FX Linked Deposit - High Yield Deposit

Seize the potential for higher interest return

than ordinary time deposit

Accrue higher potential interest rates than you would from conventional time deposits when the movement in foreign exchange market matches your view.

-

Capture Higher Potential Return

-

Higher Potential Interest Income

-

Enjoy higher potential return than conventional time deposits.

-

Opportunity to Exchange Foreign Currencies at More Favorable Rates

-

Get a chance to exchange foreign currencies at deposit maturity at more favorable rates than the current spot rates to meet your foreign currency needs.

-

A Wide Variety of Currencies for Selection

-

Choose from 10 currencies - AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD and CNH to form almost 70 combinations of currency pairs.

-

Initial Exchange Rate at Your Discretion

-

Customize the "Initial Exchange Rate" according to your investment need. It can be above, equal to or below the current spot rate.

-

Tenor at Your Choice

-

Set the investment tenor according to your view and need. It can be as short as 1 week or as long as 1 year.

-

No Fees or Charges

-

Invest without any fees or charges to maximize your return.

-

Multiple Trading Channels

-

To place a deposit, visit any of our branches or logon toOnline Banking . You may also contact your relationship manager.

-

Open an Account and Trade Online Anytime

-

Open an FX Linked Deposit Account and trade anytime viaOnline Banking Set up an eAlert and you will be notified of your FX Linked Deposit fixing exchange rate via SMS and/or email on maturity date.

-

Product Structure

-

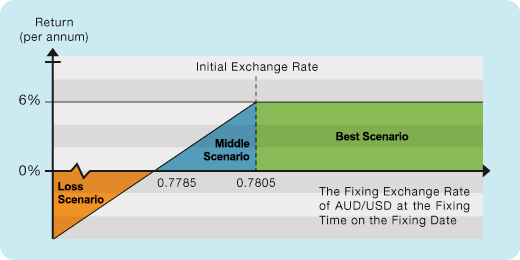

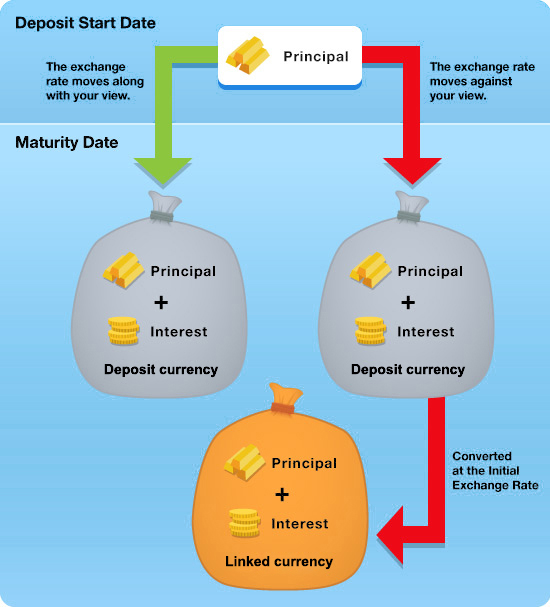

If the Linked Currency appreciates against the Deposit Currency or if the Fixing Exchange Rate is equal to the Initial Exchange Rate, you will get back the principal amount plus the interest amount in the original Deposit Currency on the maturity date.

-

Conversely, if the Linked Currency deprecates against Deposit Currency, you will get back the principal amount plus the interest amount in the Linked Currency (using the Initial Exchange Rate).

The picture above is not drawn to scale.

The above product is bound by the related terms and conditions. Please contact our staff for details.

Risk Disclosure

Investment involves risks. The prices of investment products fluctuate, sometimes dramatically, and may become valueless. Investors should not invest based on this web page alone. Before making any investment decisions, customers must consult their own independent financial advisors and read the relevant offering documents for further details including the risk factors in order to ensure that they fully understand the risks associated with the investment products.

FX Linked Deposit ("FXLD")

The FXLD is an unlisted investment product and subject to the credit and insolvency risks of the Bank. Its return is limited to the interest payable, which will be dependent on movements in some linked exchange rate. Whilst the possible return may be higher than conventional time deposits, it is normally associated with higher risks. Exchange rates are affected by a wide range of factors, including international finance, economics, politics, central banks and other bodies' intervention and natural events, and may rise or fall rapidly. The FXLD is not principal-protected and is not the same as directly buying the currencies of the currency pair. It is not protected by the Investor Compensation Fund. If the FXLD is approved by the Bank to be withdrawn before its maturity, the customer may also need to bear the costs involved which may reduce the return and the principal amount of the FXLD he may get back. There is no secondary market for the FXLD and it is not collateralized. The Bank can early terminate the FXLD.

Disclaimer

This web page does not constitute advice to buy or sell, or an offer with respect to any investment products. This web page and the FX Linked Deposit abovementioned are issued by China Construction Bank (Asia) Corporation Limited which is a licensed bank regulated by the Hong Kong Monetary Authority. This web page has not been reviewed by any regulatory authorities in Hong Kong.