Decoration Loan

Start your home makeover, enjoy low interest rate and cash rebate

Terms and Conditions apply.

Looking for greater financial flexibility in furnishing or refurbishing your home?

Our Personal Installment Loan offers up to 60 months repayment tenor. You can enjoy handling fee waiver and an array of fabulous offers upon successfully apply our Loan. You can even enjoy income proof and address proof waiver1 for applying our Loan with loan amount up to HK$100,000! Submit application before 3pm and our Personal Loan Service Manager will reply on the same day2.

APR as low as 1.5%3

| Repayment Period | ||

| 12 Months | 24 Months or above | |

| Drawdown Loan Amount (HK$) | Cash Rebate (HK$) | |

| 100,001 – 600,000 | 0.5% of drawdown amount (to the nearest dollar) Example: 200,000 X 0.5% = 1,000 |

1% of drawdown amount (to the nearest dollar) Example: 200,000 X 1% = 2,000 |

| 600,001 – 1,000,000 | 3,000 | 6,000 |

| 1,000,001 – 2,999,999 | 4,000 | 8,000 |

| 3,000,000 or above | N/A | 10,000 |

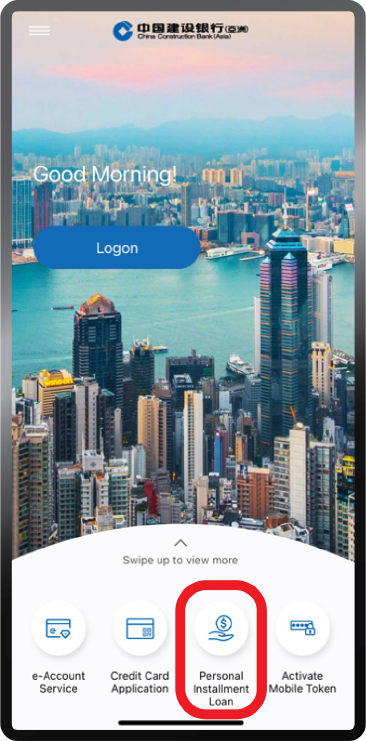

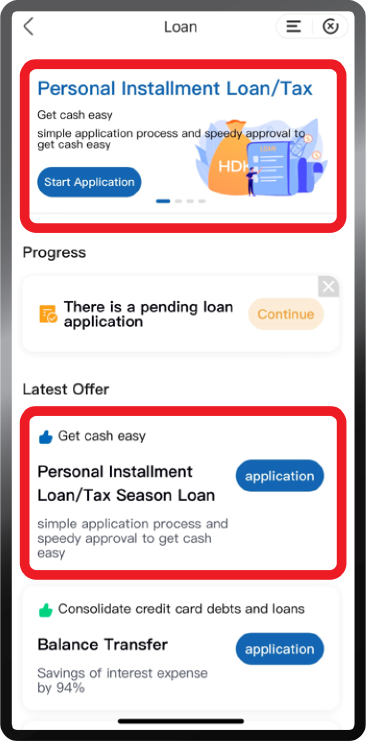

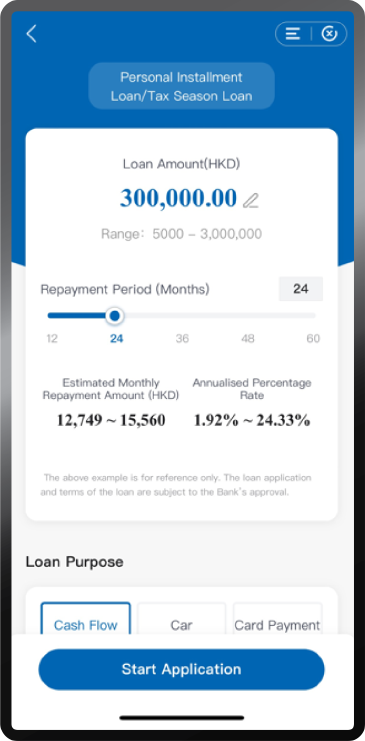

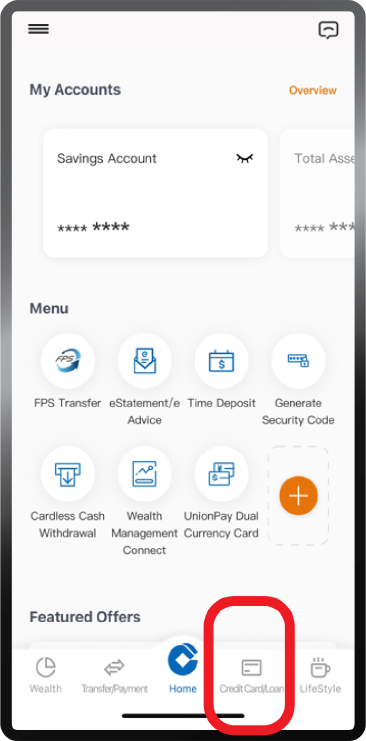

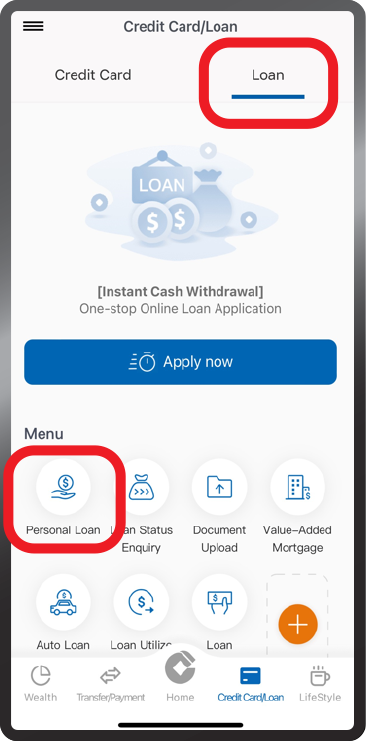

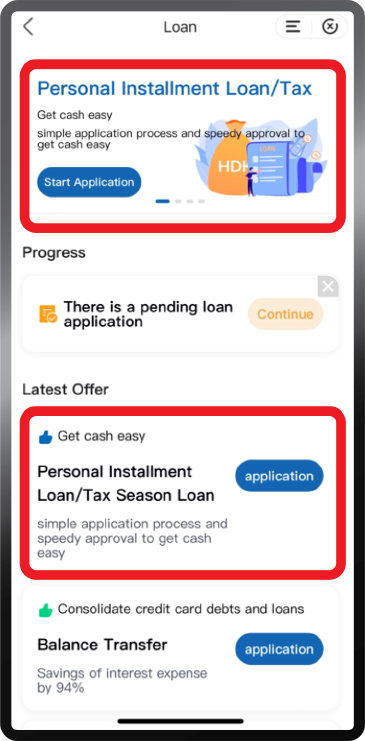

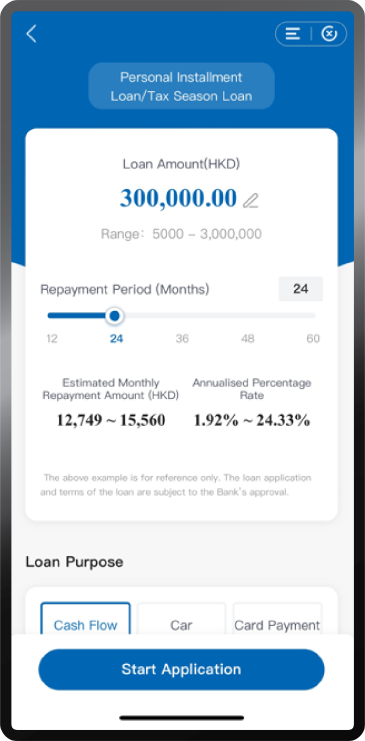

How to apply Personal Installment Loan via CCB (Asia) Mobile App

OR you may click here to apply online and get HK$500 Cash Rebate.

|

|||||||||

Application Method

- Income Proof and Address Proof waiver only available for loans with the maximum loan amount of HK$100,000 and for customers who fulfill specific credit requirements. CCB(Asia) reserves the right to request further supporting documents for loan approval purposes in certain circumstances. Larger loan amounts may be offered to customers who provide supporting documents.

- Only applicable for online loans applications received before 3:00p.m. of a business day, Bank designated staff will follow up on the application with the applicant by calling the mobile phone number provided on the application form within the same day before 5:00p.m. If the online loans application is received after 3:00p.m. or during non-business days, Bank designated staff will follow up on the application with the applicant on the next business day before 2:00p.m.. If the Bank cannot successfully contact the applicant by the mobile phone number provided on the application form the above-mentioned time, a notification SMS will be sent to the applicant's mobile phone number provided on the application form within the same day.

- The above rate is only applicable to customer whose latest Credit Score of TransUnion is within AA grade, loan amount of HK$3,000,000 with 12 months repayment period, and holding a valid HK$ Savings Account / Checking Account in the Bank as repayment account or holding a valid principal Credit Card issued by the Bank. Please contact our staff for details. Monthly flat rate 0.0675% (Annualized Percentage Rate ("APR") 1.5%) is calculated on the basis of 12 months repayment period and the loan amount of HK$3,000,000. The APR is calculated according to the standard of Hong Kong Association of Banks and rounded to the two decimal places. An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of the product expressed as an annualized rate. Interest is charged daily and calculated on the basis of 365 days per year. Please note that the actual APR of customers may be affected by customers' credit status and different from that in the above rate table. All loan repayment terms should be subject to the Bank's final approval and discretion. Customers should refer to the loan confirmation letter issued by the Bank for the actual details of the repayment terms. The Bank reserves the right of final decision on the interest rate and approval result.

- Application hotline service hours: Monday to Friday 9:00a.m. - 6:30p.m. and Saturday 9:00a.m. - 1:00p.m.

Remarks: For Personal Installment Loan amount of HK$100,000 with 12 months repayment period, the monthly flat rate is 0.27% (APR 6.11%), and the total loan repayment amount is HK$103,248 (handling fee is waived). The above example is for reference only. The loan application and terms of the loan are subject to the Bank's approval. The actual APR may vary for individual customer and the final interest rate will be subject to credit condition of the customer, please contact the staff of the Bank for details.

The above products and services are subject to relevant terms and conditions. Please contact our staff for more details.

To borrow or not to borrow? Borrow only if you can repay!