Fraudster may pose themselves as staff of CCB (Asia) or another financial institution, and contact you through phone call, SMS, email, promotion materials or message from messaging app by using fraudulent tactics (for example, offering attractive low interest rates) to induce you to provide personal information such as ID card copies, payroll slips, proofs of address and bank statements to them for applying banking products including personal loans or credit cards. Meanwhile, fraudsters also ask you to make deposits into designated account(s) as margin or service fee.

Fraudsters may claim unusual transaction record is identified in your bank account / credit card through pre-recorded message phone call, and then request you to provide them personal information such as account number, username and log-on password for “investigation”.

The below hints may help to spot bogus calls:

- “Caller ID” includes a ‘+’ sign, which indicates the call is coming from outside of Hong Kong

- Voice quality is relatively bad as if it is a long-distance call

- The caller says there are irregularities with your bank or credit card account

- The caller refuses to provide a department name or is unwilling to provide a call-back number

- The caller focuses on products such as credit products or services with a low interest rate, such as personal loan, add on mortgage, re-mortgage

- The caller tries to close the sale as quickly as possible and is impatient to discuss the product or service in detail

- Be particularly cautious when a caller asks for sensitive personal information such as your banking password

Security Tips

CCBA remind you, we will never call you or email you asking sensitive personal information including your e-Banking username and log-in password.

- If you are in doubt of the received call or message, write down the identity of the caller / sender and their phone number, then call our Bogus Call Hotline (852) 3179 5504 and provide the aforementioned information to verify the identity of the caller

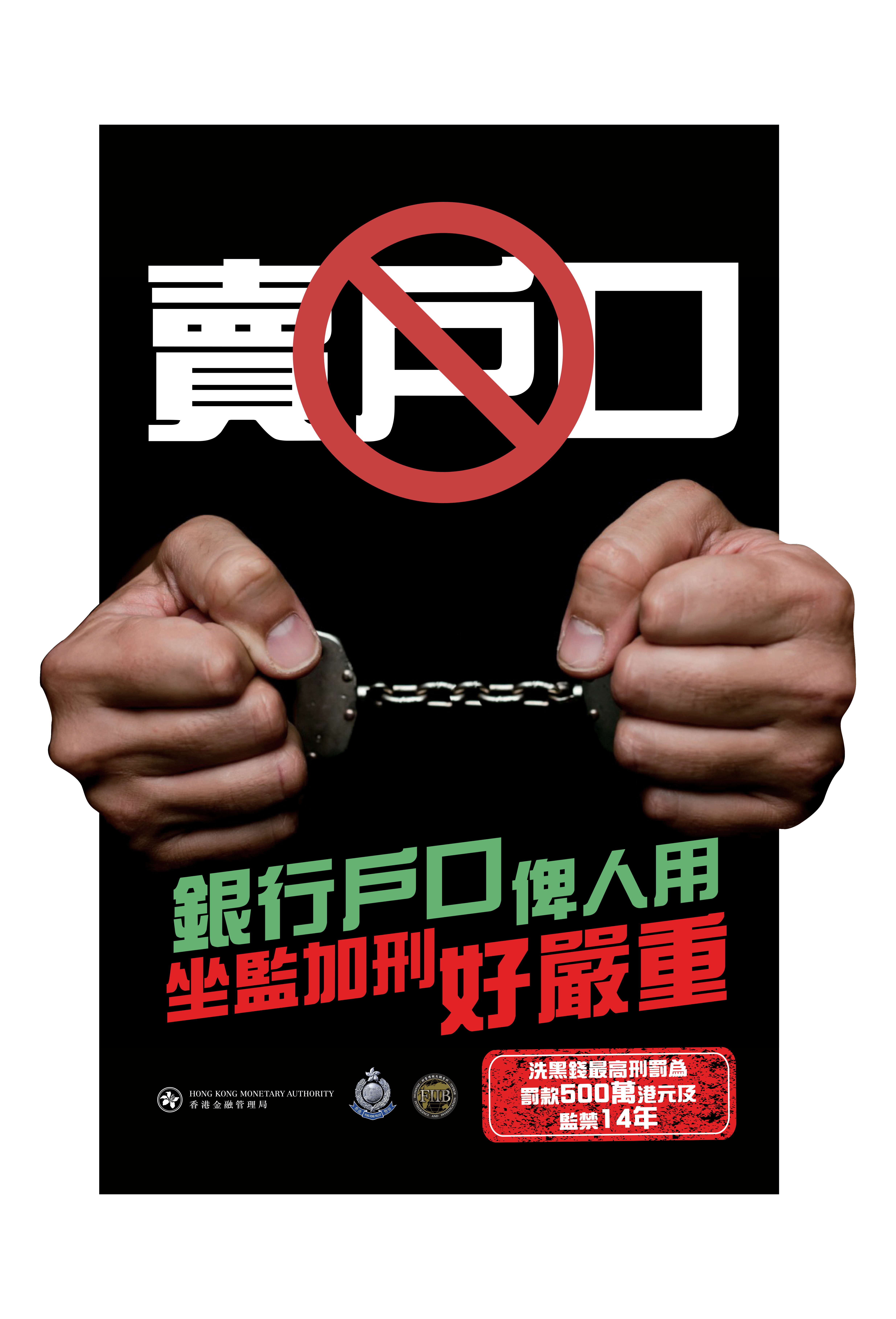

- Never disclose any sensitive personal data (e.g. log-in password or one-time password) to caller in any circumstances

- Do not provide caller the full set of personal data item (such as identity card number) per their request. Financial institution staff usually provide partial of the requested personal data they have in the identity verification process

- Never make deposit into account of an individual or a company in the application process of our banking products

- If you suspect that you have fallen prey to a scam, please report the case to the Hong Kong Police immediately