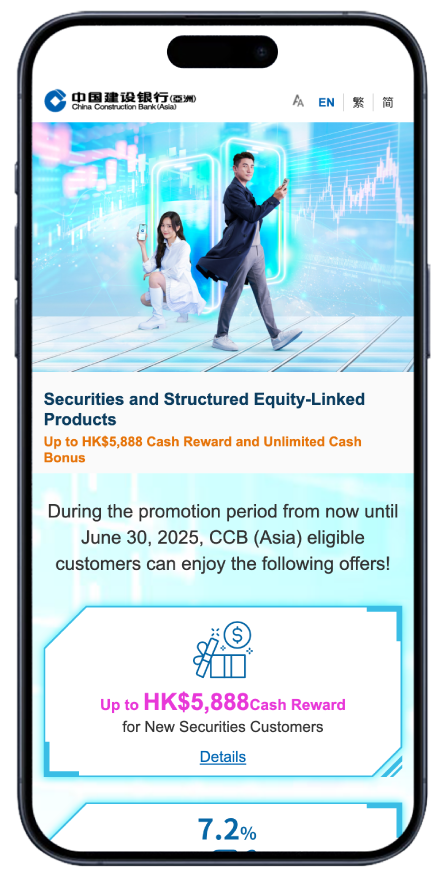

Securities and Structured Equity-Linked Products

Enjoy 0.488% p.a. Bonus HKD/USD Savings Interest Rate, up to HK$5,888 Cash Reward and Unlimited Cash Bonus

During the promotion period from now until December 31, 2025, CCB (Asia)’s new and existing personal Securities Customers who buy or sell Hong Kong/US Securities through any trading channels of the Bank and reach the required monthly transaction amount, can automatically enjoy the following bonus interest rate for a designated amount deposited in the relevant HKD/USD Settlement Account1 for one month in designated deposit period:

| HK Securities Trade | US Securities Trade | |

| Monthly Transaction Amount Requirement | HK$2,000,000 or above (or equivalent) |

US$40,000 or above |

| Deposit Amount in Settlement Account^ to Enjoy Bonus Savings Interest Rate | First HK$200,000 in HKD Settlement Account | First US$50,000 in USD Settlement Account |

Cash Reward

for New Securities Customers

for Structured Equity-Linked Products Subscription

for Securities Monthly Investment Plan

for US Securities Trading

for IPO Subscription

for New Securities Margin Customers

| Each Structured Equity-Linked Product Subscription Amount (HKD or equivalent) |

Extra 1-Month Cash Bonus (p.a.) | |

| Structured Equity-Linked Product Linked with HK Securities | Structured Equity-Linked Product Linked with US Securities | |

| HK$800,000 or above | 5.4% | 7.2% |

| HK$300,000 – below HK$800,000 | 3.6% | 4.8% |

0.488% p.a. Bonus Savings Interest Rate

Financing Interest Rate

- HKD/USD Settlement Accounts include designated HKD/USD Statement Savings Accounts and Checking Accounts.

- Customers should fulfil the following requirements in order to enjoy 0.488% p.a. bonus savings interest rate:

- Bonus HKD Savings Interest Rate: Only applicable to buy and sell trades of any HKD-denominated or RMB-denominated securities listed on the Stock Exchange of Hong Kong Limited (“HKEX”), which are conducted through automated trading channels and trading hotline of the Bank, but excluding IPO subscriptions, Securities Monthly Investment Plan transactions, transactions for securities listed on Shanghai Stock Exchange (“SSE”) via the Shanghai-Hong Kong Stock Connect, transactions for securities listed on Shenzhen Stock Exchange (“SZSE”) via the Shenzhen-Hong Kong Stock Connect and stocks transfer-in transaction. Customers should conduct eligible HK securities buy and sell trades with an accumulated monthly transaction amount of HK$2,000,000 or above (or equivalent) during the designated securities trading period to enjoy bonus interest rate for the first HK$200,000 deposit in designated Settlement Accounts (including HKD Statement Savings Accounts and Checking Accounts) in relevant deposit period.

- Bonus USD Savings Interest Rate: Only applicable to buy and sell US securities listed on NASDAQ Exchange, New York Stock Exchange or American Stock Exchange through Online Banking, Mobile Banking and trading hotline of the Bank with an accumulated monthly transaction amount of US$40,000 or above during the designated securities trading period to enjoy bonus interest rate for the first US$50,000 deposit in designated Settlement Account (including USD Statement Savings Accounts and Checking Accounts) in relevant deposit period.

For any deposit account balance that exceeds HK$200,000/US$50,000 in designated Settlement Accounts (only applicable to Statement Savings Accounts), the prevailing savings interest rate applicable to a regular HKD/USD Statement Savings Accounts as quoted by the Bank will be applied. The above interest rates (p.a.) are for reference only but not guaranteed. The savings interest rate will be subject to changes in rates quoted by the Bank from time to time. Please click here to check out the latest Savings Interest Rate. - Only applicable to personal customers of Personal Banking, Private Wealth and Private Banking who successfully open a Securities Cash Trading account and/or a Securities Margin Trading account with the Bank during the Promotion Period, and do not have any securities accounts either in sole name or joint names with the Bank during the period from April 1, 2025 to September 30, 2025 (both dates inclusive). For New Securities Account held in joint names, only the primary account holder is entitled to enjoy the offers.

- Cash reward is the reduction of brokerage fee for securities transactions. New Securities Customers shall first pay in full the standard brokerage fee according to the Bank's fee schedule of securities trading services. The Bank will credit the eligible brokerage fee reduction amount with maximum amount of HK$3,888 or equivalent to the relevant HKD settlement account of the New Securities Account in the form of cash rebate according to the date set out in the Terms and Conditions. If New Securities Customers successfully deposited eligible stocks into the new securities account with accumulated market value of deposited eligible stocks reaching below designated amounts, they can enjoy up to HK$5,888 (or equivalent) cash rebate.

Accumulated Market Value of Deposited Eligible Stocks upon below designated amount

(HKD or equivalent)Cash Reward Cap Amount for Hong Kong Stock Trade

(HKD or equivalent)HK$0 – Below HK$500,000 HK$3,888 HK$500,000 – Below HK$1,000,000 HK$4,388 HK$1,000,000 – Below HK$2,000,000 HK$4,888 HK$2,000,000 or above HK$5,888 - Only applicable to the buy and sell trades of any HKD-denominated or RMB-denominated securities listed on the HKEX, which are conducted via the New Securities Accounts through automated trading channels of the Bank; excluding IPO subscriptions, Securities Monthly Investment Plan transactions, transactions for securities listed on SSE via the Shanghai-Hong Kong Stock Connect and transactions for securities listed on SZSE via the Shenzhen-Hong Kong Stock Connect.

- Automated trading channels include Mobile Banking, Online Banking and Fortunelink Mobile App of the Bank.

- Only applicable to personal customers of Personal Banking, Private Wealth and Private Banking and staff of the Bank and the Bank's affiliates who have not subscribed for any structured equity-linked products during the period from April 1, 2025 to September 30, 2025 (both dates inclusive). For relevant accounts held in joint name, only the primary account holder is entitled to enjoy the offer.

- Only applicable to subscription transactions of structured equity-linked products where the Bank's monetary benefit being more than 2% of the investment amount.

- Personal Banking Customers who have successfully conducted buy or sell trades of any HKD-denominated or RMB-denominated securities listed on HKEX and US securities listed on NASDAQ Exchange, New York Stock Exchange and American Stock Exchange through automated trading channels (including Online Banking, Mobile Banking and FortuneLink Mobile App) of the Bank (but excluding IPO subscriptions, Securities Monthly Investment Plan transactions, transactions for securities listed on SSE via the Shanghai-Hong Kong Stock Connect, transactions for securities listed on SZSE via the Shenzhen-Hong Kong Stock Connect and stocks transfer-in transactions); Private Wealth and Private Banking Customers who have successfully conducted any buy or sell trades for HKD-denominated or RMB-denominated securities listed on the HKEX, securities listed on the SSE via the Shanghai-Hong Kong Stock Connect, securities listed on the SZSE via the Shenzhen-Hong Kong Stock Connect and US securities listed on NASDAQ Exchange, New York Stock Exchange and American Stock Exchange (but excluding IPO subscriptions, Securities Monthly Investment Plan transactions and stocks transfer-in transactions) via any trading channels.

- The promotion period for Securities Monthly Investment Plan HK$1 Handling Fee Offer is from April 1, 2025 to December 31, 2025. During the promotion period, customers set up Securities Monthly Investment Plans through their securities account or with existing Securities Monthly Investment Plans can enjoy HK$1 handling fee for each selected securities (which is inclusive of brokerage fee, stamp duty, SFC transaction levy, AFRC transaction levy and trading fee, etc. For details, please refer to our Schedule of Service Fee for Securities Trading Services.). The minimum Monthly Contribution is HK$1,000 per Securities and it must be increased in multiples of HK$1,000. The maximum amount for Monthly Contribution is HK$10,000 per Plan. Customers shall first pay the Securities Monthly Investment Plan Handling Fee of HK$50 in full (flat HK$50 per Monthly Contribution per Plan) according to the Bank’s fee schedule of securities trading services. The Bank will credit the Securities Monthly Investment Plan Handling Fee reduction amount to the relevant HKD settlement account of the Securities Account in the form of cash rebate according to the date set out in the Terms and Conditions.

- The related fee refers to the New Issues Handling Fee stated in the Bank's fee schedule of securities trading services (but not applicable to International Private Placement).

- P (Prime Rate) refers to the prevailing Hong Kong Prime Lending Rate as quoted by the Bank from time to time. As low as P-1% p.a. preferential financing interest rate is only applicable to personal customers of Personal Banking, Private Wealth and Private Banking who successfully open Securities Margin Trading Account during the promotion period from July 1, 2025 to December 31, 2025 (both dates inclusive) and do not hold any Securities Margin Trading Account whether in sole name or joint names with the Bank during the period from January 1, 2025 to June 30, 2025 (both dates inclusive). Eligible customers can enjoy a preferential financing interest rate P-1% p.a. within the month of the Securities Margin Trading Account opening and the subsequent 3 months. (Existing Securities Margin Customers can enjoy a preferential financing interest rate of P-0.5% p.a. during Securities Margin Promotion Period).

- HK$100 Supermarket Cash Voucher is only applicable to the Bank's personal customers of Personal Banking. The staff of the Bank will contact the eligible customers for cash voucher collection at designated branches 2 months after the New Securities Margin Trading Account being opened successfully.

To borrow or not to borrow? Borrow only if you can repay!

Terms and Conditions for Securities and Structured Equity-Linked Products Promotion (“Promotion”)

A. General Terms and Conditions:

- Unless otherwise specified, the promotion period is from October 1, 2025 to December 31, 2025 (both dates inclusive) (“Promotion Period”).

- The Promotion is only applicable to designated personal customers of China Construction Bank (Asia) Corporation Limited (the “Bank”), but is not applicable to corporate customers and Capital Investment Entrant Scheme customers of the Bank. The Bank reserves the right to determine the eligibility of a customer to this Promotion.

- Customers are required to pay all such other securities trading service fee(s) including but not limited to transaction levy, trading fee, stamp duty, handling fee, securities management fee, transfer fee and deposit of stocks fee (if applicable). For details, please refer to the Bank’s fee schedule of securities trading services. In addition, customers are responsible for any fees and charges which may be levied by the third-party financial institution/ bank for stock transfer-out arrangement.

- The investment services of the Bank are subject to the related Terms and Conditions issued by the Bank from time to time, please visit our branches or contact our staffs for details.

- The Bank reserves the right to vary, suspend and terminate the Promotion and to vary or modify any of these Terms and Conditions from time to time without prior notice. In case of disputes, the decision of the Bank shall be final and binding.

- If there is any inconsistency between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

B. Terms and Conditions for Cash Reward for New Securities Customers (“Cash Reward”):

- Cash Reward is only applicable to personal customers of Personal Banking, Private Wealth, Private Banking, staff of the Bank and the Bank’s affiliates.

- Cash Reward is only applicable to “New Securities Customer(s)” and it is defined as follows:

- Successfully open a Securities Cash Trading account and/or a Securities Margin Trading account with the Bank during the Promotion Period (“New Securities Customer(s)”), and

- do not have any securities accounts either in sole name or joint names with the Bank during the period from April 1, 2025 to September 30, 2025 (both dates inclusive).

For New Securities Account held in joint names, only the primary account holder is entitled to become an eligible New Securities Customer.

- In the month of opening a new Securities Account followed by the subsequent 3 calendar months (the “3-Month Promotion Period” as defined in clause B4), New Securities Customers will be entitled to a brokerage fee rebate of up to HK$3,888 (or equivalent) on buy and sell trades of HK stocks for any Eligible Transactions (as defined in clause B5) conducted via their new Securities Accounts. If New Securities Customers successfully deposited any securities listed on Stock Exchange of Hong Kong Limited (“HKEX”) (excluding IPO subscriptions), and/ or securities listed on Shanghai Stock Exchange (“SSE”) via the Shanghai-Hong Kong Stock Connect, and/ or securities listed on Shenzhen Stock Exchange ("SZSE") via the Shenzhen-Hong Kong Stock Connect (“Eligible Stocks”) into the New Securities Account from any account outside the Bank via Central Clearing and Settlement System (CCASS) or by physical scrip and accumulate the market value of deposited Eligible Stocks upon designated amounts as set out below can enjoy up to HK$5,888 (or equivalent) on buy and sell trades of HK stocks.

Accumulated Market Value of Deposited Eligible Stocks upon below designated amount

(HKD or equivalent)Cash Reward Cap Amount for Hong Kong Stock Trade

(HKD or equivalent)HK$0 – Below HK$500,000 HK$3,888 HK$500,000 – Below HK$1,000,000 HK$4,388 HK$1,000,000 – Below HK$2,000,000 HK$4,888 HK$2,000,000 or above HK$5,888 - “3-Month Promotion Period” is defined as follows:

New Securities Account Opening Month 3-Month Promotion Period October 2025 October 2025 – January 2026 November 2025 November 2025 – February 2026 December 2025 December 2025 – March 2026 - “Eligible Transactions” are defined as buy and sell trades of any HKD-denominated or RMB-denominated securities listed on HKEX, which are conducted via the New Securities Accounts through automated trading channels (including Online Banking, Mobile Banking and FortuneLink Mobile App) of the Bank; excluding IPO subscriptions, Securities Monthly Investment Plan transactions, transactions for securities listed on SSE via the Shanghai-Hong Kong Stock Connect and transactions for securities listed on SZSE via the Shenzhen-Hong Kong Stock Connect.

- The Cash Reward is the reduction of brokerage fee for securities transactions. New Securities Customers shall first pay in full the standard brokerage fee according to the Bank’s fee schedule of securities trading services. The Bank will credit the eligible brokerage fee reduction amount to the relevant HKD settlement account of the New Securities Account on or before May 31, 2026. The New Securities Account and the settlement account must be valid at the time of crediting the Cash Reward, otherwise, the Cash Reward will be forfeited.

- Market value of the deposited stocks will be calculated based on the market closing price and the number of shares of deposited stocks on the deposit day. For deposit of RMB-denominated securities, its market value will be converted into HKD based on the corresponding exchange rate quoted by the Bank. In case of any disputes, the decision of the Bank on calculation of the market value of deposited stocks shall be final.

- If customer transfers any stocks via CCASS to any account outside the Bank or withdraws any stocks by physical scrip from the New Securities Account before the above-mentioned Cash Reward is credited by the Bank, the relevant amount will not be calculated into the stocks deposit amount in Clause B3 above-mentioned. For the avoidance of doubt, if such customer sells the deposited stocks through the securities account of the Bank, the calculation of the accumulated market value of deposited stocks will not be affected.

- The Cash Reward is calculated on an individual New Securities Account basis and the cap for Cash Reward is HK$5,888 (or equivalent) for each New Securities Account. The Cash Reward will be calculated in Hong Kong Dollar. If the securities transactions are RMB-denominated securities transactions, the prevailing exchange rate as quoted by the Bank on the date as determined by the Bank will be adopted to calculate the Cash Reward.

C. Terms and Conditions for Extra 1-Month Cash Bonus of up to 7.2% p.a. for Structured Equity-Linked Products (“Extra Cash Bonus”):

- The Extra Cash Bonus is only applicable to personal customers of Personal Banking, Private Wealth and Private Banking of the Bank, staff of the Bank and the Bank’s affiliates. For account held in joint names, only the primary account holder is entitled to the Extra Cash Bonus.

- The Extra Cash Bonus is only applicable to eligible customers who have not subscribed any structured equity-linked products from April 1, 2025 to September 30, 2025 (both dates inclusive) (“Eligible Equity-Linked Products Customers”).

- During the Promotion Period, Eligible Equity-Linked Products Customers who successfully subscribed for structured equity-linked products (only applicable to structured equity-linked products with the Bank’s monetary benefit being more than 2% of the investment amount) (“Eligible Equity-Linked Products”) with subscription amount of HK$300,000 or above (or equivalent) and conducted Eligible Stocks Trade (as defined in clause C4) will be entitled to an extra 1-month cash bonus of up to 7.2% p.a. based on the subscription amount:

Each Structured Equity-linked Product Subscription Amount

(HKD or equivalent)Extra 1-Month Cash Bonus (p.a.) Structured Equity-Linked Product Linked with HK Securities Structured Equity-Linked Product Linked with US Securities HK$800,000 or above 5.4% 7.2% HK$300,000 – below HK$800,000 3.6% 4.8% - “Eligible Stocks Trade” is defined as (i) Personal Banking Customers who have successfully conducted buy or sell trades of any HKD-denominated or RMB-denominated securities listed on HKEX and US securities listed on NASDAQ Exchange, New York Stock Exchange and American Stock Exchange through automated trading channels (including Online Banking, Mobile Banking and FortuneLink Mobile App) of the Bank (but excluding IPO subscriptions, Securities Monthly Investment Plan transactions, transactions for securities listed on SSE via the Shanghai-Hong Kong Stock Connect, transactions for securities listed on SZSE via the Shenzhen-Hong Kong Stock Connect and stocks transfer-in transactions); or (ii) Private Wealth and Private Banking Customers who have successfully conducted any buy or sell trades for HKD-denominated or RMB-denominated securities listed on HKEX, securities listed on SSE via the Shanghai-Hong Kong Stock Connect, securities listed on SZSE via the Shenzhen-Hong Kong Stock Connect and US securities listed on NASDAQ Exchange, New York Stock Exchange and American Stock Exchange (but excluding IPO subscriptions, Securities Monthly Investment Plan transactions and stocks transfer-in transactions) via any trading channels.

- The extra 1-month cash bonus will be calculated based on each structured equity-linked product subscription amount instead of the aggregated amount. There is no cap for the Extra Cash Bonus. The Bank will credit the Extra Cash Bonus to the Eligible Equity-Linked Products Customer’s relevant HKD settlement account on or before March 31, 2026. If the relevant equity-linked products are foreign currency denominated, the prevailing exchange rate quoted by the Bank on the date determined by the Bank will be adopted to calculate the Extra Cash Bonus amount. The structured equity-linked account, securities account and settlement account must be valid at the time of crediting the Extra Cash Bonus, otherwise, the Extra Cash Bonus will be forfeited.

D. Terms and Conditions of HK$1 Handling Fee for Securities Monthly Investment Plan (“Monthly Plan Offer”):

- The promotion period of Monthly Plan Offer is from April 1, 2025 to December 31, 2025 (both dates inclusive) (“Monthly Plan Offer Promotion Period”).

- Monthly Plan Offer is only applicable to personal customers of Personal Banking, Private Wealth, staff of the Bank and the Bank’s affiliates (“Eligible Monthly Plan Customers”) and not applicable to Private Banking customers, corporate customers or Capital Investment Entrant Scheme customers. During the Monthly Plan Offer Promotion Period, Eligible Monthly Plan Customers set up Securities Monthly Investment Plan through personal securities account can enjoy HK$1 handling fee for each selected securities.

- Monthly Plan Offer is only applicable to existing Securities Monthly Investment Plan customers and customers who set up Securities Monthly Investment Plan during the Monthly Plan Offer Promotion Period.

- Customers shall first pay the Securities Monthly Investment Plan Handling Fee of HK$50 in full (flat HK$50 per Monthly Contribution per Plan) according to the Bank’s fee schedule of securities trading services. The Bank will credit the eligible Securities Monthly Investment Plan Handling Fee reduction amount to the relevant HKD settlement account of the Securities Account in the form of cash rebate on or before March 31, 2026. The Securities Account and the settlement account must be valid at the time of crediting the cash rebate, otherwise, the Monthly Plan Offer will be forfeited.

- The minimum monthly contribution is HK$1,000 per securities and it must be increased in multiples of HK$1,000. The maximum amount for monthly contribution is HK$10,000 per Plan. For the latest list of eligible securities, please refer to the eligible list of securities provided by the Bank.

- Unless otherwise specified, the Bank will execute purchase instructions on behalf of customers during trading hours on the every 10th of each calendar month (“Execution Date”). “Hold Fund Date” is 2 days before the Execution Date, and if the Hold Fund Date is not a trading day, both the Hold Fund Date and the Execution Date will be postponed to the next trading day. If only the Execution Date is not a trading day, the Execution Date will be postponed to the next trading day while the Hold Fund Date will remain unchanged.

- When a customer holds or sells securities products, they are required to pay fees associated with securities trading services. These include, but are not limited to, brokerage fee, trading fees, stamp duty, handling fees, SFC transaction levy, transfer fees, stock deposit fees and Safe Custody Fee (if applicable). For details, please refer to the Bank’s fee schedule of securities trading services.

- If you need to terminate your Securities Monthly Investment Plan, customers should submit the termination instruction at any of our branches 3 trading days before the Hold Fund Date, the relevant instruction will be effective on that calendar month. If the relevant instruction is submitted after such date, it will be effective in the next calendar month. If you submit your termination request via Online/Mobile Banking, the effective date will be displayed on screen.

E. Terms and Conditions for Unlimited $0 Brokerage Fee on Buy and Sell Trades of US Stocks (“US Stocks $0 Brokerage Fee”):

- US Stocks $0 Brokerage Fee is applicable to the customers who (a) have successfully activated an US securities account and successfully signed W-8BEN (or W-8BEN-E Form and registered the USD settlement account during the Promotion Period (“Eligible US Securities Customer”), and (b) buy/sell US securities listed on NASDAQ Exchange, New York Stock Exchange or American Stock Exchange through Online Banking, Mobile Banking and Trading Hotline of the Bank during the Promotion Period.

- There is no limit on the transaction amount, number of trades and brokerage fee waiver to each Eligible US Securities Customer. US stocks $0 Brokerage Fee is not applicable to Securities Monthly Investment Plan and IPO application.

- Eligible US Securities Customers are required to pay other transaction costs, including but not limited to SEC fee, Settlement Fee and Tax of US securities (if applicable). For details, please refer to the Bank's fee schedule of securities trading services.

F. Terms and Conditions of $0 Handling Fee for IPO Subscription (“IPO Handling Fee Offer”):

- IPO Handling Fee Offer is only applicable to personal customers of Personal Banking, staff of the Bank and the Bank’s affiliates (“Eligible IPO Offer Customers”). For holders of a Securities Account in joint names, only the primary account holders will be eligible for the IPO Handle Fee Offer.

- During the Promotion Period, Eligible IPO Offer Customers who successfully subscribe for IPO shares via any automated trading channels (including Online Banking, Mobile Banking and FortuneLink Mobile App) of the Bank (“Eligible Transactions”) can enjoy waiver of the New Issues Handling Fee stated on the Bank’s fee schedule of securities trading services (“IPO Handling Fee Offer”).

- IPO Handling Fee Offer is not applicable to International Private Placement.

- Eligible IPO Offer Customers shall first pay the New Issues Handling Fee according to the Bank’s fee schedule of securities trading services and the Bank will rebate the paid New Issues Handling Fee of Eligible Transactions (“Handling Fee Rebate(s)”) to the Eligible IPO Offer Customers’ relevant HKD or RMB settlement account on or before March 31, 2026.

- Eligible IPO Offer Customers must maintain the relevant Securities Trading Account and settlement account at the time of crediting the entitled Handling Fee Rebates. Otherwise, the Handling Fee Rebates will be forfeited.

- Upon submission of the IPO subscription, the Eligible IPO Customer is required to fulfill all the eligibility criteria and terms as set out in the offering document or prospectus of the relevant IPO.

G. Terms and Conditions for Securities Margin Preferential Financing Interest Rate as low as P-1% p.a. (“Securities Margin Promotion”):

- The promotion period of Securities Margin Promotion is from July 1, 2025 to December 31, 2025 (both dates inclusive) (“Securities Margin Promotion Period”).

- In Securities Margin Promotion, “New Securities Margin Customer” is defined as follows:

- Personal customers of Personal Banking, Private Wealth and Private Banking of the Bank, and

- successfully open a Securities Margin Trading Account during the Securities Margin Promotion Period, and

- did not hold any Securities Margin Trading Account whether in sole name or joint names with the Bank during the period from January 1, 2025 to June 30, 2025 (both dates inclusive).

- New Securities Margin Customer can enjoy a preferential financing interest rate P-1% p.a. within the first 3 months after the Securities Margin Trading Account opening during the Securities Margin Promotion Period. (Existing Securities Margin Customers can enjoy a preferential financing interest rate of P-0.5% p.a. during Securities Margin Promotion Period).

- P (Prime Rate) refers to the prevailing Hong Kong Prime Lending Rate as quoted by the Bank from time to time.

- If the New Securities Margin Customer is the Bank’s personal customer of Personal Banking who open a New Securities Margin Trading Account will be entitled to Supermarket Cash Voucher valued at HK$100 (“Cash Voucher”) (“Eligible Securities Margin Customers”). The staff of the Bank will contact the Eligible Securities Margin Customers for Cash Voucher collection at designated branches 2 months after the New Securities Margin Trading Account being opened successfully.

- Cash Vouchers are available on a first-come-first-served basis and while stocks last. Each New Securities Margin Customer can only enjoy the Cash Voucher once during the Securities Margin Promotion Period.

- The use of Cash Voucher is subject to the terms and conditions of the relevant supplier. The Bank is not the supplier of the Cash Voucher. All enquiry(ies) or complaint(s) regarding the Cash Voucher or the quality of the related services or products should be referred to or resolved directly with the supplier.

- The Cash Voucher cannot be exchanged for cash or other prizes. The Cash Voucher will not be re-issued if lost, expired or damaged.

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investment products are not equivalent to or alternative of time deposits. They are not protected deposits and are not protected by the Deposit Protection Scheme in Hong Kong. Some investment products may involve derivatives. Certain investment products may not be available in all jurisdictions and/or may be subject to restrictions. The investment decision is yours, but you should not invest in an investment product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. Investors should not invest based on this promotion material alone. Before making any investment decision, customers should consult their own independent professional financial, tax or legal advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products. The information is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Securities Trading

It is as likely that losses will be incurred rather than profits made as a result of buying and selling securities.

Securities Margin Trading

If a client maintains a margin account with the Bank, the risk of loss in financing a transaction by deposit of collateral is significant. The client may sustain losses in excess of the client’s cash and any other assets deposited as collateral with the Bank. Market conditions may make it impossible to execute contingent orders, such as “stop-loss” or “stop-limit” orders. The client may be called upon at short notice to make additional margin deposits or interest payment. If the required margin deposits or interest payments are not made within the prescribed time, the client’s securities collateral may be liquidated without the client’s consent. Moreover, the client will remain liable for any resulting deficit in the client’s account and interest charged on the client’s account. The client should therefore carefully consider whether such a financing arrangement is suitable in light of the client’s own financial position and investment objectives.

Structured Equity-linked Products

Structured equity-linked products are structured products which involves derivatives and substantial risks including, among others, market risks, liquidity risks, risks relating to changes in market conditions, counterparty risks, and the risks that the issuer(s) will be unable to satisfy its obligations under the structured equity-linked products. Customers should recognize that their structured equity-linked products may mature worthless. While the maximum return on a structured equity-linked product is usually limited to a predetermined amount of cash, an investor stands to potentially lose up to the entire investment amount if the underlying stock price moves substantially against the investor’s view.

RMB Currency Risk

RMB is currently not freely convertible and is subject to exchange controls and restrictions (which are subject to changes from time to time without notice). You should consider and understand the possible impact on your liquidity of RMB funds in advance. The fluctuation in the exchange rate of RMB may result in losses in the event that you convert RMB into other currencies. Onshore RMB and offshore RMB are traded in different and separate markets operating under different regulations and independent liquidity pool with different exchange rates. Their exchange rate movements may deviate significantly from each other.

Exchange Rate Risk

Currency exchange rates are affected by a wide range of factors, including but not limited to national and international financial and economic conditions and political and natural events. The effect of normal market forces may at times be countered by intervention by central banks and other bodies. At times, exchange rates, and prices linked to such rates, may rise or fall rapidly.

Currency Exchange

Currency exchange involves bid-ask spread.

Online Investment Trading Services

Due to unpredictable network traffic congestion and other reasons, the Internet and other electronic media may not be reliable media of communication and transactions conducted over the Internet and via other electronic media are subject to: (i) possible failure or delay in the transmission and receipt of instructions for any or all transactions in investment products or other information, and (ii) possible failure or delay of execution or execution at prices different from those prevailing at the time when your instructions were given. There are risks associated with the online investment trading system, including the failure of hardware and/or software, and the result of any such system failure may be that your orders are either not executed according to your instructions or are not executed at all. There are risks of interruption, distortion, omission, blackout or interception during the transmission of instructions for any or all transactions in investment products, as well as of any misunderstanding or errors in communication.

Disclaimer of Online Investment Trading Services

Disclaimer

China Construction Bank (Asia) Corporation Limited is a licensed bank regulated by the Hong Kong Monetary Authority and a Registered Institution (CE No. AAC155) under the Securities and Futures Ordinance to carry on Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) Regulated Activities. This promotion material is intended to be distributed in the Hong Kong Special Administrative Region (“Hong Kong”) for reference only. It shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any investment product in or outside Hong Kong and does not constitute any prediction of likely future movements in prices of any investment products. This promotion material is issued by China Construction Bank (Asia) Corporation Limited, and has not been reviewed by the Securities and Futures Commission or any other regulatory authorities in Hong Kong.

Risk Disclosure for Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect