CCB (Asia) UnionPay Dual Currency Debit Card

Secure microchip technology

protects you better

All CCB (Asia) UnionPay Dual Currency Debit Card have been upgraded to clip-based ATM card. This will provide you with greater security for your ATM card data and prevent duplication of your card as counterfeit card. It also brings you a wide range of new services that cater you cross-border financial needs.

UnionPay Dual Currency Debit Card has more memory and one card can link up to 10 accounts. Customer can now manage accounts with ATMs more easily and conveniently. Account type includes:

- UnionPay Dual Currency Debit Card has more memory and one card can link up to 10 accounts. Customer can now manage accounts with ATMs more easily and conveniently. Account type includes:

- HKD/RMB/USD^ Savings Accounts

- HKD/RMB/USD^ Checking Accounts

- Multi-Currency Savings Accounts ^^

- HKD and RMB Multi-Currency Savings Accounts ^

- Time Deposit *

- Loan Account *

| ^ | HKD and RMB Multi-Currency Savings Accounts can ONLY be accessed by chip-supported CCB (Asia) and JETCO ATMs in Hong Kong or chip-supported China Construction Bank Macau Branch and JETCO ATMs in Macau. |

| ^^ | Only balance enquiry service is available for USD and Multi-currency account (except HKD & RMB) at Jetco and CCB (Asia) chip-supported ATMs. Due to exchange issue, ATM cash withdrawal service is not supported. |

| * | Only balance enquiry service is available for Time Deposit and Loan account at CCB (Asia) chip-supported ATMs, while ATM cash withdrawal service is not supported. The account balance is up to the previous working day. |

- Balance Enquiry

- HKD, RMB & Other Foreign Currencies Withdrawal

- HKD, RMB Cash Deposit

- HKD, RMB & USD Cheque Deposit

- Merchant Spending^ (UnionPay POS terminal and EPS)

- UnionPay App QR Code Payment+

- Mini Statement*

- Bill Payment

- Interbank Funds Transfer (HKD)

- Funds Transfer Within the Same Card (HKD & RMB)

- Funds Transfer to 3rd party account with CCB (Asia) (HKD)

- PIN Change#

- FAQ, please click here.

| ^ | Merchant spending is not applicable to the HKD and RMB Multi-Currency Savings Accounts linked on the card. Customer must have HKD/RMB Checking/Saving account for using the UnionPay/EPS POS service. |

| + | In order to perform UnionPay QR code payment, cardholders are required to download UnionPay mobile App and complete the banking customer identity verification according the in-App instruction. Please refer the [ UnionPay QR code payment]sub page for Card Binding & payment detail. |

| * | Mini-Statement Service is applicable to all accounts. (Except Time Deposit(s) and Loan Account(s)) |

| # | If customer is required to change PIN, please select primary account on the ATM and then select PIN Change Serivce. |

Important Note:

- In Hong Kong and Macau, RMB withdrawal service from RMB account is only available at China Construction Bank (Asia) and China Construction Bank Macau Branch ATMs.

- When customer withdraws RMB notes from HKD account or withdraws HKD notes from RMB account, the exchange rate will be the ATM RMB / HKD notes selling rate provided by bank.

- Some banks in overseas may charge you ATM handling fee and some ATMs overseas many not accept the Bank’s UnionPay Dual Currency Debit Card. Customers should contact the overseas banks for details.

- The daily cash withdrawal limit/ fund transfer limit is a master limit shared among all accounts under the same card and is calculated in HKD or its equivalent. The POS payment limit is also shared between payments made through UnionPay in Hong Kong and Mainland, and EPS in Hong Kong.

- There is no ATM handling fee when using China Construction Bank ATMs in Mainland China or Bank of America ATMs in the United States via UnionPay or its cooperation network partners for ATM cash withdrawal and balance enquiry. Customer may contact China Construction Bank or Bank of America if necessary.

- The handling fee for each cash withdrawal at Jetco ATMs in Macau is HKD/RMB25

- The handling fee for each cash withdrawal and balance enquiry at UnionPay ATM is HKD/RMB15 and HKD/RMB5 respectively. When using China Construction Bank ATM in Mainland China, the cash withdrawal and balance enquiry handling fee will be waived

- No handling fee for cash withdrawal will be charged by the Bank at local JETCO ATMs, the Bank's ATMs and Bank of America ATMs in the U.S

- The handling fee for each interbank funds transfer transaction from the Bank to other banks is HK$10

- All customers (including PREMIER BANKING, Wise Banking, Golden Years Banking, Employer Payroll Autopay, Personal, Commercial and Corporate account customers) will enjoy card annual fee waiver until further notice.

- Daily cash withdrawal/ funds transfer limit for Dual Currency Debit Card, Premier Banking Dual Currency Debit Card, Private Wealth Dual Currency Debit Card, Private Banking Dual Currency Debit Card and UnionPay ATM Remittance Card is HK$100,000 or equivalent.

- Unlimited transfer of funds between the accounts in a card

- The minimum cash withdrawal amount is HK$100 and HK$500 when using China Construction Bank (Asia) ATMs and other JETCO ATMs

- Bill Payment services is limited to HKD Account. Daily limit for JETCO bill payment and tax payment is HK$50,000 and HK$100,000 respectively

- Daily limit for EPSCO spending and payment and UnionPay spending is HK$50,000 per card

- Due to the different dispensing limit of ATMs, customers may have to perform more than one transaction in order to obtain the amount of cash required

From now on, UnionPay Dual Currency Debit Cardholder can enjoy the following offer:

All customers (including PREMIER BANKING, Wise Banking, Golden Years Banking, Employer Payroll Autopay, Personal, Commercial and Corporate account customers) will enjoy card annual fee waiver until further notice.

UnionPay QR code payment promotion

CCBA UnionPay Duel Currency Debit Cardholder could enjoy UnionPay QR Code payment promotion, given cardholder bound their card on UnionPay App. For more UnionPay App promotion detail, please click here .

With binding CCB (Asia) UnionPay Dual Currency Debit Card on UnionPay App, you could make easier, faster and safer local and cross-border QR code payment. Add your card to UnionPay App now to enjoy the greatest promotion offers !

CCB (Asia) UnionPay Dual Currency Debit Card binding on UnionPay App

- All types of CCB (Asia) UnionPay Dual Currency Debit Cards could be binding on UnionPay App (Except Cross Border Long Card and UnionPay Photo Smart Kid Savings Account Card

- Once the card bound on UnionPay App, QR Code payment be proceeded by either merchant scan user QR code or user scan merchant QR code

How to add your CCB (Asia) UnionPay Dual Currency Debit Card to UnionPay App

Register

Step 1

Download “UnionPay App” at App Store or Google Play Store

Step 2

New User Registration”

Step 3

Choose “Hong Kong/Macau” and enter your mobile number

Step 4

Enter SMS verification code

Step 5

Set up your login password and click “Enter”

Step 6

Registration completed

Enroll UnionPay Credit Card

Step 1

Click “Add Card” under “Card”

Step 2

Enter UnionPay Card Number or take a photo of your Card

Step 3

Confirm your mobile number*, enter related Card information like security code (CVN2) and valid date*Your mobile number must be the same as the record of card issuer

Step 4

Enter verification code from the SMS

Step 5

Set up your payment password

Step 6

Card adding complete

Payment Method

Merchant Scan (Customer Presented Mode)

Step 1

Click “Payment code”

Step 2

Scanned by Merchant(If your transaction exceeds a certain amount when paying with UnionPay App, you might need to enter your PIN)

Step 3

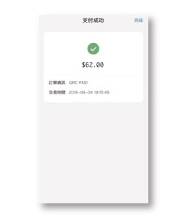

Payment completed

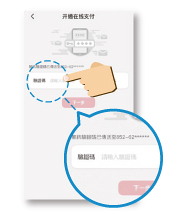

User Scan (Merchant Presented Mode)

Step 1

Click “Scan”

Step 2

Scan Merchant QR code and enter payment password to confirm the payment

Step 3

Payment completed

Please click here to visit UnionPay website for more tutorial.

Please click here to visit more UnionPay App promotion offer.

Terms & Conditions

- The service is available to CCB(Asia) (the “Bank”) UnionPay Dual Currency Debit Card (Except Cross Border Long Card and UnionPay Photo Smart Kid Savings Account Card).

- The Bank does not provide the aforementioned products and mobile payment service. Any enquiries, comments or complaints about the quality of relevant products or services should be directed to the mobile payment service provider. The Bank shall not be responsible for any matters in relation to relevant products or services. The UnionPay App ("UnionPay App") is provided by UnionPay International Company Limited ("UnionPay International"), including its affiliates and subsidiaries. For queries, please click here.

- The registration, activation or use of the Eligible Card for the UnionPay App with Privacy Policy is applied. Details for Privacy Policy, please refer to the UnionPay App.

- The Bank, mobile payment service provider and participating merchants reserve the right to cancel or amend the offers or to amend the terms and conditions at any time without prior notice. In case of disputes, the decision from the Bank, mobile payment service provider and participating merchants shall be final and conclusive.

- In the event of discrepancies between the Chinese version and English version of these terms and conditions, the Chinese version shall prevail.

Keep your card safe

- Sign on the signature panel at the back of your bank card immediately with a permanent ink pen upon receipt of your bank card and keep the card in a secure place. Contact the Bank immediately if you lose your bank card/PIN

- Do not keep the bank card and the PIN together. Never write down the PIN on the bank card or on anything usually kept with or near it

- Do not allow anyone else to use your bank card and PIN

- Call our 24-hour Bank By Phone at (852)2779 5533 or log in to Mobile Banking/ Online Banking or notify any of our branches immediately if your bank card is retained by ATM, lost or stolen

Keep your PIN safe

- Change your PIN immediately when using your bank card for the first time and destroy the PIN letter

- Do not use easily accessible personal information such as birthday, telephone number or recognizable part of your name for setting up password

- Set a password that is difficult to guess and different from the ones for other services

- Do not use your bank card PIN for any other cards, internet banking accounts, online memberships or internet services

- Change your PIN regularly

- Do not write down or record the PIN without disguising it

- Do not disclose your card PIN to anyone else, including our staff

Other Notices

- If you intend to withdraw cash from overseas ATMs, check with our bank whether your intended overseas destination can support cash withdrawal using your bank card. You should also activate the overseas bank cash withdrawal function in advance and set a prudent overseas ATM cash withdrawal limit and an activation period, please click here to learn more.

- Check the transaction records provided by our bank in a timely manner. Inform our bank immediately if you lose your bank card, or in case of any suspicious transactions or situations. Banks will not ask for any sensitive personal information (including passwords) through phone calls or emails

- Call our 24-hour Bank By Phone at (852)2779 5533 or log in to Mobile Banking/ Online Banking immediately or notify any of our branches during office hours if your bank card is retained by ATM, lost or stolen

- You may have to bear a loss when a card has been used for an unauthorized transaction before you have told the bank that the card/PIN has been lost or stolen or that someone else knows the PIN. Provided that you have not acted fraudulently, with gross negligence or has not otherwise failed to inform the bank as soon as reasonably practicable after having found that your card has been lost or stolen, the maximum liability for such card loss is HK$500

- To learn more about Debit Card Chargeback, please click here for details or download the “DECLARATION OF DEBIT CARD TRANSACTION DISPUTE” form.

Other related information

- To learn more about the e-leaflet of "Major safety tips on using ATMs" published by Hong Kong Monetary Authority, please click here.

- To learn more about the information on banking services as published by the Hong Kong Monetary Authority in different languages (Including " Security Tips on Using Automated Teller Machines"), please click here.

- To learn more about the publications by The Hong Kong Association of Banks, please click here.

- FAQ, please click here.

- Card Types

CCB (Asia) UnionPay Dual Currency Debit Card

UnionPay ATM Remittance Card

CCB (Asia) Premier Banking Dual Currency Debit Card

CCB (Asia) Private Wealth Dual Currency Debit Card

CCB (Asia) Private Banking Dual Currency Debit Card