Fund is managed and run by a professional fund manager. Based on different market conditions, the team will adjust the investment fund portfolio according to economic and market trends, in order to manage the risks and strive to generate returns.

- Regional diversification: The fund can invest in multiple regions, such as the world, Europe, the United States, Asia (Japan/excluding Japan), emerging markets (such as Southeast Asia / Latin America / Eastern Europe), and even single countries / industries (such as technology / gold / (new) energy)

- Diversified allocation: investors can choose stock funds, bond funds, or both stock and bond funds

- Industry diversification: Choose funds from a designated/single industry, such as technology, real estate, industry, energy or infrastructure and other more popular investment themes

- Currency diversification: Most funds offer HKD, USD, EUR, AUD, NZD, CAD, GBP, JPY, CHF, SGD and RMB options

of funds

Service

Overdraft

Statement

Services

Investment Plan

With a minimum investment of only HK$1,000, you will have access to mutual funds from over 30 well-known management companies.

Helps you to understand your risk profile, design an investment portfolio and select the most appropriate mutual fund to meet your needs.

You may use your mutual fund as security for our All-in-One Secured Overdraft.

All activities related to your mutual fund will be reflected on your monthly statement.

Invest in mutual funds with greater convenience via Mobile or Online Banking and enjoy easier submissions for Mutual Fund Transfer-In Applications via Online Banking’s “Online Mutual Fund eTransfer-In Application” function.

Invest as low as HK$1,000 per month*, offers the flexibility you need to match your personal financial attitude and investment objectives. Details here.

* If for other foreign currency investment plan, invest as low as USD150 or equivalent.

under different market conditions. Learn More

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investment products are not equivalent to or alternative of time deposits. They are not protected deposits, and are not protected by the Deposit Protection Scheme in Hong Kong. Some investment products may involve derivatives. Certain investment products may not be available in all jurisdictions and/or may be subject to restrictions. The investment decision is yours, but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should not invest based on this promotion material alone. Before making any investment decision, customers should consult their own independent professional financial, tax or legal advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products. The information is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Mutual Fund

The past performance of a mutual fund is not a guide to its future performance and yields are not guaranteed. Customers could lose some or all of the principal amount invested. Funds are not obligations of, or guaranteed by, the Bank or any of its affiliates. The Bank will normally be paid a commission or rebate by the fund manager.

Disclaimer

This promotion material is intended to be distributed in the Hong Kong Special Administrative Region (“Hong Kong”) for reference only, and shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any investment product in or outside Hong Kong. The promotion materials are issued by China Construction Bank (Asia) Corporation Limited which is a licensed bank regulated by the Hong Kong Monetary Authority, an approved insurance agent under the Insurance Ordinance (Chapter 41, Laws of Hong Kong) and a Registered Institution (CE No. AAC155) under the Securities and Futures Ordinance to carry on Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) Regulated Activities. This promotion material has not been reviewed by any regulatory authorities in Hong Kong.

Disclaimer of Online Investment Trading Services

Important Notice to customers for Mutual Fund Investment Services

The above services are bound by the related terms and conditions. Please contact our staff for details.