A. General Enquiry

- What is e-Account Service?

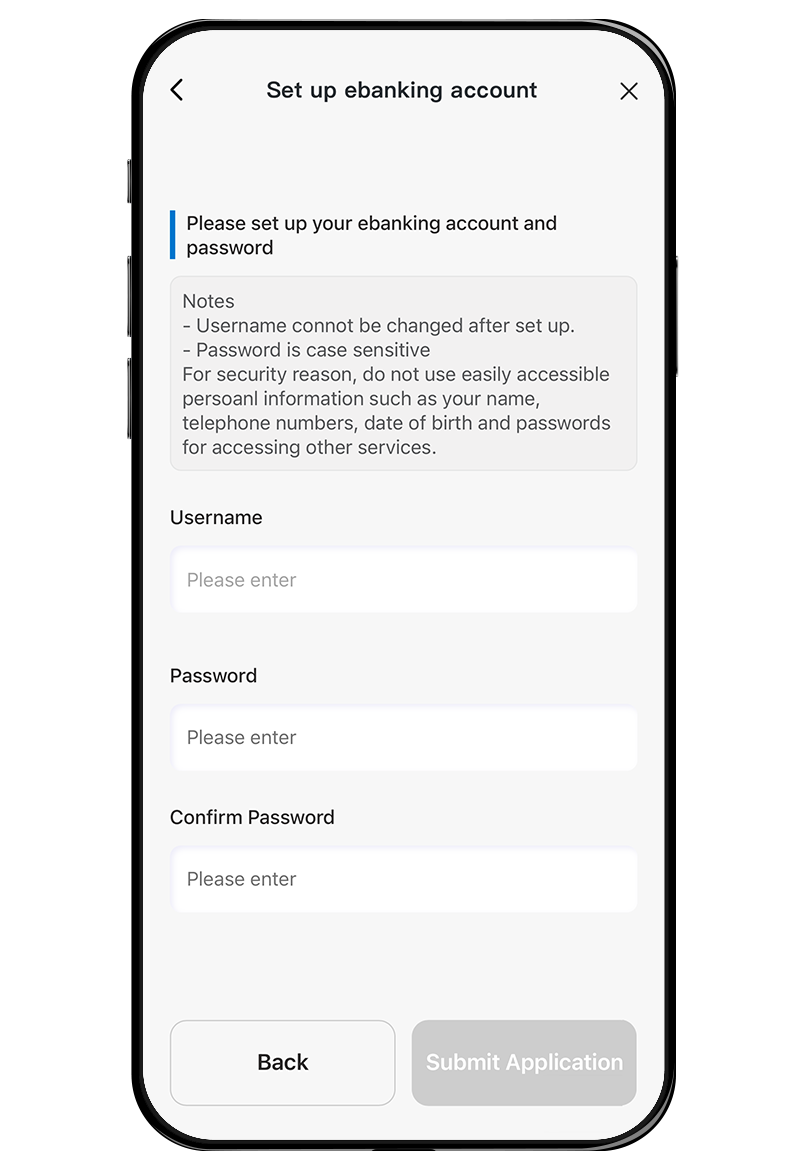

e-Account Service is one of the functions built in the CCB (HK&MO) Mobile App, you can open a deposit account (including HKD Statement Savings, Multi-Currency Statement Savings and Time Deposit), and other valued added services. The process is quick and simple, there are no time restrictions on account opening. For details, please refer to Terms and Conditions for e-Account Service.

- Am I eligible to set up deposit account(s) through e-Account Service via CCB (HK&MO) Mobile App?

e-Account Service is now only available to new-to-bank customers and customers must be:

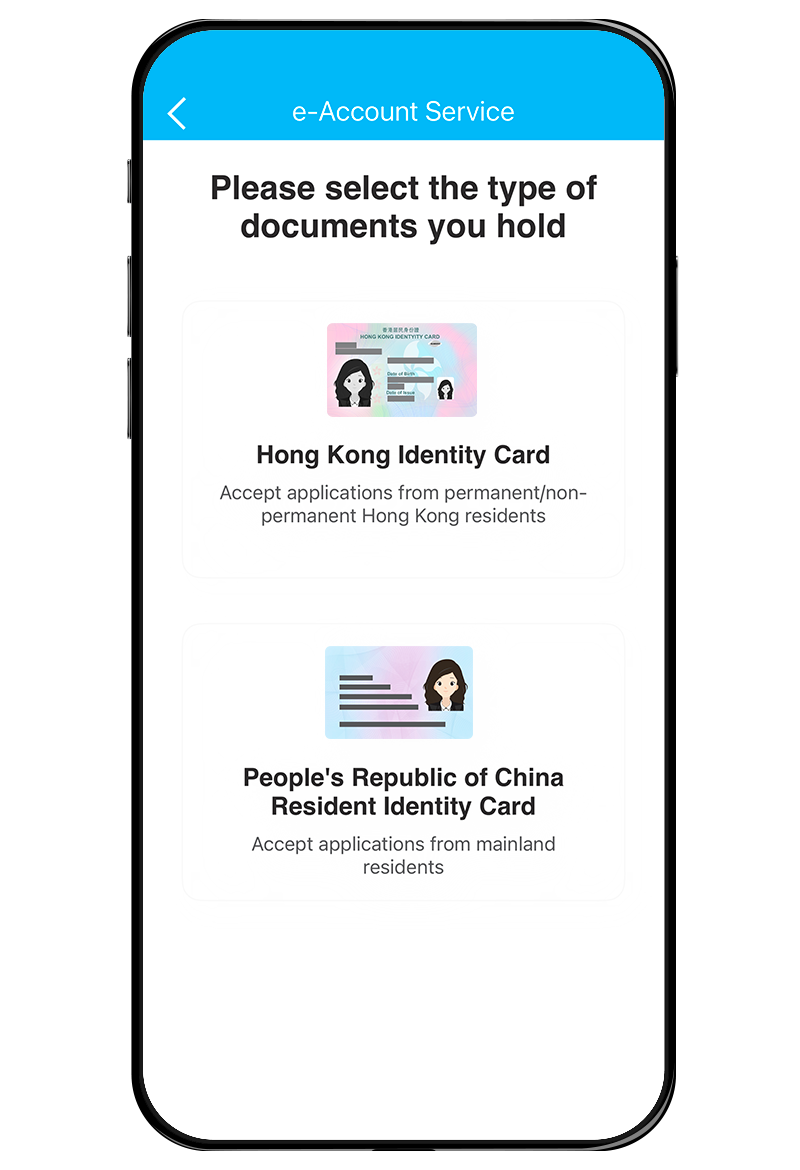

Applicable to Hong Kong Residents:

- Aged 18 years or above;

- Valid Hong Kong Permanent or Non-Permanent Identity Card (HKID) holder. For Non-Permanent HKID holder, limited to holder with Nationality of China / Macao China / United Kingdom / Canada / Australia / New Zealand;

- A non-U.S. person (A U.S. person generally means a U.S. citizen or resident individual who holds an Alien Registration Card (or “green card”));

A tax resident of Hong Kong Applicable to visitors (Mainland residents) in Hong Kong:

- Aged 18 years or above;

- Valid People's Republic of China Resident Identity Card (PRCID) and a valid Exit-entry Permit Identity Card (EEPID);

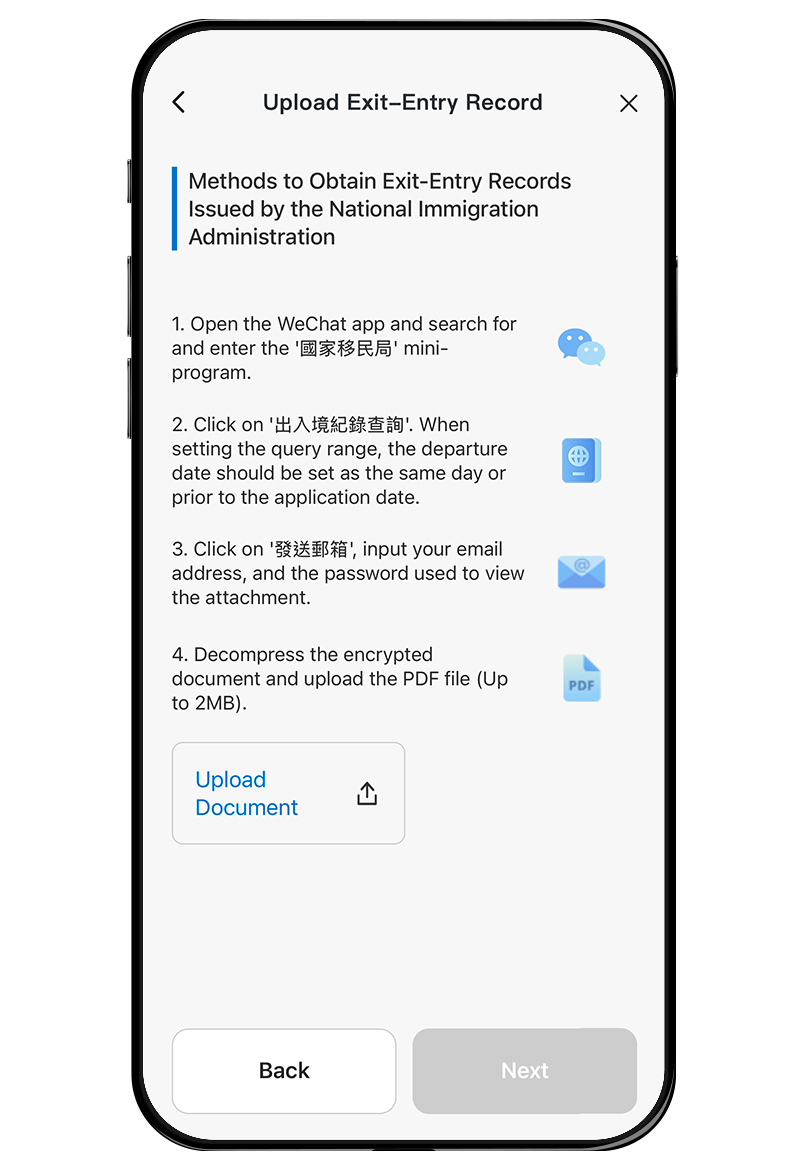

- Valid Exit-Entry Record issued by the National Immigration Administration;

- A non-U.S. person (A U.S. person generally means a U.S. citizen or resident individual who holds an Alien Registration Card (or “green card”)); A tax resident of China

For other customers or those who fail to pass the identity verification of e-Account Service, please visit our branches for account opening.

- What are the benefits for opening deposit account(s) through e-Account Service via CCB (HK&MO) Mobile App?

Convenience: You can open accounts anytime

Fast: Able to complete the application through e-Account Service in a short period of time

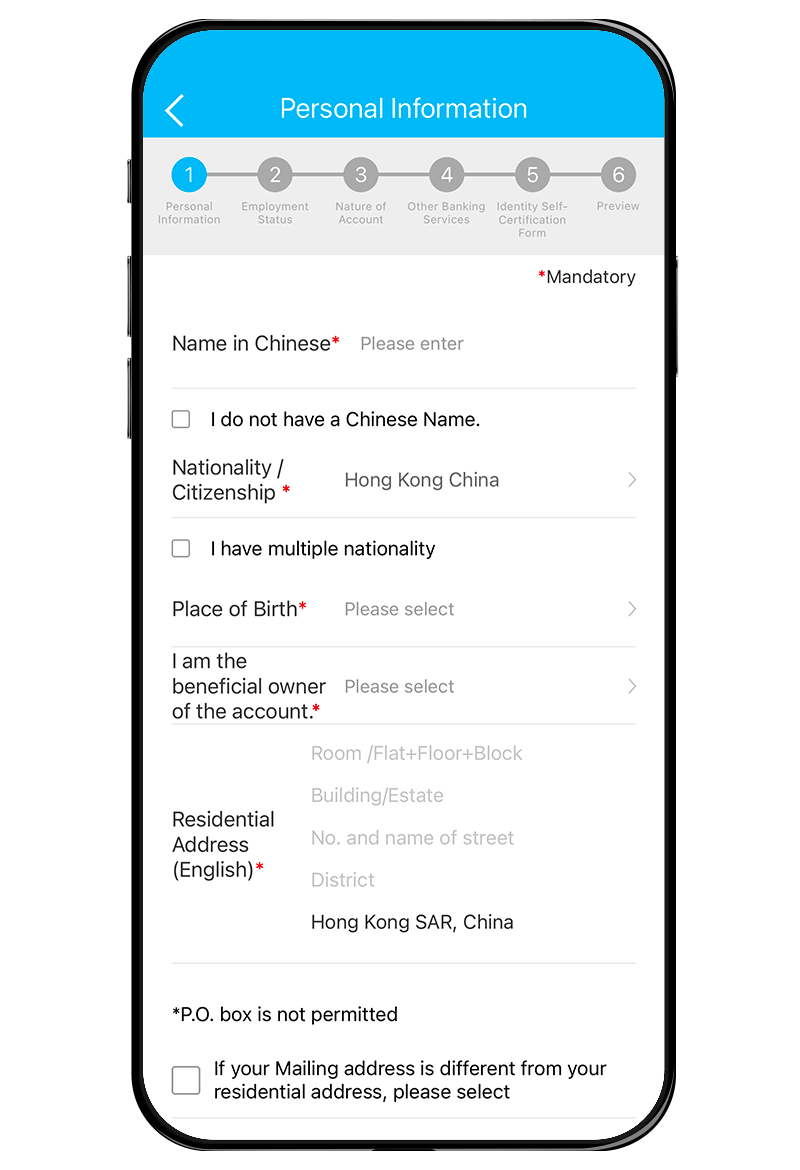

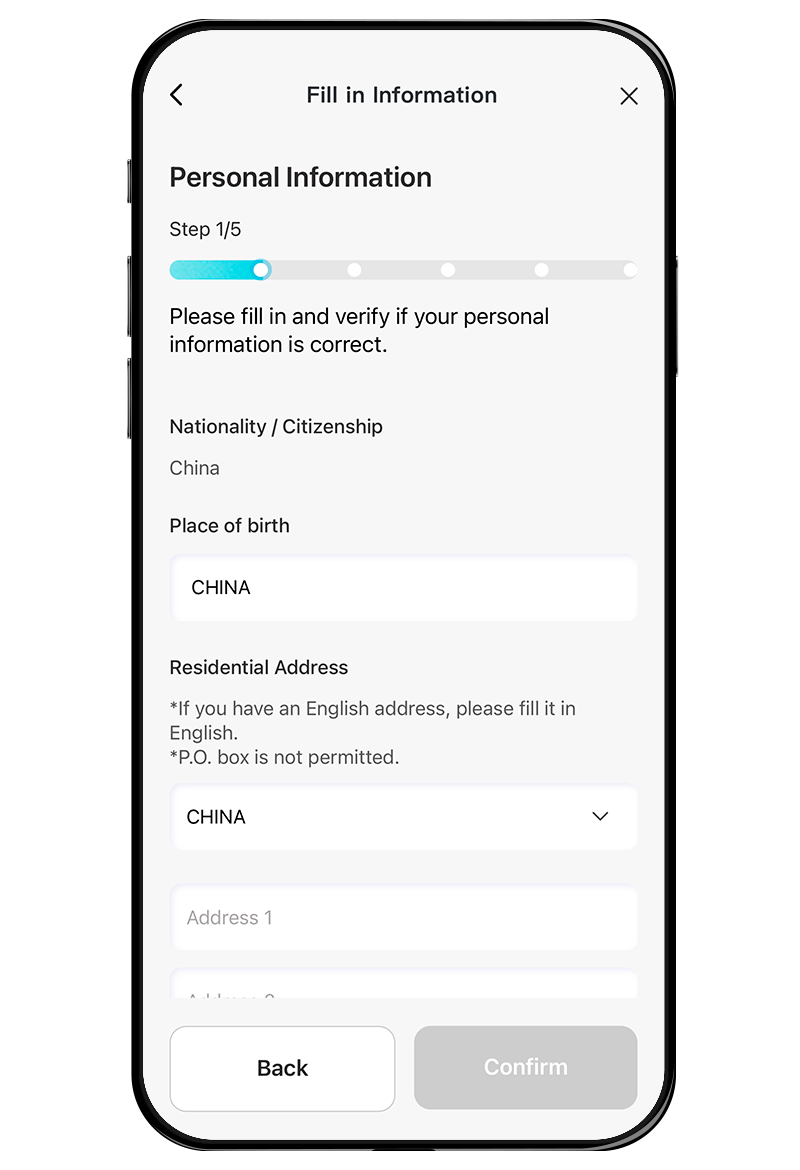

- How to open deposit account through e-Account Service?

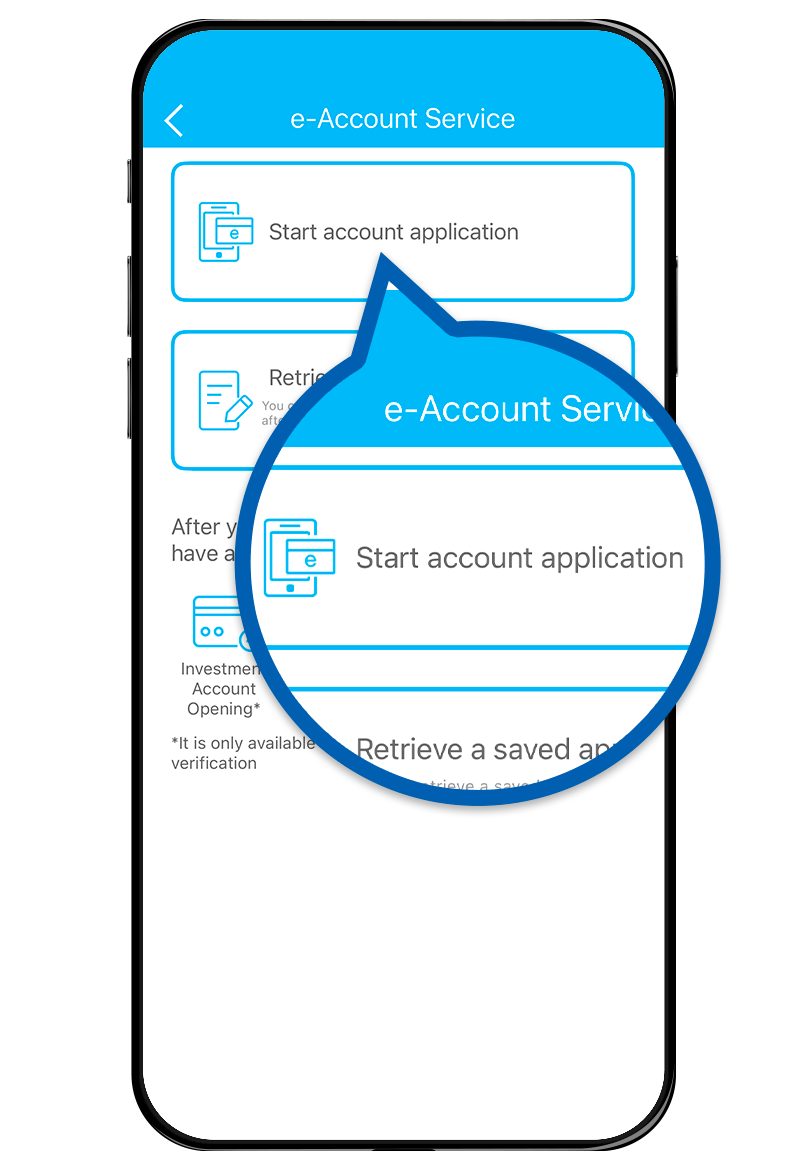

Simply download the latest version of CCB (HK&MO) Mobile App at the App Store or Google Play or AppGallery, tap “e-Account Service” on the homepage, then select “Start account application”.

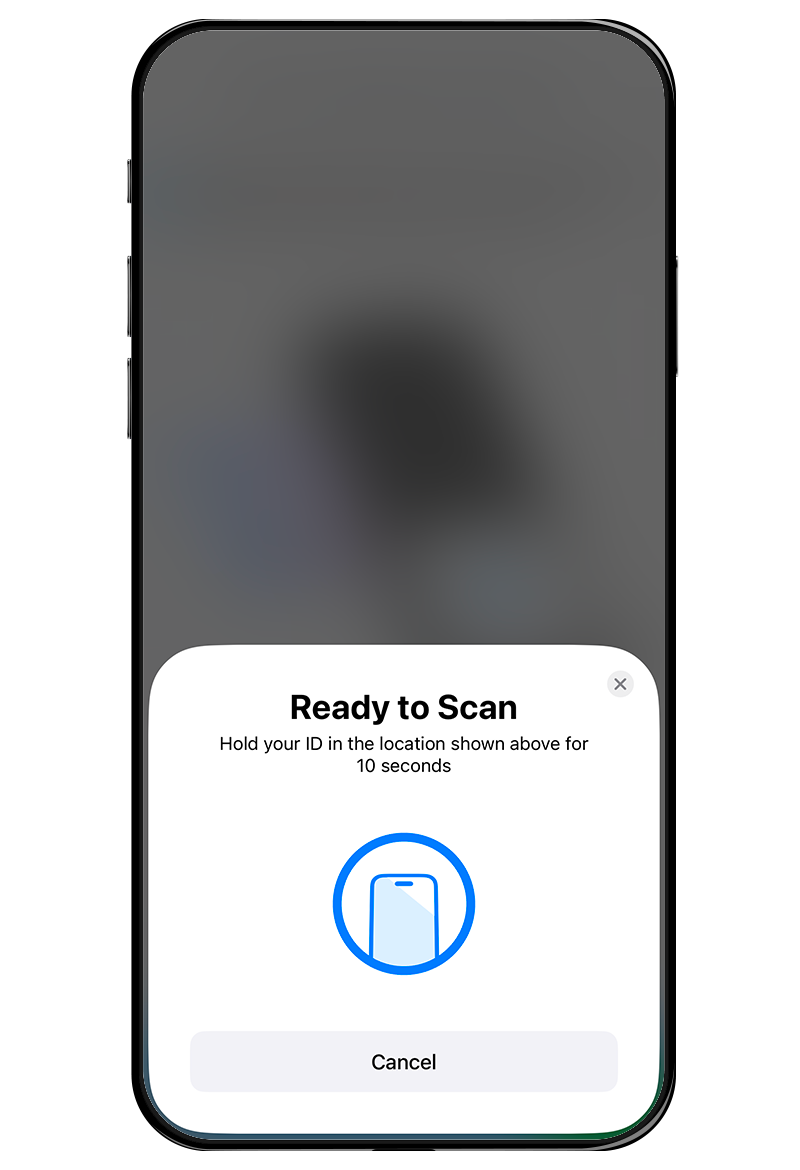

Please ensure your mobile device operation system meets the minimum requirements, for further details, please visit Requirements of Mobile Operating System; and is equipped with front and back cameras for identity verification. When opening an account using a Mainland Resident ID card, a device with location detection and NFC reading functions is required.

- Are there any fees or charges for opening account through e-Account Service?

There is no fee to open account through e-Account Service. For details of charges of other banking services, please refer to the Schedule of Service Fees for General Banking Services.

- Why does it fail to pass the identity verification of e-Account Service?

There are a few conditions that may affect the identity verification results, which includes the environment where video of the identity card and selfies are taken and condition of the identity card.

When capture your identity card, please ensure that:

- remove any protection cover of the identity card;

- ensure there is no damage and/ or stain on the identity card;

- capture your identity card with sufficient light, avoid dark or messy background and reflective surface or blocking the light source;

- hold the edge of the identity card and avoid blocking any information on the identity card, do not place it on a flat surface;

- keep your identity card within the frame;

- tilt your identity card slowly according to the instruction; and

- ensure your identity card image is clear, non-reflective, in focus and not blurry

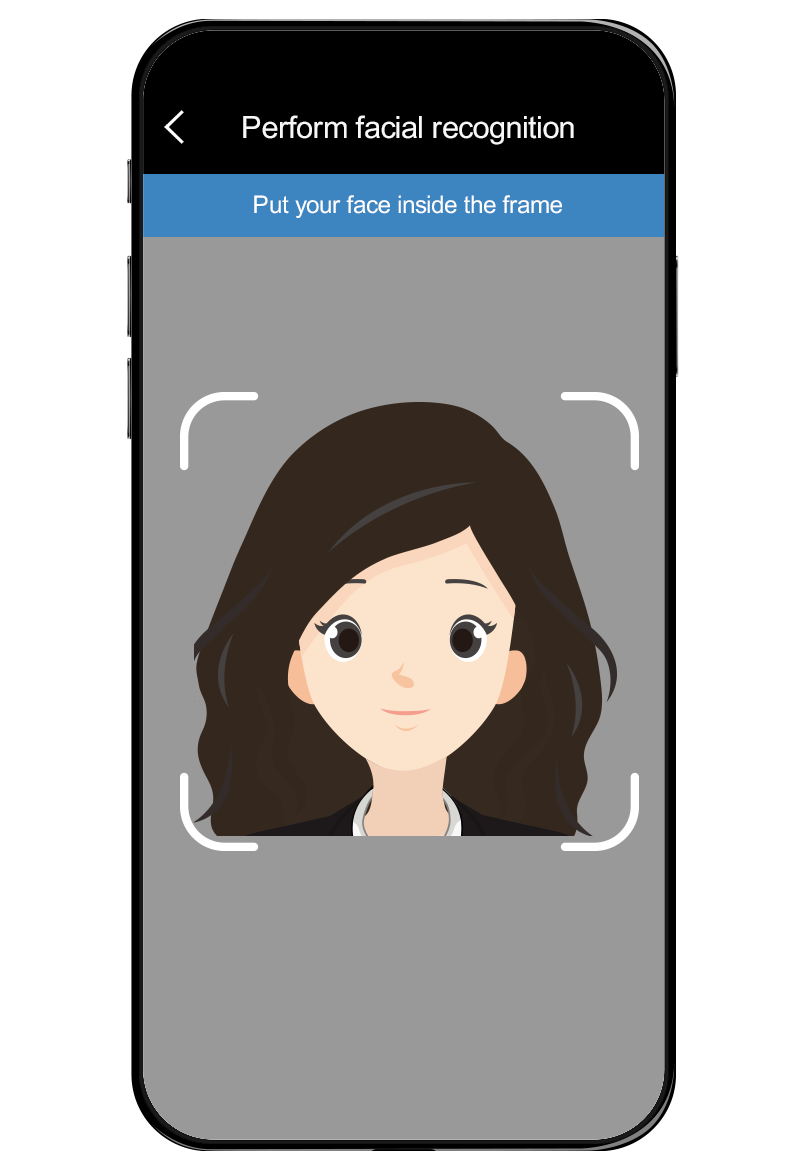

When taking selfies, you need to:

- remove any accessories which may cover your face, including hat and sunglasses;

- take selfies under a clear background and environment

- avoid unnecessary facial expressions and face the camera;

- place your mobile vertically, hold the phone camera at eye level and look straight into the camera, ensure your face is placed at the center within the frame with sufficient space around;

- stay still and wait until the system successfully detects your face before making the gestures

- follow the instructions for selfies, and the random instructions include blink, nod and shake head side by side softly, the system will proceed to the next gesture when a successful gesture has been detected

You can also bring along with your identity card to branch for account opening.

- Which type of documents are required to upload for opening account? E.g. Address proof?

For deposit account opening through e-Account Service, you are required to upload identity documents and selfies only. PRCID holders are required to upload the 'Entry-Exit Record' issued by the National Immigration Administration. If more document(s)/information is/are required, we would invite you to visit our branch to complete the account opening process.

- Am I able to save or continue to finish the uncompleted application?

Yes, you could save and continue the application after passing mobile number and email verifications. Please remember to click “Next” button from employment status page onwards to save your application. You can continue the application within 30 days. However, if the application is not submitted within 30 days or you didn’t save your application before you quitted the application, you would be required to fill in a new application.

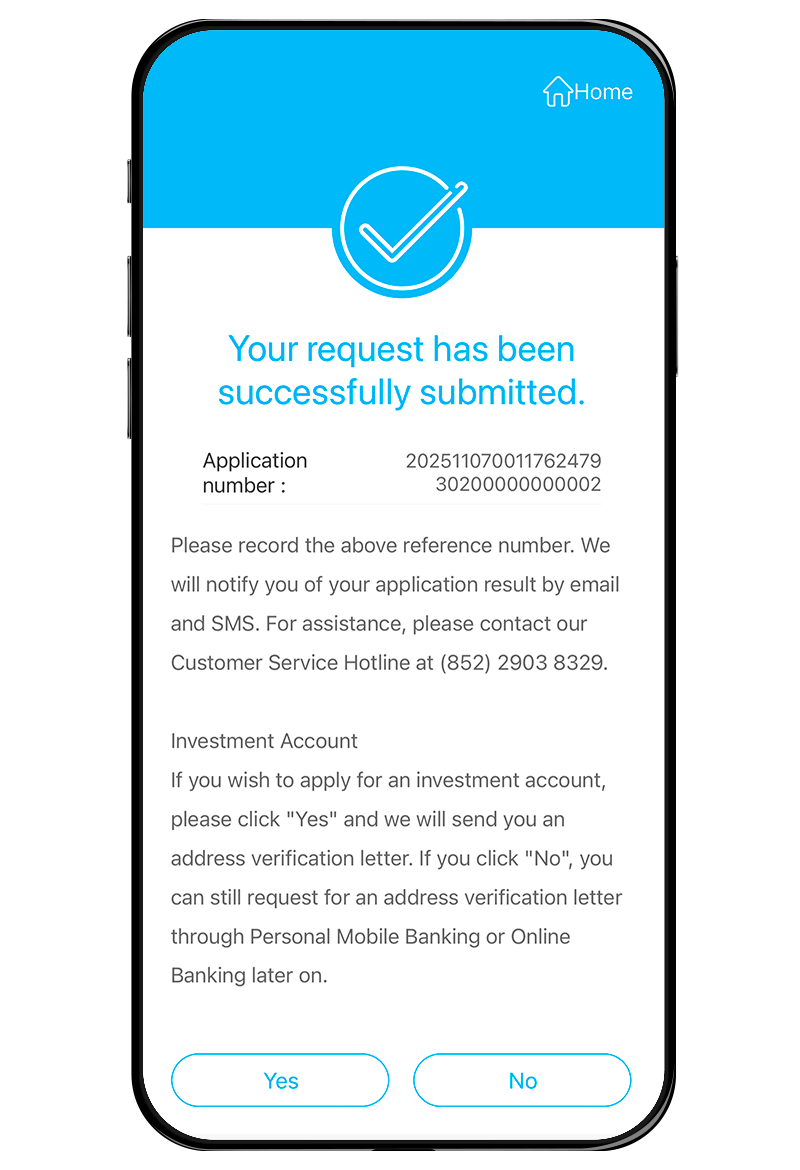

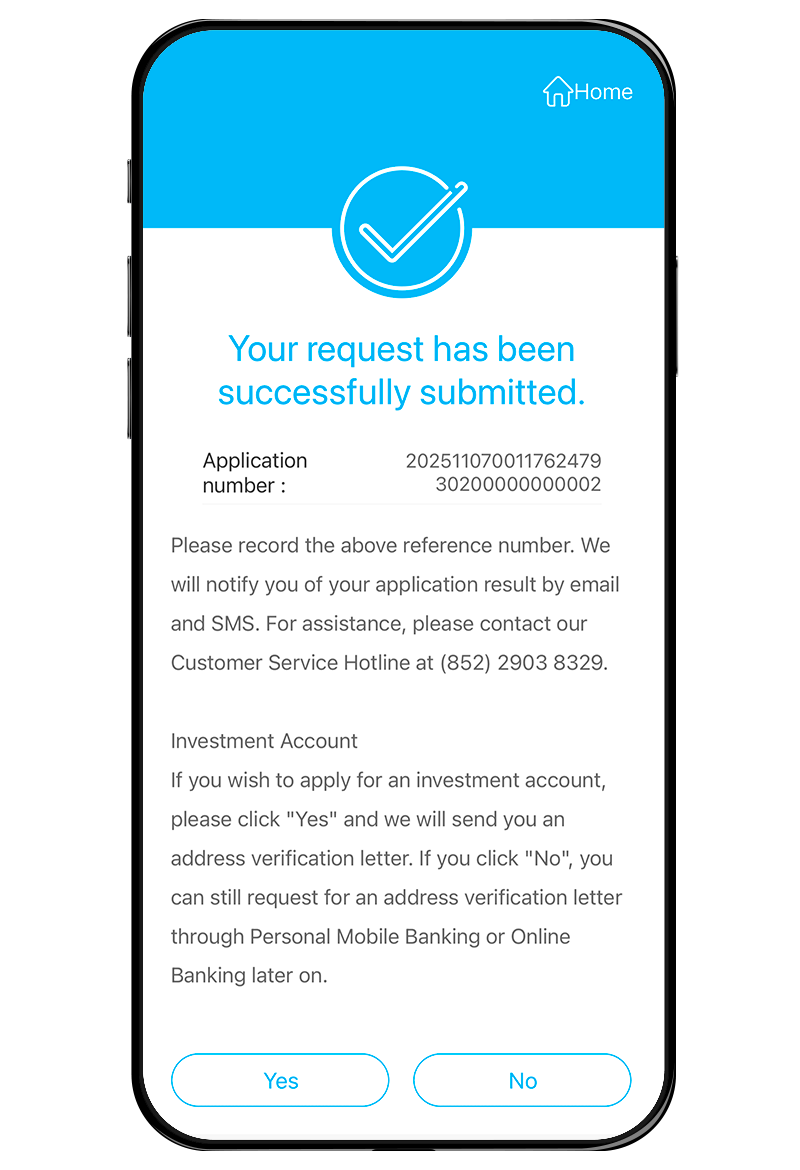

- How to check the application status?

Application verification period varies according to the documents and information submitted, you will receive your initial application result via email and SMS within 1 day at the soonest, once you have received the successful application notification, the account(s) is/are ready but deposit and withdrawal functions are not available yet. When the final verification is completed, you will receive SMS notification on the status. The Bank has the absolute discretion to approve or reject the application during the final verification without giving any reason even the initial application result is passed.

- Can I continue with the pending application with the other mobile device?

Yes. If you resume the application within 30 minutes, please use the same mobile device to continue the unfinished process. If the saved record is over 30 minutes, you can download CCB (HK&MO) Mobile App on another mobile device, tap ‘e-Account Service’ and then choose ‘Continue Application’, where you could resume your pending application with the following information:

- Identity Card Number:

- Hong Kong residents: Including initial English character (in capital letter) and check digit (bracket is required) (if applicable), e.g. A123456(7)

- Visitors (Mainland residents) in Hong Kong: 18 digit, e.g. 110102200101018881

- The phone number you provided during your previous application

- One time password sent to your mobile number provided during the application last time

- Why can’t I receive the one-time password?

The one-time password will be sent to the mobile number and email address registered with the Bank. For one-time password via email, please also check your “spam email folder”.

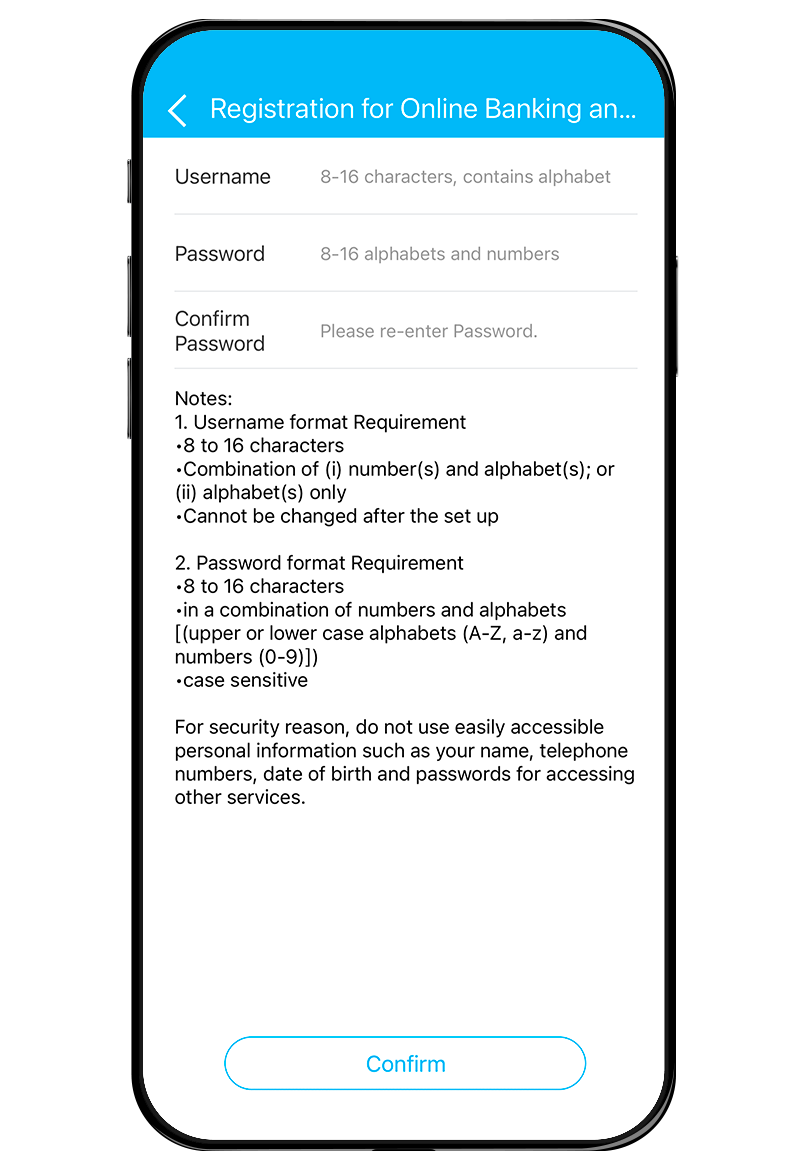

B. Online Banking and Security Tips

C. Deposit Service

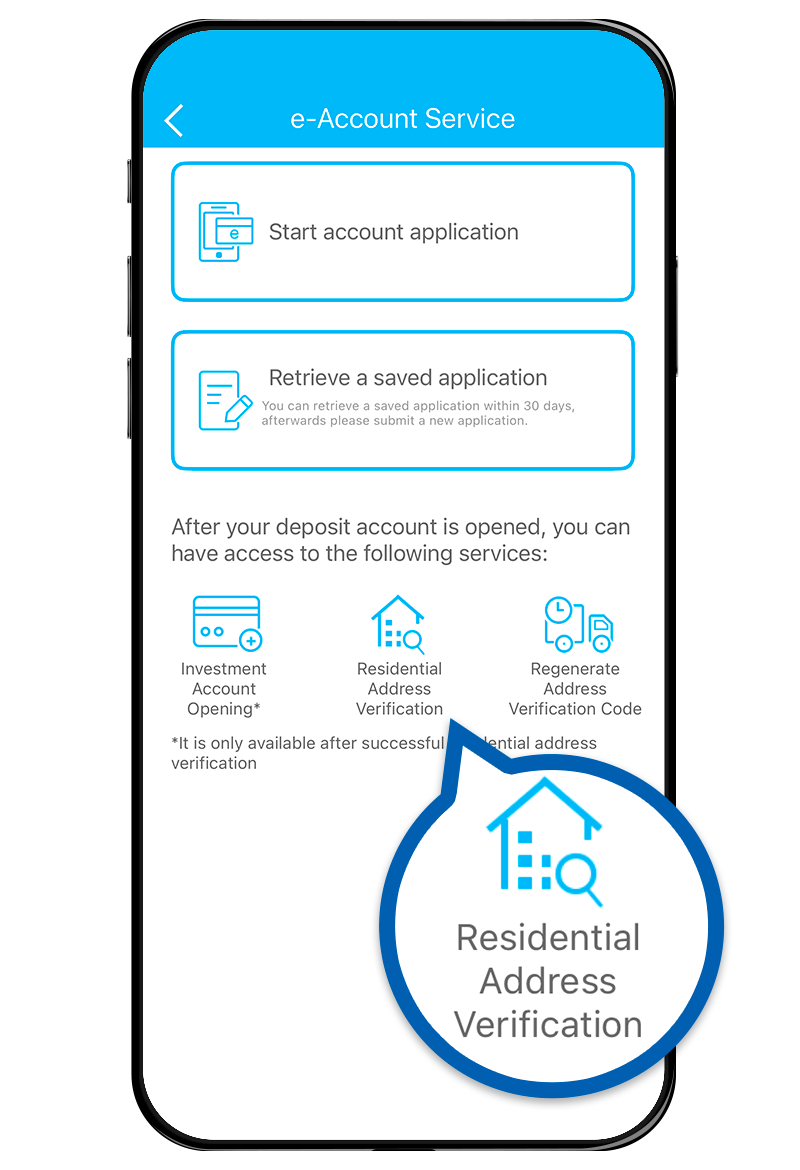

- What services are available for e-Account Service of CCB (HK&MO) Mobile App?

You can open a Multi-Currency Statement Savings account. This account offers 11 currencies including HKD, USD, RMB, GBP, CAD, AUD, NZD, JPY, CHF, EUR and SGD.

You can also open a HKD Statement Savings account and a Time Deposit account. The deposit tenor of Time Deposit is up to 12 months, and foreign currency Time Deposit is also available in a wide range of currencies.

Except for those written instructions or other service instructions which require handwritten signature (e.g. apply for cheque book or cash withdrawn over the counter), most of the services with the account are allowed. For application of other banking services, please also provide us with a specimen of your handwritten signature to set up the related services at branch.

- Is the deposit protected?

Deposits in the account(s) are qualified for protection. China Construction Bank (Asia) Corporation Limited is a member of the Deposit Protection Scheme in Hong Kong. Eligible deposits taken by the Bank are qualified for protection under the Deposit Protection Scheme up to a limit of HK$800,000 per depositor.

- Can I enroll checking account service?

Yes, you can visit our branch during office hour to open a checking account.

- Can I enroll payroll service and enjoy the applicable promotion offer?

Yes, the relevant promotion offer is bound by the applicable terms and conditions.

- Can I enjoy the preferential rate for Time Deposit account?

Upon account opening, you can set up a time deposit through Online Banking or Mobile Banking, deposit tenor is up to 12 months. Foreign currency time deposit is also available in a wide range of currencies. The preferential rate offered at branches is also applicable to Online Banking and Mobile Banking.

- How can I transfer funds to the deposit account set up through e-Account Service?

The deposit and withdrawal functions of the account are available after the final verification of account. You can deposit funds into the account through cheque deposit over the counter or deposit into cheque drop-in box at our branches, or funds transfer with other local bank account / Clearing House Automated Transfer System (CHATS) or “FPS” (Faster Payment System), or cash deposit into the account.

- How can I transfer funds to my bank account in other bank or third parties?

Once the final verification of the account is completed, the deposit and withdrawal functions of the account will be available, and you can perform transactions including funds deposit, transfer to account of another bank under the same name or third party’s name in Hong Kong. If you would like to use the unregistered account fund transfer service, please visit our branch to apply for the unregistered account fund transfer service and security token first.

D. ATM Service

E. Investment Service (Mutual Fund, Securities Trading or FX Linked Deposit) (Applicable to Hong Kong Residents only)